Altcoins were down as long-side leverage saw pressure. Ethereum and Solana led the way in liquidations as the market turned cautious.

- CryptoKaleo argued Bitcoin's structure resembles Fall 2020, while Daniel Kostecki sees U.S. liquidity as a Q1 2026 tailwind.

- Dogecoin (DOGE) fell 3.3% in 24 hours, leading to losses among the major tokens.

- Ethereum, Solana, and XRP suffered long-heavy liquidations as Bitcoin's 57% dominance pressured altcoins.

Analysts believe Bitcoin’s (BTC) current structure resembles that of ‘Fall 2020’, with the asset anticipating a move higher in the first quarter of 2026.

Bitcoin (BTC) has been range-bound in the 86,000 to 88,000 range on Tuesday. However, CryptoKaleo, a key opinion leader on socials, stated on X that the asset’s movement is similar to that of Fall 2020.

In 2020, Bitcoin’s value suddenly lost critical support, retraced much of its previous leg, and then created a new range before the narrative shifted to bullish. Kaleo said that today's backdrop – equities hitting new highs–traders are calling Bitcoin "dead." The market is in the early stages of a long-term rally rather than a downturn, believes the analyst. He said, “It's only a matter of time before that narrative changes.”

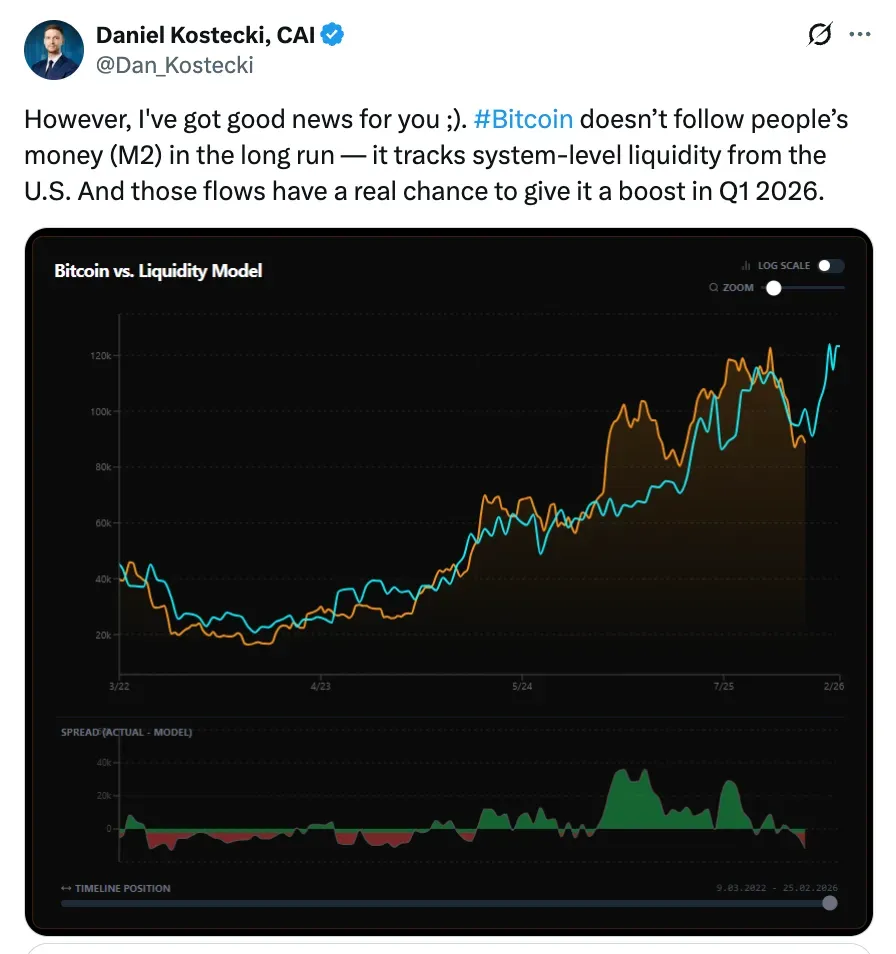

Bitcoin Does Not Reflect Global Money Supply

Adding to that view, Daniel Kostecki, principal analyst at CAI, stated that Bitcoin does not react to global money supply over time, but rather system-level U.S. liquidity. He stated that the upcoming liquidity flows might significantly help Bitcoin, with a potential tailwind emerging in the first quarter of 2026, based on his liquidity model.

Bitcoin (BTC) was trading near $87,400, down about 1.4% in the last 24 hours as its spot remained rangebound. According to CoinGlass data, liquidations were active on the last day, totalling approximately $84.6 million – $63.0 million longs against $21.7 million shorts – indicating a leverage reset. On Stocktwits, retail sentiment around Bitcoin remained in the ‘extremely bearish zone’, with chatter remaining at ‘normal’ levels.

Altcoins Slide As Long-Side Leverage Gets Flushed

With Bitcoin’s market dominance holding steady at around 57.35% over the week, its influence continued to weigh on altcoins. Ethereum (ETH) fell nearly 2.4% to $2,949, continuing to lead forced unwinds. ETH experienced about $64.4 million in 24-hour liquidations with $52.2 million longs and $12.3 million shorts, indicating that the long side remained crowded. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish territory’ over the past day as chatter remained at a ‘normal’ level.

Solana (SOL) traded near $122.60, down 2.9% over the past 24 hours. Solana reported roughly $22.0 million in liquidations, with longs accounting for $21.1 million and shorts accounting for $0.93 million, implying that dip purchasers are still being washed in derivatives. On Stocktwits, retail sentiment around Solana remained in ‘bearish territory’ as chatter remained at ‘normal’ levels over the past day.

Ripple’s native token XRP (XRP) was trading around $1.86, down almost 2.2% on the day. Liquidations were lighter, totaling around $3.73 million, with $3.13 million in long positions and $0.60 million in shorts, keeping the pressure on directional longs. On Stocktwits, retail sentiment around XRP remained in ‘bearish territory’ as chatter remained at ‘normal’ levels over the past day.

Dogecoin (DOGE) slipped 3.3% to $0.129, with around $2.62 million in liquidations, with $2.50 million in longs, and $0.12 million in shorts, indicating that speculative leverage is being reduced. On Stocktwits, retail sentiment around Solana remained in ‘bearish territory’ as chatter remained at ‘low’ levels over the past day.

Binance Coin (BNB) traded around $842, down approximately 1.9% in the past 24 hours. Liquidations remained moderate at around $0.80 million, reflecting relatively low leverage. On Stocktwits, retail sentiment around Binance coin remained in ‘bearish territory’ as chatter remained at ‘normal’ levels over the past day.

Cardano (ADA) fell roughly 3.1% to $0.360, with over $1.10 million in liquidations, consistent with widespread de-risking across major cryptocurrencies. On Stocktwits, retail sentiment around Cardano dipped to ‘extremely bearish’ territory from ‘bearish territory’ over the past day as chatter remained at a ‘normal’ level.

TRON (TRX) was trading around $0.283, down about 0.3% over the past 24 hours, while liquidation activity remained minimal at roughly $37,900 in total. On Stocktwits, retail sentiment around Tron dipped to ‘bearish’ from the ‘neutral’ zone over the past day as chatter remained at a ‘normal’ level.

The total liquidation stood at $256.99 million in the entire crypto market, predominated by long positions.

Read also: Arizona Advances Bill To Exempt Bitcoin, Crypto From Property Taxes

For updates and corrections, email newsroom[at]stocktwits[dot]com<