The Reserve Bank of India (RBI) cut its key repo rate by 50 basis points to 5.50%, the third reduction in 2025, totaling 100 basis points.

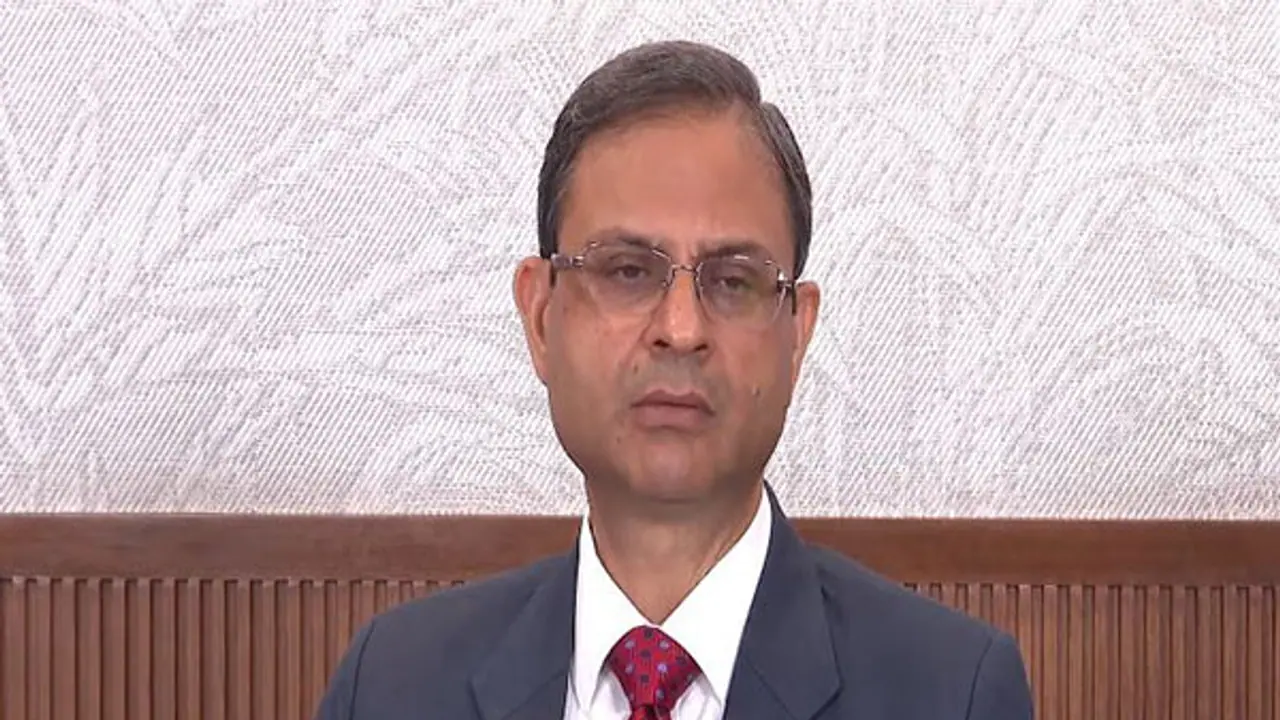

In a stronger-than-expected move, the Reserve Bank of India (RBI) on Friday slashed the key policy repo rate by 50 basis points, bringing it down to 5.50 per cent. The decision was announced by RBI Governor Sanjay Malhotra following the conclusion of the Monetary Policy Committee (MPC) meeting.

This marks the third consecutive rate cut by the RBI in 2025 and brings the total reduction for the calendar year to 100 basis points (bps). The move is aimed at supporting growth amid a benign inflation outlook and sustained moderation in Consumer Price Index (CPI) inflation.

Inflation remains below target

Governor Malhotra noted that the decision came as headline inflation remained consistently below the RBI’s medium-term target of 4 per cent. “The MPC decided to reduce the policy Repo Rate under the Liquidity Adjustment Facility by 50 basis points to 5.5%, with immediate effect,” he said.

As a result of the rate cut:

- Standing Deposit Facility (SDF) rate is revised to 5.25%

- Marginal Standing Facility (MSF) rate and Bank Rate are now at 5.75%

RBI's recent rate cut timeline

Here’s a quick look at the recent trend in repo rate revisions:

Effective Date Repo Rate

6 June 2025 - 5.50%

9 April 2025 - 6.00%

7 February 2025 - 6.25%

6 December 2024 - 6.50%

9 October 2024 - 6.50%

8 August 2024 - 6.50%

7 June 2024 - 6.50%

5 April 2024 - 6.50%