Among major altcoins, Chainlink’s token was the hardest hit, dropping over 8%, followed by Avalanche, which fell more than 7%.

Altcoins slid during U.S. trading hours on Friday after inflation data reinforced concerns over persistent price pressures, adding to market uncertainty and dragging Bitcoin down to $85,000.

The Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, rose 2.5% year over year in February, according to data released Friday by the Bureau of Economic Analysis. According to Reuters, economists surveyed by FactSet expected annual price growth to be 2.5%, the same pace as January.

On a monthly basis, headline PCE inflation rose 0.3%, also in line with forecasts.

Core PCE inflation, which strips out food and energy costs and is viewed as a more stable measure of price trends, climbed 2.8% year over year.

Monthly core inflation increased 0.4%, slightly above the consensus estimate of 0.3%.

The data also pointed to resilient consumer spending. Personal consumption expenditures rose by $87.8 billion, or 0.4%, in February, exceeding expectations of a 0.3% increase and rebounding from a 0.3% decline in January.

The inflation report weighed on cryptocurrencies, which were already weighed down over tariff concerns, with Bitcoin (BTC) falling 1.6% over the past 24 hours to trade around $85,000, according to CoinGecko.

Ethereum's native token, Ether (ETH), saw a sharper decline of over 6%, breaking below the psychologically significant $2,000 level.

Among major altcoins, Chainlink (LINK) was the hardest hit, dropping over 8%, followed by Avalanche (AVAX), which fell more than 7%. Sui (SUI), Dogecoin (DOGE), and Litecoin (LTC) each lost around 6% over the same period.

On Stocktwits, retail sentiment around Bitcoin edged higher but remained in ‘neutral’ territory as chatter slid to ‘extremely low’ levels.

One user warned that mounting uncertainty could tip the economy into a recession – if one hasn’t already begun.

Another user shared that they had liquidated their portfolio and were looking to repurchase assets at what they expected to be deep discounts.

Bitcoin’s price has fallen nearly 3% over the past 30 days but remains up 20.9% over the past year.

Retail sentiment around Ethereum’s native token improved but remained in ‘bearish’ territory.

One user described the current conditions as a crypto bear market.

Another user warned that the downturn was just beginning.

Ether's price has tumbled 21% over the past month and remains down more than 46% over the past year.

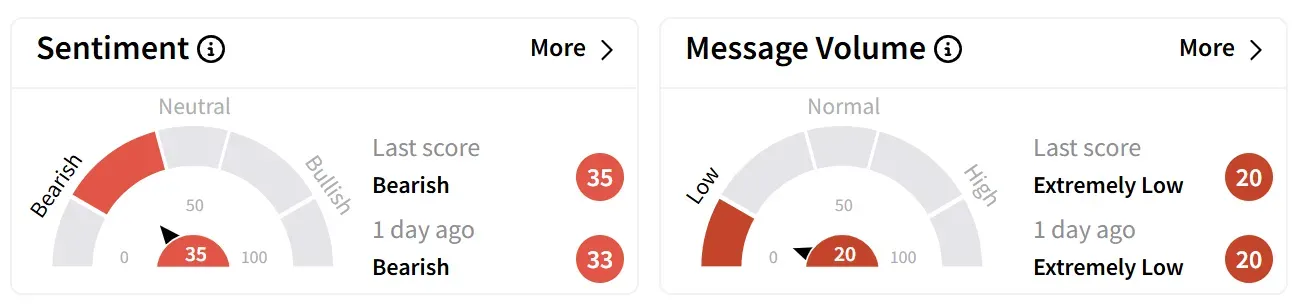

Retail sentiment around Chainlink’s token was also in ‘bearish’ territory as chatter dipped to ‘extremely low’ from ‘low’ levels.

One trader expressed disappointment over the token’s continued weakness.

Chainlink's token is down 5.9% over 30 days and 25% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Walrus Token Breaks Out at Launch, Finds Place Among Top Crypto Gainers – SUI Rallies in Tandem While Retail Eyes More Upside