In 2025, ASP Isotopes finalized several agreements with TerraPower to finance and supply fuel for advanced nuclear projects.

- ASP Isotopes’ collaboration with TerraPower focuses on constructing a new uranium enrichment facility in South Africa.

- The agreement also ensures delivery of the initial fuel cores for TerraPower’s Natrium reactor in Wyoming.

- Meta will fund the construction of up to eight Natrium plants, with delivery of initial units as early as 2032.

ASP Isotopes Inc. (ASPI) stock drew a lot of investor attention on Friday after Meta Platforms (META) entered into a long-term agreement with TerraPower to secure a substantial supply of nuclear energy.

In 2025, ASP Isotopes finalized several agreements with TerraPower to finance and supply fuel for advanced nuclear projects.

Advanced Enrichment Technology

The company focuses on uranium enrichment, a process essential for powering modern nuclear reactors. Naturally occurring uranium is largely composed of U-238, which cannot sustain nuclear fission. To generate energy, reactors require U-235, which must be separated through a process known as enrichment.

ASP Isotopes uses its proprietary Aerodynamic Separation Process, a method that increases efficiency and reduces costs compared with traditional techniques. The company’s strategy centers on producing High-Assay Low-Enriched Uranium (HALEU), the fuel necessary for small modular reactors (SMRs) and other advanced nuclear systems.

ASP Isotopes’ stock traded over 13% higher in Friday’s premarket.

Agreement With TerraPower

ASP Isotopes’ collaboration with TerraPower focuses on constructing a new uranium enrichment facility in South Africa and ensuring a long-term supply of HALEU for TerraPower’s Natrium reactor in Wyoming.

The agreement ensures delivery of the initial fuel cores for TerraPower’s Natrium reactor in Wyoming, while a 10-year contract, starting in 2028, will supply up to 150 metric tons of HALEU through 2037.

Friday’s agreement between Meta and TerraPower is significant because the tech giant will fund the construction of up to eight Natrium plants, with delivery of the initial units as early as 2032.

What Are Stocktwits Users Saying?

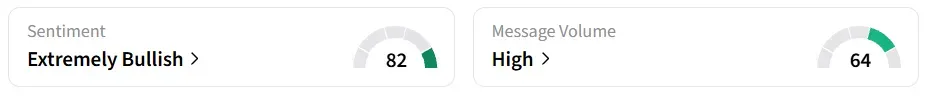

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘high’ message volume levels.

A bullish Stocktwits user suggested going long on the stock.

Another user expressed optimism about nuclear power.

ASPI stock has gained over 43% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<