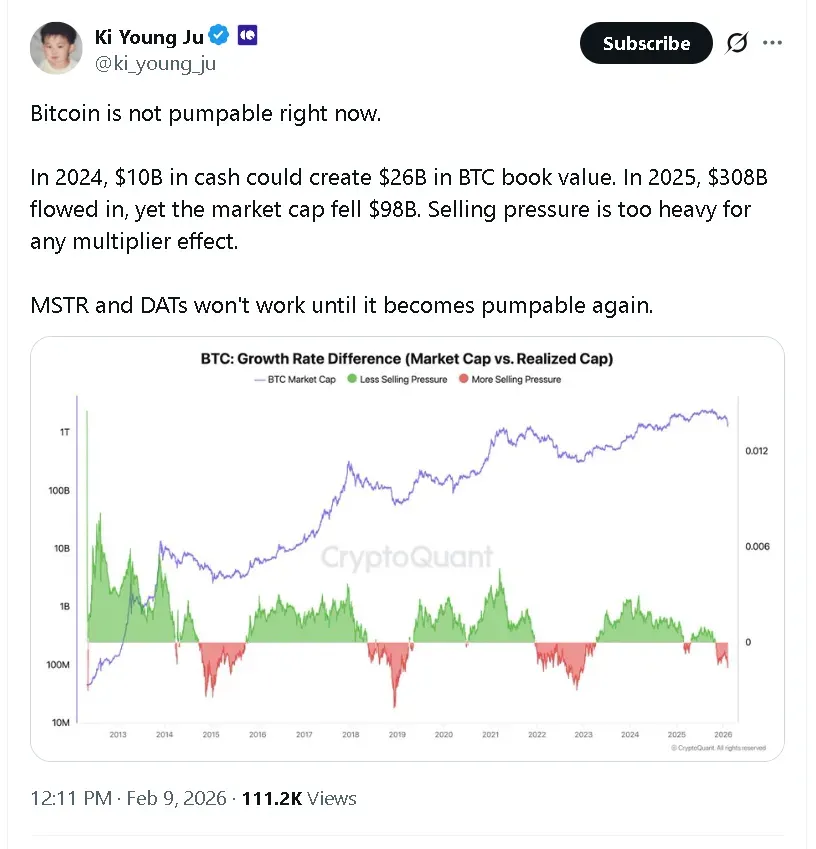

In a post on X, Ki Young Ju highlighted that the relationship between inflows and a pump in Bitcoin’s price has weakened compared with prior cycles.

- Ju said heavy selling pressure has eliminated Bitcoin’s historical multiplier effect.

- He warned that MSTR and other digital asset treasuries are likely to remain under pressure until Bitcoin’s price is on the uptrend again.

- MSTR’s stock fell in pre-market trade on Tuesday, though the stock has outperformed Bitcoin year to date.

Bitcoin’s (BTC) price action is being weighed down by persistent selling pressure, even after record inflows, according to CryptoQuant founder Ki Young Ju, who said that the apex cryptocurrency is not “pumpable” right now.

In a post on X, Ju said the relationship between new capital and price appreciation has weakened compared with prior cycles. He noted that roughly $10 billion in inflows translated into an estimated $26 billion increase in Bitcoin’s book value in 2024. Whereas in 2025, more than $308 billion flowed into the market in 2025, while Bitcoin’s total market capitalization fell by $98 billion.

“Selling pressure is too heavy for any multiplier effect,” he wrote, adding that Michael Saylor-backed Strategy (MSTR) and other digital asset treasuries (DATs) are likely to remain under pressure until Bitcoin breaks its downtrend.

Retail Investors Watch Washington Talks

Bitcoin’s price dipped back below $69,000 on Tuesday morning despite edging 0.4% higher in the last 24 hours. Retail sentiment around the cryptocurrency on Stocktwits remained in ‘bearish’ territory over the past day, with chatter at ‘extremely high’ levels.

Meanwhile, MSTR’s stock was moving lower in the pre-market session, down 3.27%, with retail sentiment around the Bitcoin proxy in the ‘neutral’ zone and chatter at ‘extremely high’ levels.

Some users joked about the unrealized Bitcoin losses on MSTR’s balance sheet.

Others anticipated that today’s second round of talks between crypto industry leaders and officials in Washington could create a bullish catalyst for Bitcoin’s price if the discussion goes well.

While Bitcoin’s price has fallen more than 20% this year, MSTR’s stock is down just 10%.

Read also: Cathie Wood’s ARK Adds Bullish Shares After Peter Thiel–Backed Crypto Exchange Jumps 16%

For updates and corrections, email newsroom[at]stocktwits[dot]com.<