The company also disclosed plans of a $175 million underwritten share offering after releasing its Phase 3 trial data.

- Analysts lifted price targets and reaffirmed bullish ratings after the Phase 3 results.

- The new trial data showed strong skin clearance with results improving over time.

- Alumis outlined plans for an FDA filing in 2026.

Shares of Alumis Inc. hit a record high after Wall Street responded positively to the company’s Phase 3 psoriasis trial results, prompting multiple analysts to raise price targets and reiterate bullish ratings on the stock.

The rally followed Alumis’ announcement of positive topline data from its Phase 3 Onward program evaluating Envudeucitinib in patients with moderate-to-severe plaque psoriasis.

Alumis’ stock surged over 95% on Tuesday to $16.23, and added another 3% in after hours trading.

Leerink, Oppenheimer Raise Targets After Trial ‘Win’

Following the data, Leerink Partners raised its price target on Alumis to $32 from $20 and maintained an ‘Outperform’ rating, implying upside of about 100% from the stock’s last close.

The firm said the strong topline results and additional details from the investor call reinforced Envudeucitinib’s favorable clinical profile and reignited strategic optionality around what it described as a “potentially best-in-class” Tyrosine Kinase 2 (TYK2) franchise, calling the outcome a clear “win.”

Separately, Oppenheimer raised its price target to $50 from $25 and reiterated an ‘Outperform’ rating, implying upside of about 212% from the stock’s last close. Analyst Jeff Jones said Envudeucitinib appears “highly competitive and potentially superior to Icotrokinra on some endpoints” following the trial results.

Phase 3 Data Shows High Levels Of Skin Clearance

Alumis said Envudeucitinib met all primary and secondary endpoints in both Onward1 and Onward2 trials with high statistical significance. By 16 weeks, 74% of patients saw major improvement in their psoriasis, and nearly 60% had skin that was clear or almost clear across the two studies.

By 24 weeks, Alumis said about two-thirds of patients saw near-complete clearing of their psoriasis, while more than 40% had completely clear skin. The company also said Envudeucitinib performed better than the standard treatment across all key measures of skin improvement at that point in the trial.

The company said treatment was generally well tolerated through Week 24, with a safety profile consistent with its Phase 2 program and no new safety signals observed.

Regulatory Timeline

Alumis said it plans to submit a New Drug Application to the U.S. Food and Drug Administration in the second half of 2026 and expects to present additional Onward data at an upcoming medical meeting.

Envudeucitinib is also being tested as a potential treatment for lupus, another autoimmune disease, with topline data from the Phase 2b Lumus trial expected in the third quarter of 2026.

After releasing the Phase 3 data, Alumis announced plans for an underwritten public offering of $175 million of common stock, with an option for underwriters to purchase additional shares.

How Did Stocktwits Users React?

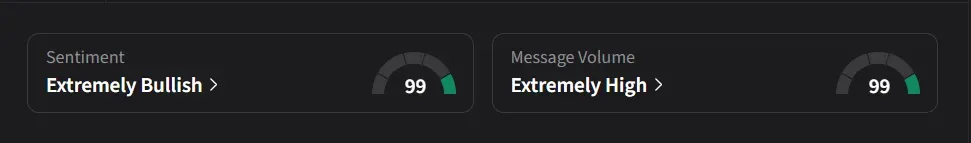

On Stocktwits, retail sentiment for Alumis was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the company has no debt, ample cash on hand, and a positive long-term outlook.

Another user said they expect the stock to hold above $16 after the offering, move gradually toward the $18–$20 range, and then potentially pull back afterward.

Alumis’ stock has risen 92% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<