SEBI-registered analyst Harika Enjamuri expects the stock to reach ₹ 3,050, with key resistance at ₹2,840 and support at ₹2,475

Shares of Balkrishna Industries have posted a strong bullish breakout from a falling channel on both daily and weekly charts, marking a potential trend reversal after an extended downtrend, according to SEBI-registered research analyst Harika Enjamuri.

The breakout was confirmed as the stock crossed a key resistance zone between ₹2,650–₹2,700, bolstered by strong volume and a relative strength index (RSI) of 69.04, signaling robust momentum.

At the time of writing, shares of Balkrishna Industries were trading at ₹2,786.60, up by ₹13.90 or 0.5% for the day.

Enjamuri highlighted that the stock has reclaimed its key exponential moving averages (EMAs) of 9, 70, and 100, which are now sloping upwards, a positive signal for the potential continuation of the uptrend.

The analyst believes this signals a strong foundation for further gains.

In the near term, Enjamuri expects some resistance at ₹2,840, with a sustained close above this level paving the way for further upside toward ₹ 2,920 and eventually a target of ₹3,050.

She advised that dips towards the ₹2,630–₹2,650 range could present healthy pullbacks, while ₹2,475 remains a strong support level for the stock.

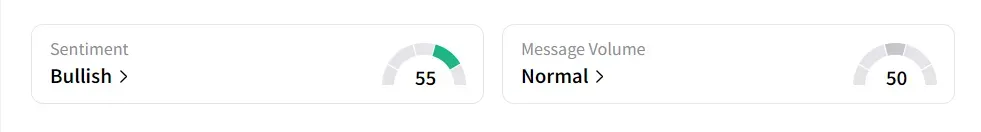

On Stocktwits, Sentiment was ‘bullish’ amid ‘normal’ message volume.

Shares of Balkrishna Industries have fallen 3% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<