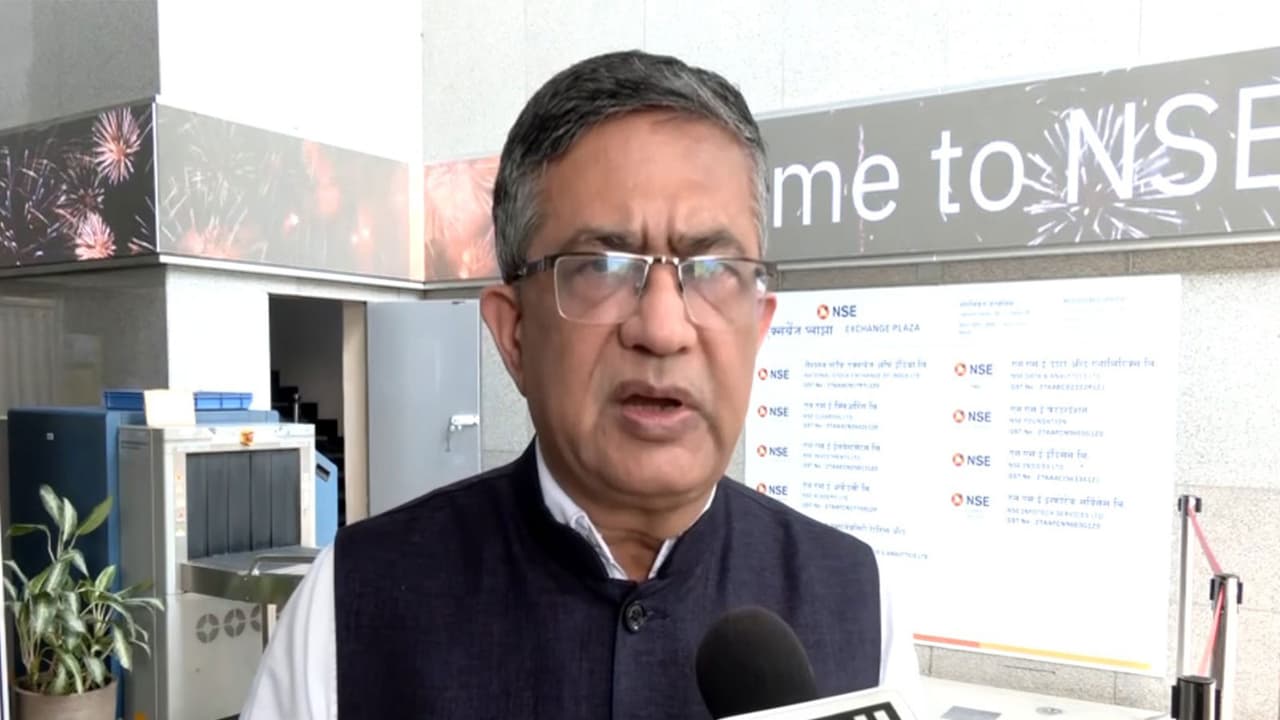

NSE CEO Ashish Kumar Chauhan explains the STT hike's goal to curb speculation, discusses robust systems for glitches, new free cash flow norms for SME IPOs, readiness for T+0 settlement, and projects an 8-9 month timeline for the NSE IPO.

On STT Hike and Market Speculation

National Stock Exchange (NSE) MD and CEO Ashish Kumar Chauhan spoke about the recent hike in Securities Transaction Tax (STT) during the FY 27 budget. He noted that the tax has been raised several times over the years, with the latest increase specifically targeting equity futures and options. While daily traders may feel the pinch, Chauhan explained that the government's primary goal is to curb excessive speculation in the market.

"Naturally, people who are sort of daily trading have an issue. But overall, the government has a perspective that they want to reduce speculation," Chauhan said. He added that beyond taxes, other measures are being looked at to handle this social issue, noting, "There are other ways also they probably are exploring in terms of ensuring that product suitability guidelines and also combining many expires into one."

On Technical Glitches and System Robustness

When asked about how the exchange handles technical glitches during high market volatility, Chauhan pointed out that IT systems globally have become incredibly complex. He compared the situation to other digital services, noting that even widespread systems like UPI have faced outages without the same level of public outcry. However, he emphasised that stock exchanges are making heavy investments to ensure they can recover quickly when things go wrong.

"India has one of the most robust systems across the world in terms of the IT system for the stock exchange ecosystem put together," he stated. Despite this, he acknowledged that no system is perfect, "Somewhere along the line, we continue to feel that IT systems have become complex and they will have, once in a while, some amount of glitches. We need to, of course... be more alert at ensuring that such things don't happen."

On SME IPOs and New Listing Framework

On the topic of SME IPOs, Chauhan stressed that listing a company is a major responsibility that requires a long-term plan and a willingness to follow regulations. To ensure that only high-quality companies enter the market, the NSE has introduced a new mandatory requirement focusing on free cash flow rather than just reported profits. This move is designed to filter out companies with weak business models that might otherwise meet basic regulatory requirements.

"We then, at NSE level alone, we created a new framework called free cash flow," Chauhan explained. He highlighted why this metric is crucial for stability: "The companies which have free cash flow available... those companies have done better in terms of the volatility, in terms of their profitability going forward, and their ability to sustain themselves in the long run."

On T+0 Settlement Readiness

Regarding the move to T+0 settlement, which allows for same-day transaction processing, Chauhan expressed full confidence in India's technological readiness. He noted that while India is a global leader in settlement speed, the transition also depends on the readiness of foreign investors and global systems. He pointed out that certain segments in India, like mutual fund distributions and bond fundraising, are already operating on instant or same-day timelines.

"India has been a pioneer and a thought leader and execution leader in terms of using the technology," Chauhan said. He made it clear that the exchange is ready to move whenever the regulator gives the green light: "As and when the regulators and policymakers think it fit... there should not be any issue technologically."

On NSE IPO Timeline

Finally, addressing the long-awaited NSE IPO, Chauhan provided a clearer timeline following the receipt of the No Objection Certificate (NOC) on January 31. He mentioned that the exchange is currently preparing its Draft Red Herring Prospectus (DRHP). He estimated that the entire process, including the necessary paperwork and regulatory steps, would take most of the current year to complete.

"It will take around eight to nine months," Chauhan confirmed. "We are in the process to prepare our DRHP and completing other work." (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)