Lake Street said the standalone business would grow faster after the deal while Citizens said it would advance Applied Digital's focus on high-performance compute data center development.

- Lake Street maintains a ‘Buy’ rating on Applied Digital, with a $45 price target.

- Citizens has an ‘Outperform’ rating on Applied Digital, with a $40 price target.

- Applied Digital announced the spin-off of its cloud computing business and subsequent merger with Ekso Bionics on Monday.

Shares of Applied Digital Corporation (APLD) and Ekso Bionics Holdings Inc. (EKSO) were in focus on Tuesday morning after two Wall Street analysts expressed optimism about the latest spin-off and merger deal.

Lake Street’s Rob Brown said that Applied Digital’s cloud GPU spin-off would unlock significant value for the company, according to a note on TheFly. He added that it was "largely a forgotten asset within Applied" that would grow faster as a standalone business.

Meanwhile, Citizens said that the deal would advance Applied Digital's focus on high-performance compute data center development, as per TheFly.

On Monday, Applied Digital announced the spin-off of its cloud computing business and subsequent merger with Ekso Bionics.

Shares of APLD are up 2% on Tuesday while shares of EKSO have climbed over 46% at the time of writing.

Deal Contours

Applied Digital announced that it would merge Applied Digital Cloud with Ekso Bionics to form a new entity, ChronoScale Corporation, that would provide accelerated compute infrastructure for artificial intelligence workloads.

Applied Digital would own approximately 97% of ChronoScale after the completion of the deal, which is expected to close in the first half of 2026. Meanwhile, Ekso is exploring strategic paths to potentially sell all or most of its current business.

ChronoScale will operate as a focused platform delivering high-performance compute infrastructure optimized for advanced AI training and inference workloads, the company said.

Street Consensus

Lake Street’s Brown said that the planned spin-out of the cloud GPU business should unlock significant value, noting that public and private peers carry multi-billion valuations. While the unit was an earlier leader and its 6 GPU clusters generated $75M in annual revenue, ultimately the standalone unit would be more valuable, he said.

Lake Street maintains a ‘Buy’ rating on Applied Digital, with a $45 price target.

Meanwhile, Citizens has an ‘Outperform’ rating on Applied Digital with a $40 price target. The analyst said that the deal would create a dedicated platform for compute that would capture incremental demand for AI infrastructure. Citizens said that the deal would allow Applied Digital to focus on improving equity returns in its core colocation business.

How Did Stocktwits Users React?

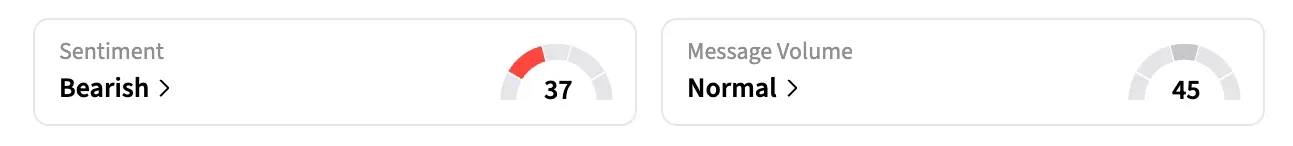

On Stocktwits, retail sentiment around APLD shares remained in the ‘bearish’ territory over the past day, while message levels jumped to ‘normal’ levels at the time of writing.

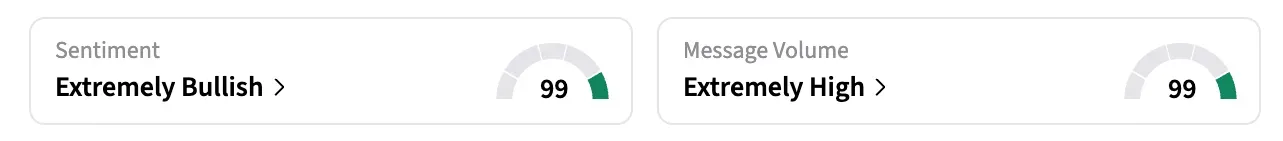

Meanwhile, retail sentiment around EKSO shares jumped to ‘extremely bullish’ from ‘bearish’ territory over the past day amid ‘extremely high’ message levels.

Shares of APLD were up over 211% in the past year, while shares of EKSO were down over 40% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<