In his latest note, Jeremy Siegel expects the FOMC meeting to be uneventful, with no changes to the dot plot or the central bank’s monetary policy.

- Siegel added that the markets are shifting their focus to the imminent Fed Chair nomination.

- While Kevin Hassett was the frontrunner for several weeks, Siegel views ex-Fed official Kevin Warsh and BlackRock’s Rick Rieder to be among the frontrunners now.

- He added that the markets view both the options as benign, which has kept the policy uncertainty contained.

Jeremy Siegel, professor emeritus of finance at the University of Pennsylvania’s Wharton School of Business, stated that the Federal Reserve may signal a “clear pause” on rate cuts on Wednesday.

In his latest note, the Wharton professor stated that he expects the FOMC meeting to be uneventful, with no changes in the dot plot or the central bank’s monetary policy.

The FOMC is scheduled to meet on January 27 and January 28, with the outcome announced at the conclusion of the two-day meeting. This is also its first meeting for 2026, and comes after three consecutive 25 bps rate cuts toward the end of 2025.

Shifting Focus Of Markets

Siegel added that the markets are shifting their focus to the imminent Fed Chair nomination. While White House National Economic Council Director Kevin Hassett was the frontrunner for several weeks, Siegel views ex-Fed official Kevin Warsh and BlackRock Inc.’s Chief Investment Officer, Rick Rieder, to be among the frontrunners now.

“Attention is also turning to the Fed leadership question, where the field has narrowed to what looks like a two-horse race between Warsh and Rieder,”

He added that the markets view both the options as benign, which has kept the policy uncertainty contained.

The Case For A Pause

The economist pointed to the macroeconomic data released since December that makes a strong case for a pause this month.

In December, the Bureau of Economic Analysis reported that the U.S. economy grew at an annualized rate of 4.3% in the third quarter (Q3), higher than the Dow Jones forecast of 3.2%, as cited by MarketWatch.

The BEA stated that the acceleration in real GDP in Q3 compared to the second quarter (Q2) reflected a smaller decrease in investment, an acceleration in consumer spending, and an upturn in exports and government spending.

The December jobs report from the Bureau of Labor Statistics (BLS) showed the unemployment rate inching lower to 4.4% in December, down from a revised 4.5% in November.

The Fed’s preferred inflation gauge, Personal Consumption Expenditures (PCE) index, came in at 2.8% in November on an annualized basis, in line with expectations.

Data from CME Group’s Fedwatch tool indicates a 97.2% probability that the Fed will maintain interest rates at the current 3.5% to 3.75% range.

Expert Points To A ‘Wild Card’

Schwab Center for Financial Research analysts stated in a recent note that the markets are currently pricing in no changes to the policy rates.

However, the firm’s director of fixed income strategy, Howard Cooper, pointed out what investors should watch out for on Wednesday. “The statement will likely contain minimal changes. The press conference is always the wild card,” he said.

The firm also said in its note that dissents will be another aspect to watch out for following the conclusion of the FOMC’s meeting on Wednesday. “Some Fed policymakers have made it clear they want rates lowered faster, but they're unlikely to have their way today,” stated SCFR.

Analysts at ING Think echoed similar sentiments in their latest note ahead of the Fed meeting.

“The main focus will therefore be on possible dissent and communication, also around the issue of the Fed’s independence. The decision will also be overshadowed by President Trump's upcoming pick of a new Fed Chair,” the firm said.

What Are Prediction Markets Indicating?

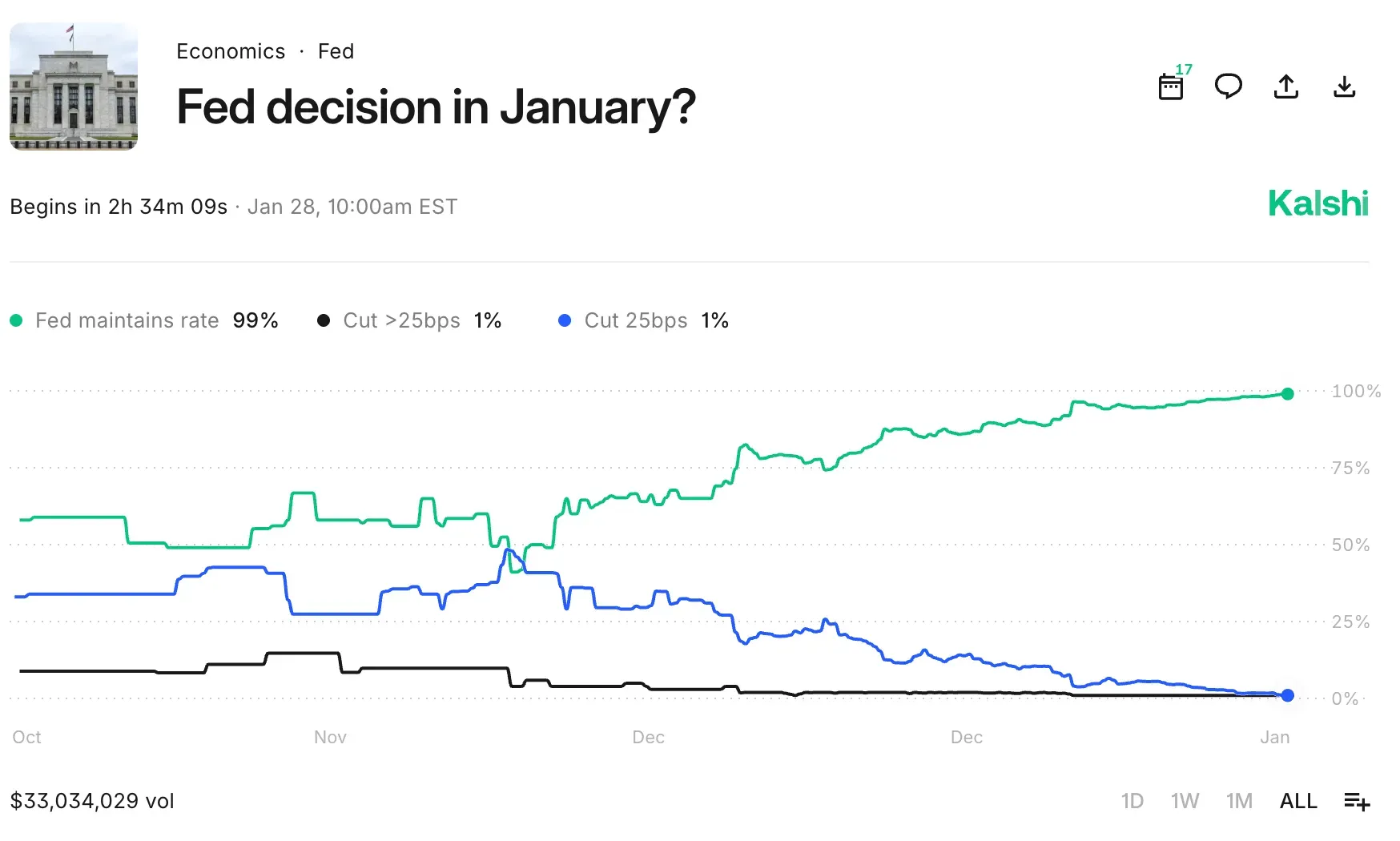

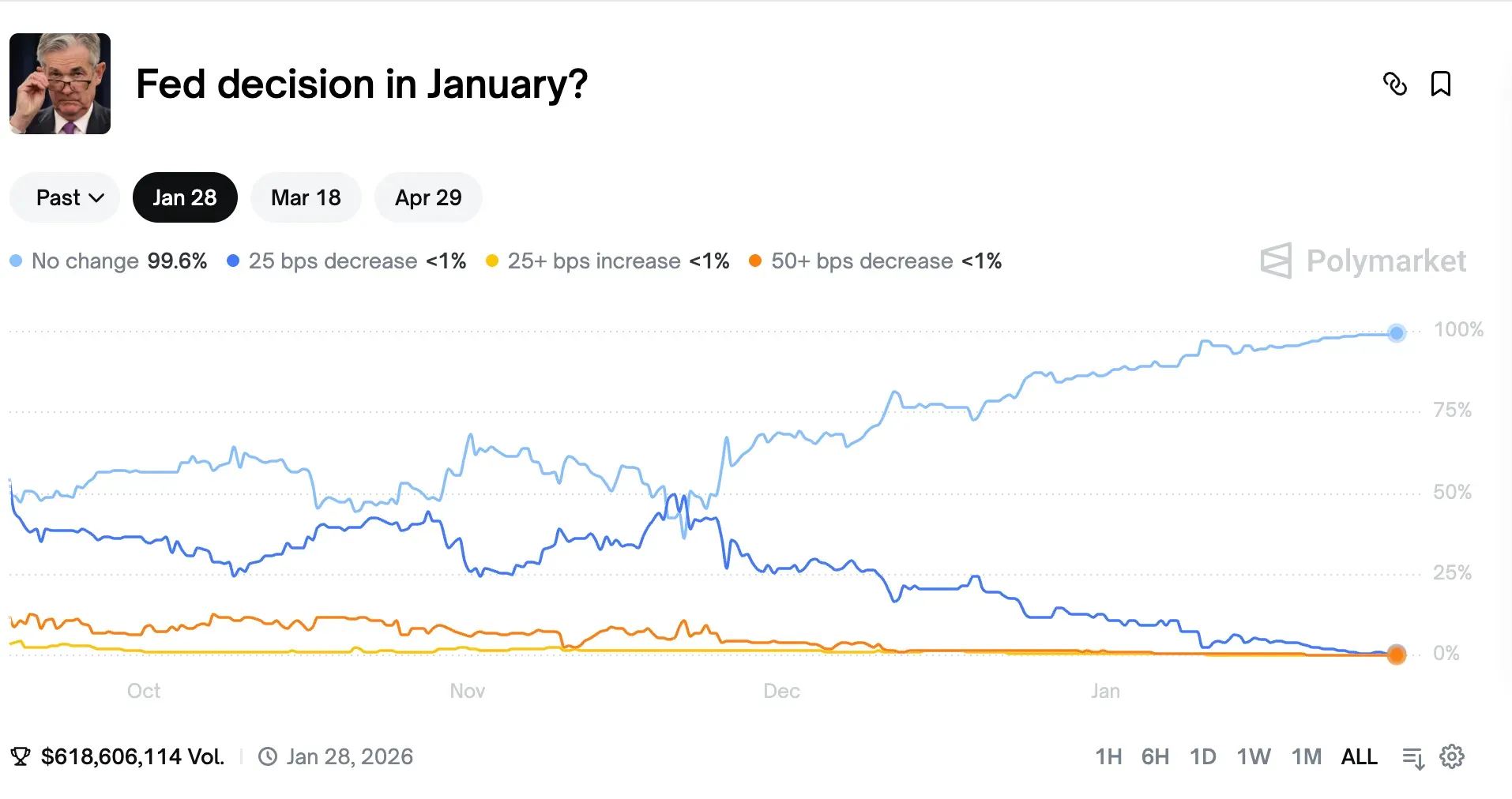

Bettors on popular prediction markets, Kalshi and Polymarket, overwhelmingly expect the Fed to keep rates unchanged this week.

While total betting volumes on the two platforms stood at nearly $652 million at the time of writing, 99% of the votes were in favor of the Fed keeping rates unchanged.

Meanwhile, U.S. equities gained in Wednesday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.34%, the Invesco QQQ Trust ETF (QQQ) rose 0.91%, and the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.06%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bearish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was down by 0.39% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) fell 0.09%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<