Despite substantial price drops, crypto market sentiment remained risk-off, with forced long liquidations driving selling pressure rather than panic exits.

- XRP price plunged about 7% to $1.87, making it the biggest loser among the top tokens in the crypto market.

- Bitcoin fell below $86,000 while analysts warned of more losses as long positions were heavily liquidated.

- Tron stayed fairly steady, making it one of the few large-cap coins that maintained its value.

Ripple (XRP) led losses among major tokens on Monday night, as Bitcoin (BTC) fell below $86,000 and the crypto market saw over half a billion in liquidations.

XRP’s price was trading at $1.87, down nearly 7%, as the larger cryptocurrency market remained under pressure. The move came amid a risk-off tone across digital assets, with most major tokens trading in the red over the previous 24 hours.

According to CoinGlass data, overall crypto liquidations hit $584 million while XRP saw approximately $14.47 million in leveraged bets wiped out. The majority of XRP’s losses came from long positions, compared to about $205,000 in shorts.̣ On Stocktwits, retail sentiment around XRP remained in ‘bearish’ territory, with ‘low’ levels of chatter over the past day.

Analysts Warn Of Deeper Downside Risk As Bitcoin Slides

Bitcoin’s price traded near $86,100 after reaching an intraday low of around $85,400. The apex cryptocurrency was down more than 4% in the past 24 hours. BTC's liquidations totaled around $174.14 million, as leveraged long positions were closed amid the selloff. On Stocktwits, retail sentiment around BTC dipped from ‘bearish’ to ‘extremely bearish’ territory, but chatter around the cryptocurrency remained unchanged in the last 24 hours at ‘low’ levels.

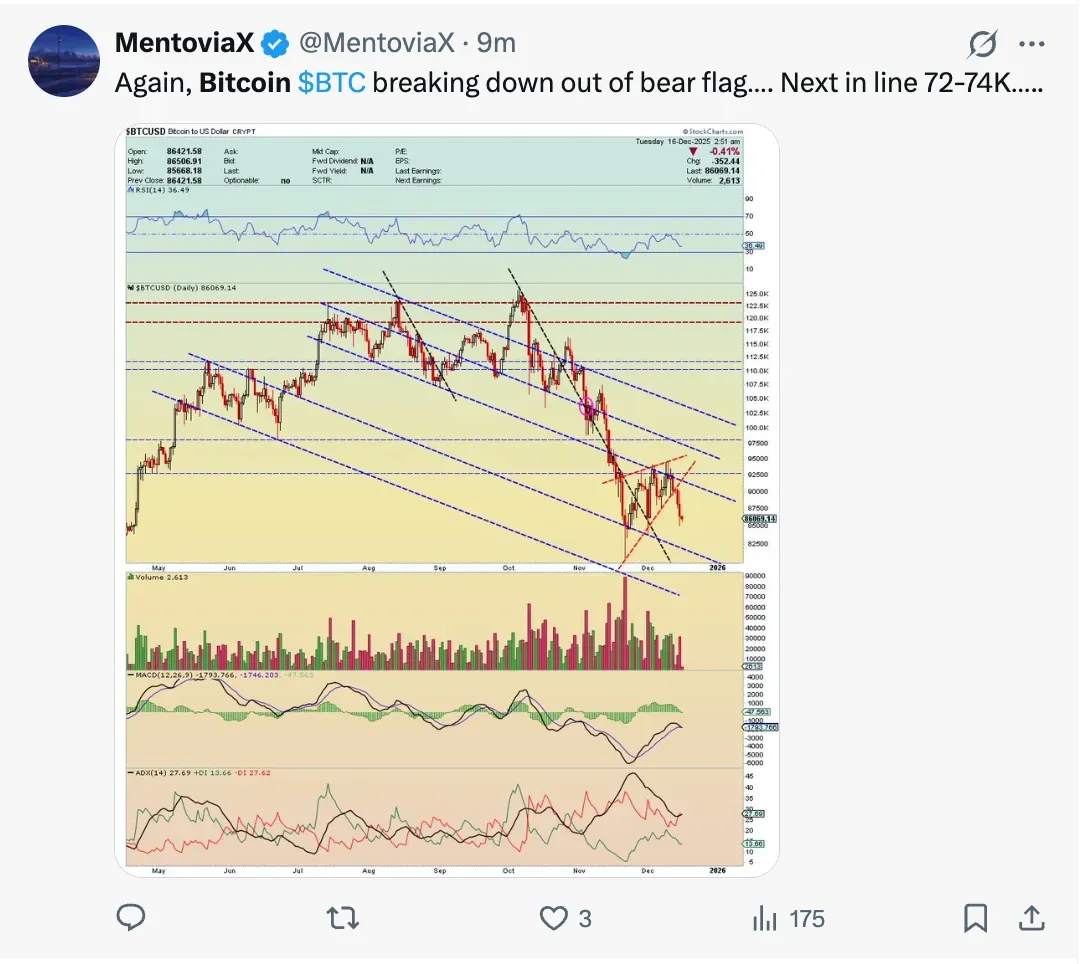

On Sunday, macro trader Peter Brandt warned that Bitcoin could slip further and go as low as $25,000 if the bearish sentiment continues. One market observer and tech investor on X predicted Bitcoin might reach between $72,000 to $74,000 if the bear run continues.

ETH, SOL, DOGE Follow Bitcoin’s Lead

Ethereum (ETH) plummeted to roughly $2,955, down over 5% in the past day. ETH dominated liquidation volumes throughout the market, with a total of around $186.34 million in liquidations, indicating significant deleveraging in the derivatives market. On Stocktwits, retail sentiment around ETH slipped from ‘neutral’ to ‘bearish’ territory over the past day. However, the chatter around the coin stayed steady at ‘normal’ levels.

Solana (SOL) fell to about $126.50, down about 5%, along with nearly $34.54 million in liquidations. Most of the forced unwinds were long positions. On Stocktwits, retail sentiment around SOL slipped from ‘bullish’ to ‘neutral’ territory in a day, with ‘low’ levels of chatter.

Dogecoin (DOGE) fell to roughly $0.129, which is more than 8% 5.6% lower than the previous day. There were about $11.83 million in total liquidations. Most of the losses, about $11.54 million, were on the long side, while only about $282,000 were on the short side. Retail sentiment around DOGE dropped from ‘bearish’ to ‘extremely bearish’ zone on Stocktwits, while conversation around the cryptocurrency remained ‘low’ in the last 24 hours.

Cardano, BNB Trails But Tron Stays Put

Cardano (ADA) also underperformed, dropping to roughly $0.38, roughly 5.2% down in 24 hours. ADA saw about $3.67 million in liquidations, and most came from long positions. Retail sentiment around ADA dropped from ‘neutral’ to ‘bearish’ territory on Stocktwits, although message volume stayed at ‘normal’ levels in the last 24 hours.

Binance coin (BNB) traded around $857, down slightly over 4%, with about $2.22 million in liquidations. On Stocktwits, BNB's retail sentiment remained 'normal' over the day as chatter around the coin dipped from ‘normal’ to ‘low’ levels.

TRON (TRX), on the other hand, held steady around $0.278, dipping less than 1% in the last 24 hours. Tron saw about $91,550 in long liquidations and about $25,870 in short liquidations over the past day. On Stocktwits, TRX’s retail sentiment remained in ‘bearish’ territory with 'low' levels of chatter.

Read also: Bank of Japan’s Reported Rate Hike Could Put Bitcoin Under Stress, Say Analysts

For updates and corrections, email newsroom[at]stocktwits[dot]com.<