Overall crypto market capitalization declined 1.6% to $3.2 trillion.

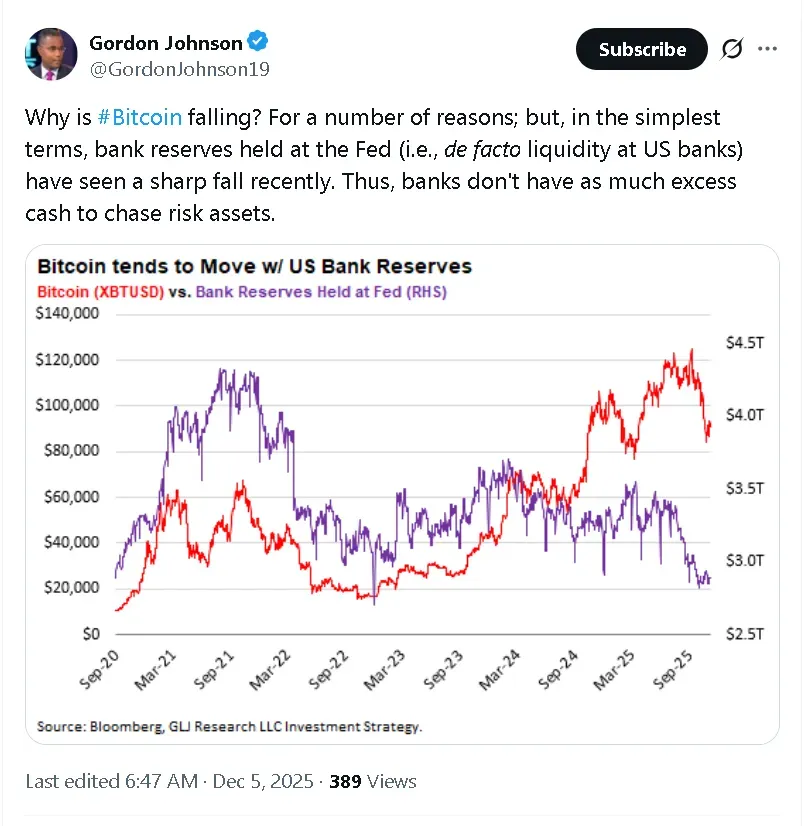

- According to analyst Gordon Johnson, Bitcoin is falling because U.S. banks have less money available.

- CoinGlass data showed $291 million in liquidations over the past day, primarily from long positions.

- Deribit’s weekly report noted increased demand for Bitcoin downside protection relative to Ethereum.

Ripple’s native token XRP (XRP) and Solana (SOL) led losses in early morning trade on Friday as the crypto market took another dip and Bitcoin (BTC) dropped below $92,000.

XRP’s price fell 4.2% in the last 24 hours, trading at around $2.06. On Stocktwits, retail sentiment around the altcoin remained in ‘bearish’ territory. Solana followed, losing 4% over the last 24 hours. SOL’s price was trading at around $137, with retail sentiment around the token in the ‘neutral’ zone as message volume dipped to ‘low’ from ‘normal’ levels.

Bitcoin, Ethereum (ETH), and other major tokens also moved lower. BTC’s price dropped to about $91,500, down 1.8% over the past 24 hours, while ETH’s price fell 2% to roughly $3,100, slipping after a prior session’s gains following the Fusaka update. Dogecoin (DOGE) and Cardano (ADA) declined around 3.5% each, and Binance Coin (BNB) fell 1.7%.

Crypto Market Takes A Hit

The overall cryptocurrency market capitalization declined 1.6% over the past day, dropping to $3.2 trillion. CoinGlass data showed total liquidations of $291 million, mostly from long positions – traders betting on price gains. Ethereum led liquidations with $93 million, Bitcoin followed with $88 million, and Solana saw $13 million wiped out.

According to analyst Gordon Johnson, Bitcoin is falling because U.S. banks have less money available. He noted that when banks have less cash on hand, they are less able to invest in riskier assets like Bitcoin. Less demand from these big financial players means downward pressure on Bitcoin’s price.

Market Positions For Potential Bitcoin Drop

Deribit’s weekly report highlighted increased demand for downside protection on Bitcoin relative to Ethereum, with traders purchasing options to hedge potential declines.

It noted that funding rates for Ethereum remain negative, reflecting bearish positioning, while Bitcoin’s rates are neutral to slightly positive. Short-term Bitcoin options indicate elevated volatility expectations, signaling that traders are bracing for further swings.

According to on-chain analysis firm Glassnode, Bitcoin’s recent drawdown caused the largest spike in realized losses since the FTX collapse in late 2022. It stated that short-term holders (STHs) accounted for the bulk of losses, while long-term holders remained relatively insulated, suggesting stress is concentrated among recent buyers.

Read also: Musk’s X Reportedly Hit With €120M EU Fine For Content Breaches, Hours After JD Vance Cautioned Against It

For updates and corrections, email newsroom[at]stocktwits[dot]com.<