The analyst recommends staggered buying with medium-to-long-term targets between ₹150 and ₹190.

Ashok Leyland shares hit fresh 52-week highs on Monday, mirroring the strength in the broader auto index after leading passenger vehicle makers such as Maruti Suzuki, Hyundai, Tata Motors, and M&M reduced car prices to pass on the full benefit of the GST 2.0 rate cuts to customers.

The revised tax slabs, effective September 22, will bring the rates on small cars down to 18% GST and SUVs to 40%.

SEBI-registered analyst Priyank Sharma is bullish on Ashok Leyland and recommended buying up to ₹120, layering in gradually, with target prices of ₹150, ₹165, and ₹190, and a stop loss of ₹110 on a weekly closing basis. He recommended a medium-to-long-term holding period.

Technical Analysis

Sharma noted that the stock has made a fresh all-time high breakout, surpassing both the 52-week high of ₹134.31 and the previous month’s peak, signaling a bullish structural shift.

It has found strong support near the 2023 high of ₹95.75, which now acts as a robust foundation for upside momentum. This breakout suggests a sign of strength, potentially paving the way for the price to reach ₹150 to ₹190 in the near to mid-term, according to him.

Brokerages Bullish

Nomura has maintained a ‘Buy’ call with a target price at ₹144, indicating a 11% upside potential, following Ashok Leyland’s pact with China’s CALB Group to develop next-generation batteries.

What Is The Retail Mood?

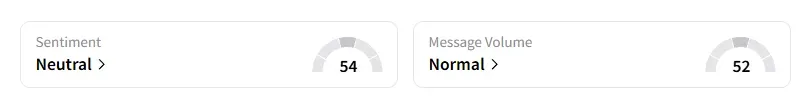

Data on Stocktwits shows that retail sentiment has been ‘neutral’ for over a week.

Ashok Leyland shares have gained 24$ year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<