RDDT dropped 9.4% on Thursday, after an analyst outlined weakness on the advertising sales front.

- Reddit shares dropped the most since Oct. 1 on Thursday, and rebounded slightly in the after-market session.

- RBC Capital Markets said small businesses are prioritizing organic presence on Reddit over spending on ads on the platform.

- RDDT has pulled back in recent months and is down 16% from its September peak.

Reddit, Inc. stock plunged 9.4% on Thursday, though it edged up in after-hours trading, with Stocktwits sentiment climbing even as a Wall Street analyst pointed to some pressure on the advertising front.

In an investor note, RBC Capital Markets highlighted "challenging" feedback from small and medium-sized business (SMB) ad agency checks for Reddit.

The investment firm said the response from ad buyers was “more mixed,” with instances of small brands shifting toward building organic presence strategies rather than focusing solely on advertising spending.

Although Reddit had a strong 2025 on the business front, driven by superior AI tools that improved ad sales and a partnership with OpenAI that brought in incremental revenue, the stock has pulled back in recent months.

Alongside concerns over slowing traffic, a wave of insider sales — including by the CEO, CTO, and chief legal officer — has also weighed on the stock. Investors will get a clearer picture when Reddit reports fourth-quarter results on Feb. 5.

Analysts expect sales to rise by 57% to $669 million and adjusted profit to rise 71% to $1.45 per share, according to Koyfin.

Still, Thursday’s stock drop – the worst since Oct. 1 – fueled both speculation and buy calls from retail traders on Stocktwits. “Something massively controversial for Reddit is cooking, and it’s not looking good… this dump seems like someone has got the news,” said a user.

A bullish user said, “Buying opportunity, every dip should be bought violently.”

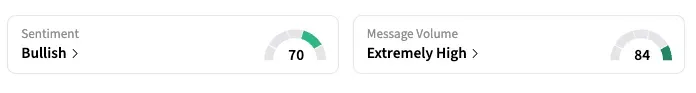

Retail sentiment for RDDT climbed multiple points higher in the ‘bullish’ zone over the previous day.

Reddit shares are down 6.3% so far this year and, at $226.76, are trading about 16% below their lifetime high from September 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<