Coinbase is expected to announce its own prediction markets and tokenized equities next week.

- Gemini’s new product follows five years of regulatory review before securing DCM approval.

- The exchange is offering fee-free event trading for a limited time to attract early users.

- The U.S. prediction market remains limited to a small number of regulated venues.

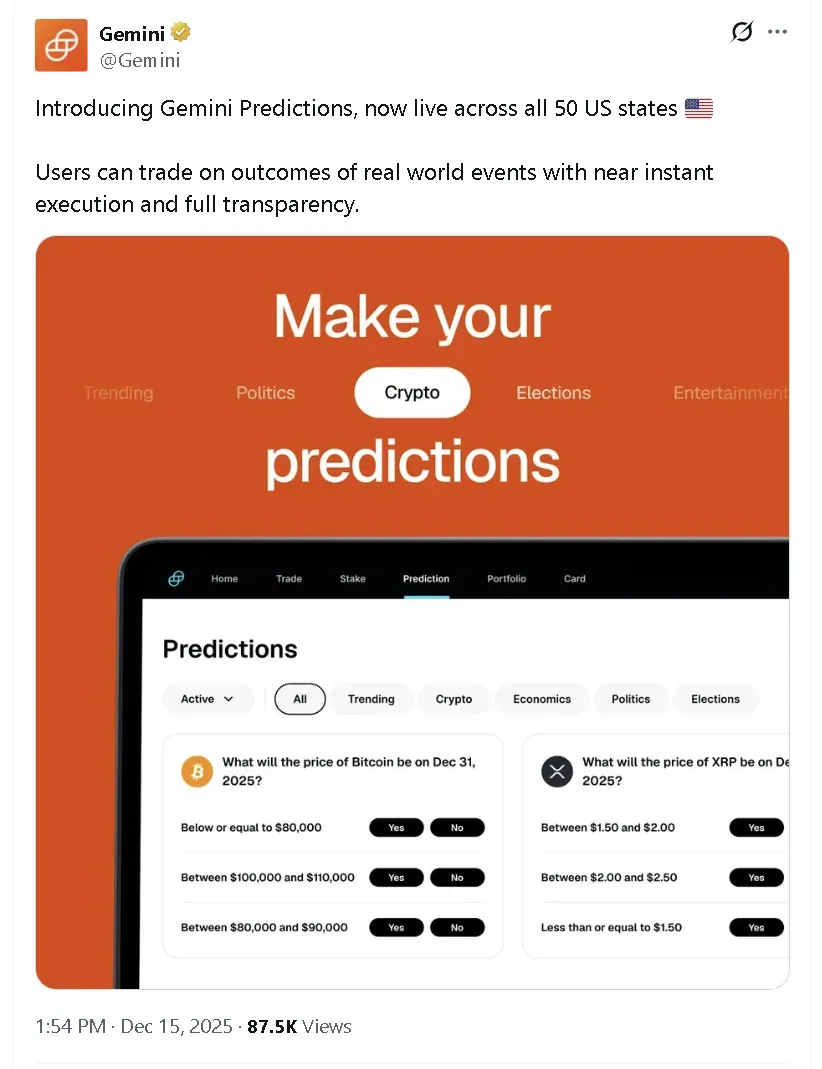

Gemini (GEMI) joined Robinhood (HOOD), Kalshi, Polymarket, and others in Wall Street’s new prediction market push on Monday.

The crypto exchange, led by the Winklewoss twins, said it has launched ‘Gemini Predictions’ across all 50 U.S. states. For a limited period, the company will not charge fees on event-based trades, according to a post on X.

The rollout comes one week after the U.S. Commodity Futures Trading Commission approved Gemini to operate as a Designated Contract Market (DCM), clearing the way for the firm to offer regulated prediction markets to U.S. customers after roughly five years seeking approval.

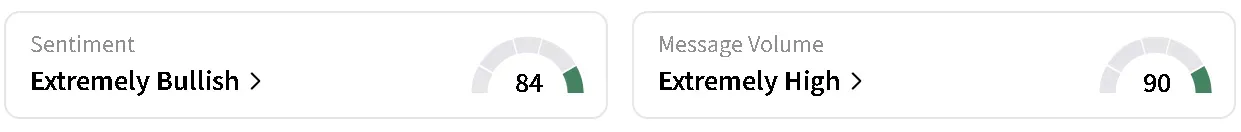

Despite the news, GEMI’s stock fell more than 12% in Monday’s session and edged 0.8% lower in after-hours trade amid a broader downtrend in crypto equities as Bitcoin (BTC) dropped to around $85,000. On Stocktwits, however, retail sentiment around the company remained in ‘extremely bullish’ territory alongside ‘extremely high’ levels of chatter over the past day.

Gemini Beats Coinbase To Market

Gemini’s launch appears to put it ahead of Coinbase (COIN), which is expected to unveil prediction markets and tokenized equities next week, according to a Bloomberg report.

The report said Coinbase plans to launch tokenized stocks in-house rather than through partners. Robinhood and crypto exchange Kraken already offer tokenized U.S. stocks and exchange-traded funds, part of a broader push to bring traditional financial products onto blockchain rails.

Trading activity in tokenized equities has increased in recent months. Monthly transfer volume rose 32% over the past 30 days to $1.45 billion, according to the report, reflecting growing demand for blockchain-based representations of public securities.

COIN’s stock fell more than 6% on Monday and edged 0.8% lower in after-hours trade. Retail sentiment around the crypto exchange slid to ‘neutral’ from ‘bullish’ territory over the past day, while chatter remained at ‘normal’ levels.

Gemini Part Of Small CFTC Group

With its DCM status, Gemini joins a small group of CFTC-regulated venues permitted to offer event contracts in the U.S. The market is currently dominated by Kalshi, which operates under the same regulatory framework.

Under CFTC rules, event contracts allow traders to buy and sell binary outcomes tied to real-world events, including elections, economic data, and other measurable outcomes. These products are regulated derivatives, distinct from traditional betting or gaming products.

Decentralized platforms such as Polymarket continue to operate offshore and remain unavailable to U.S. users under current regulations, highlighting the growing divide between regulated domestic markets and permissionless global alternatives. On Stockwits, retail sentiment around Kalshi trended in ‘bearish’ territory, while retail sentiment around Polymarket was in the ‘neutral’ zone.

Meanwhile, Robinhood’s ‘prediction market’ offering operates through its event contracts hub, where users trade CFTC-regulated yes-or-no contracts. The platform routes trades through regulated derivatives exchanges and markets the products as event contracts rather than betting. HOOD's stock fell 3.55% on Monday and was down more than 1% in after-hours trade. On Stocktwits, retail sentiment around the company trended in 'bullish' territory, amid 'high' levels of chatter.

Read also: Elon Musk Becomes First Person Ever Worth $600B — Widens Lead Over Larry Page As Trillionaire Milestone Nears

For updates and corrections, email newsroom[at]stocktwits[dot]com.<