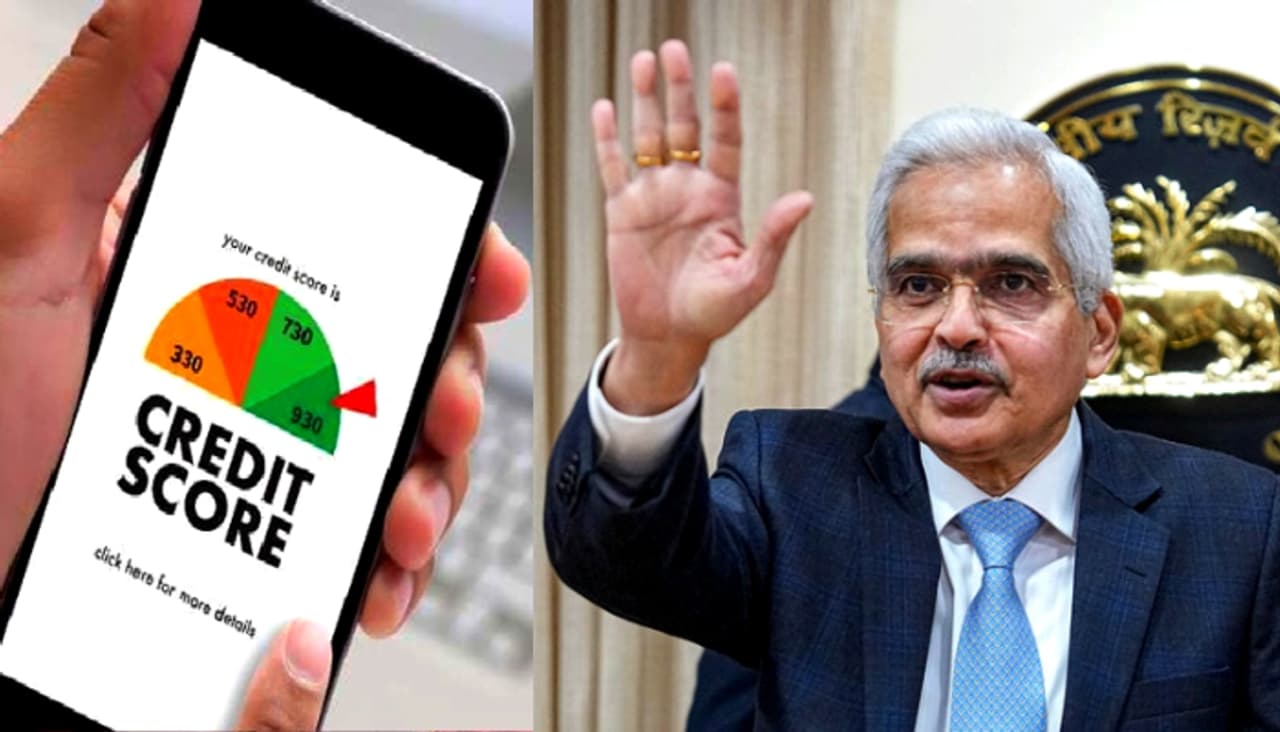

RBI's new CIBIL score rules: What you need to know

Credit score plays a crucial role in securing loans from banks. Learn about the important rules and regulations set by the Reserve Bank of India regarding CIBIL scores.

The Reserve Bank of India has implemented new rules regarding CIBIL scores due to numerous complaints. A good CIBIL score is essential for easy loan approvals.

Credit scores will be updated every 15 days, effective January 1, 2025. This allows banks to make informed lending decisions and provides individuals with poor scores an opportunity to improve them.

Free CIBIL score check

Banks and non-banking institutions must inform customers when their credit reports are accessed. This notification can be sent via SMS or email and has been made mandatory due to complaints.

Customers whose loan applications are rejected must be informed of the reason. This transparency helps them understand the factors affecting their credit worthiness.

Credit institutions must provide a free, comprehensive credit score report annually. The link to access this report should be available on the institution's website.

Customers must be notified in advance if their account is about to default due to non-repayment. Nodal officers must be appointed to address credit score disputes.

Lending institutions must resolve customer complaints within 30 days or face a penalty of Rs 100 per day. Specific timelines and penalties apply to both banks and credit bureaus.

Stay updated with the Breaking News Today and Latest News from across India and around the world. Get real-time updates, in-depth analysis, and comprehensive coverage of India News, World News, Indian Defence News, Kerala News, and Karnataka News. From politics to current affairs, follow every major story as it unfolds. Get real-time updates from IMDon major cities weather forecasts, including Rain alerts, Cyclonewarnings, and temperature trends. Download the Asianet News Official App from the Android Play Store and iPhone App Store for accurate and timely news updates anytime, anywhere.