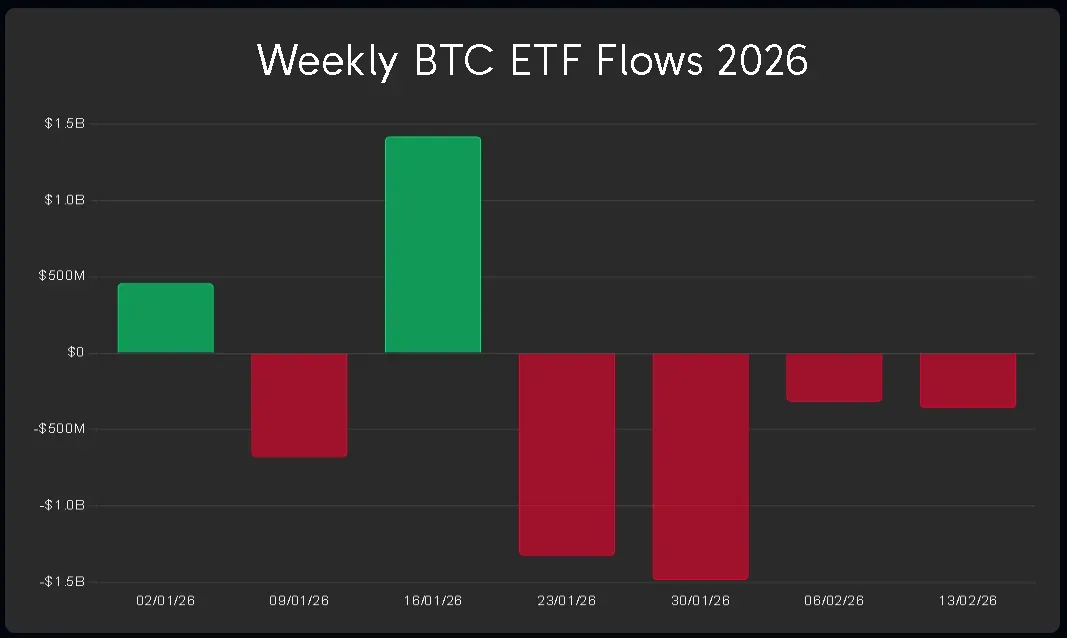

Spot Bitcoin ETFs have recorded four consecutive weeks of net outflows totaling more than $3.4 billion.

- If the trend continues, the market will log its longest outflow streak on record, to match the $5 billion exodus from Bitcoin funds in March 2025.

- Last week alone saw roughly $360 million in outflows despite a brief $15.2 million daily inflow on Friday.

- Arkham Intelligence cited regulatory uncertainty around the CLARITY Act and macroeconomic factors as ongoing pressure points for crypto markets.

Spot Bitcoin (BTC) ETFs have seen weekly net outflows for a four weeks now, and are on track to log their longest outflow streak since March last year.

According to data from SoSoValue, more than $3.4 billion exited Bitcoin funds in the last four weeks. Last week saw approximately $360 million in outflows, up from $318 million the prior week, despite Friday's rebound of $15.2 million in daily net inflows.

If this trend continues through the end of the week, it will mark the fifth straight week in the red for Bitcoin ETFs. It said the last time that the market saw a five-week streak of outflows was in February and March of 2025, when over $5 billion of capital fled from Bitcoin funds, and it is thus far the longest outflow streak on record.

Bitcoin’s price was trading at around $68,200, down 0.6% in the last 24 hours. Retail sentiment around Stocktwits around the apex cryptocurrency remained in the ‘bearish’ zone over the past day, and chatter stayed at ‘low’ levels.

Regulatory, Macro Factors Add Pressure

A report by Arkham Intelligence noted that while many forecast that the four-year cycle around Bitcoin may no longer apply in 2026, the current market downturn suggests it may still be in effect.

According to the on-chain analysis firm, the regulatory environment remains a central concern for the crypto industry, with the CLARITY Act caught in a stalemate. It added that changes at the Federal Reserve, such as the recent nomination of Kevin Warsh for Fed Chair, are also affecting market sentiment.

Arkham added that while liquidity has increased through Reserve Management Purchase (RMP) policy measures, interest rates remain a concern for riskier assets like Bitcoin and other cryptocurrencies.

Read also: Bitcoin’s $70K Tease Turns To Tumble, ETH Dumps Below $2K – Fed Minutes, PCE Data On Traders Radar

For updates and corrections, email newsroom[at]stocktwits[dot]com.<