Retail sentiment on Stocktwits is mixed as Aehr Test Systems’ stock declined pre-earnings, despite optimism around new semiconductor contracts.

Aehr Test Systems (AEHR) stock fell over 3.5% in mid-day trading Monday ahead of its second-quarter earnings release scheduled after the bell.

Analysts expect the chip maker to report earnings of $0.03 per share on revenue of $15.04 million, according to Stocktwits data.

The company’s previous quarter saw a 36% decline in revenue to $12.1 million year-over-year and a 23% contraction in profit margins to 5%.

Net income dropped sharply, down 86% to $660,000.

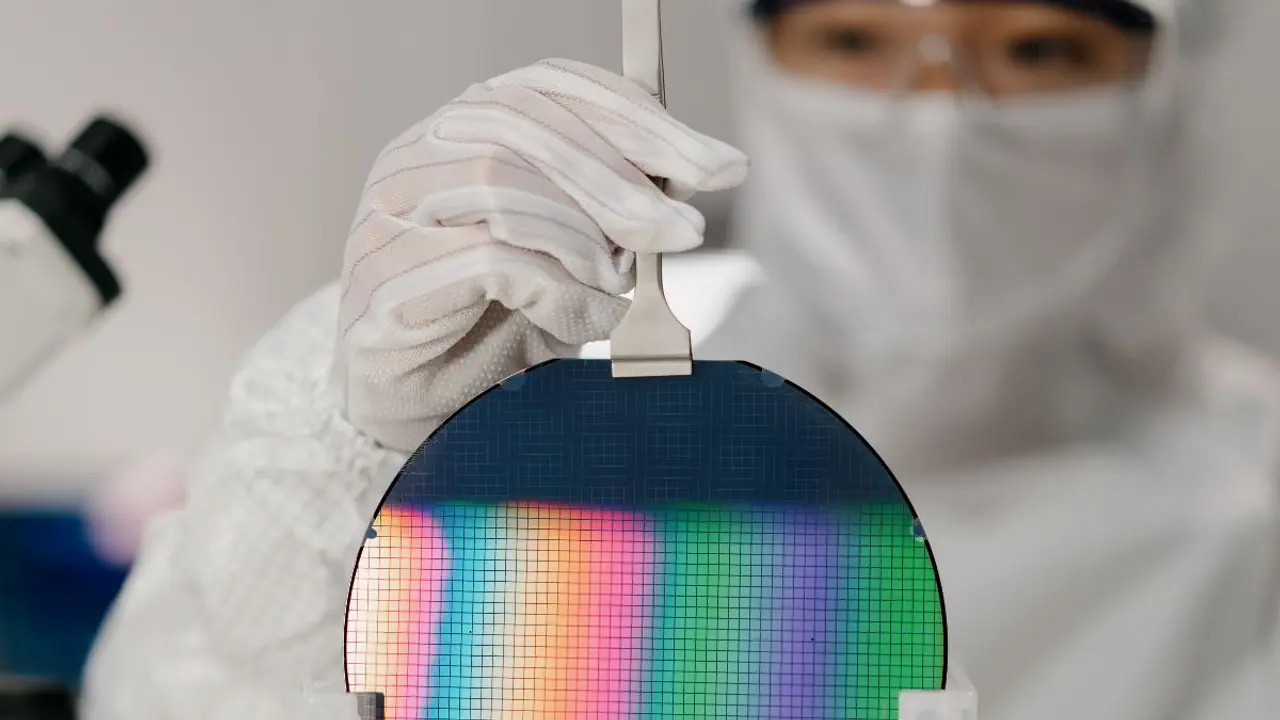

The company is known for providing test systems for burning-in and testing memory and logic integrated circuits. It designs, manufactures, and markets solutions tailored to ensure the performance and durability of logic and memory devices, sensors, and optical components.

Some retail investors on Stocktwits expressed optimism that new contracts could improve this quarter’s performance.

Last week, Aehr announced an initial production order from an unnamed top-tier automotive semiconductor supplier for its FOX-XP wafer-level test and burn-in system.

This system, designed for gallium nitride power semiconductor devices, is set for immediate shipment.

Options activity ahead of earnings is elevated, with volume 2.4 times the norm. Calls outnumber puts at a ratio of 2:1, while implied volatility points to an anticipated price swing of approximately 16.2%, or $2.52, after the results.

This is slightly below the median earnings move of 17.5% observed over the past eight quarters, suggesting relatively muted expectations.

On Stocktwits, retail sentiment remained in the ‘neutral’ zone even as chatter increased to ‘normal’ from ‘low’ levels, a day ago.

Some users on the platform were puzzled by the pre-earnings dip, while others expect strong forward guidance to lift the stock post-earnings.

Aehr Test Systems’ stock has declined by over 8% in the past year. In January alone, it lost 6.5% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Edison International Stock Plunges As CEO Admits Uncertainty Amid Wildfire Liability Concerns: Retail Sentiment Hits Year-Low