CloudX, co-founded by CEO Jim Payne, has launched an AI-driven advertising platform that automates many tasks typically handled by engineers and ad operations teams.

- Applovin CEO Adam Foroughi has highlighted the company’s scale, noting that advertisers spend “well over $11 billion dollars annually” across its network.

- AppLovin’s Axon platform uses machine learning to optimize ad placement in real time.

- The company is scheduled to report its fourth-quarter earnings on February 11.

AppLovin Corp. (APP) saw its stock slide sharply on Wednesday, as investor anxiety grew over the arrival of a new artificial intelligence competitor, CloudX, that could change the mobile advertising landscape.

The selloff reflects concern that emerging platforms may challenge AppLovin’s established ad tech business.

CloudX Emerges As New Rival

The startup CloudX, co-founded by CEO Jim Payne, has launched an AI-driven advertising platform designed to automate many tasks typically managed by engineers and ad operations teams, potentially streamlining programmatic ad workflows.

The startup claims it can handle vast volumes of ad impressions using AI, which has stoked fears among market participants. AppLovin stock traded over 13% lower on Wednesday mid-morning.

However, Applovin CEO Adam Foroughi has highlighted the company’s scale, noting that advertisers spend “well over $11 billion dollars annually” across its network. That ecosystem reaches more than one billion daily active users, largely through mobile gaming. The backbone of this strategy is AppLovin’s Axon platform, which uses machine learning to optimize ad placement in real time.

What Are Stocktwits Users Saying?

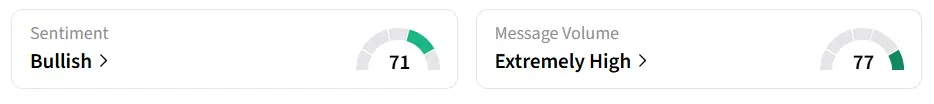

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory while message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

A bullish Stocktwits user suggested ignoring the noise and sees the dip as a major buying opportunity.

Another user said that CloudX and Google’s Project Genie are not a threat to AppLovin.

Fourth-Quarter Earnings

The company is scheduled to report its fourth-quarter earnings on February 11 and expects revenue in the range of $1.57 billion and $1.6 billion. Analysts see a revenue of $1.61 billion and earnings per share of $2.95.

Founded in 2012, AppLovin specializes in mobile advertising technology and software solutions for app developers. Its platform connects advertisers with consumers through programmatic campaigns while enabling app publishers to monetize effectively.

APP stock has gained over 4% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<