Estimates indicate a muted Q1 performance from the private sector lender, resulting in investor sentiment dampening on Stocktwits.

Investor focus shifts to private sector banks, with Axis Bank set to kick off earnings later on Thursday. The stock is trading 12% below its all-time high.

According to reports, Axis Bank is expected to post a muted Q1FY26 performance due to sluggish loan growth and weak margins. Net interest income is projected to grow by around 2%, while profit after taxes is expected to increase by 3.5%.

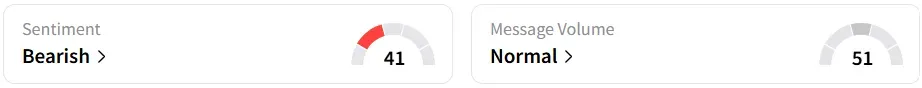

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day earlier. It is among the top 10 trending stocks on the platform.

From a technical perspective, Axis Bank stock appears to be consolidating just above the ₹1,110 - ₹1,130 support zone, as observed by SEBI-registered analyst Rohit Mehta.

The recent price action indicates a sideways-to-bullish bias, with gains from the March 2025 lows showing signs of a pause, Mehta said. A sustained move above ₹1,130 could push the stock toward the ₹1,240 - ₹1,260 region, while a break below ₹1,110 could lead to ₹945.65.

On the fundamentals front, Axis Bank posted a 7.35% growth in revenue in its fourth quarter (Q4FY25). However, profit before tax (PBT) and EPS fell on a year-on-year basis. The bank boasts a strong 5-year profit CAGR of 72.2% and an improved working capital cycle; however, concerns remain regarding its low interest coverage ratio and high contingent liabilities of ₹29.5 lakh crore, the analyst noted.

Shareholding trends reveal declining stakes by both promoters and foreign investors (FIIs), while domestic investors (DIIs) increased their holding to 40.87%.

The stock was down marginally to ₹1,165.80 in early trade, and has gained nearly 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com. <