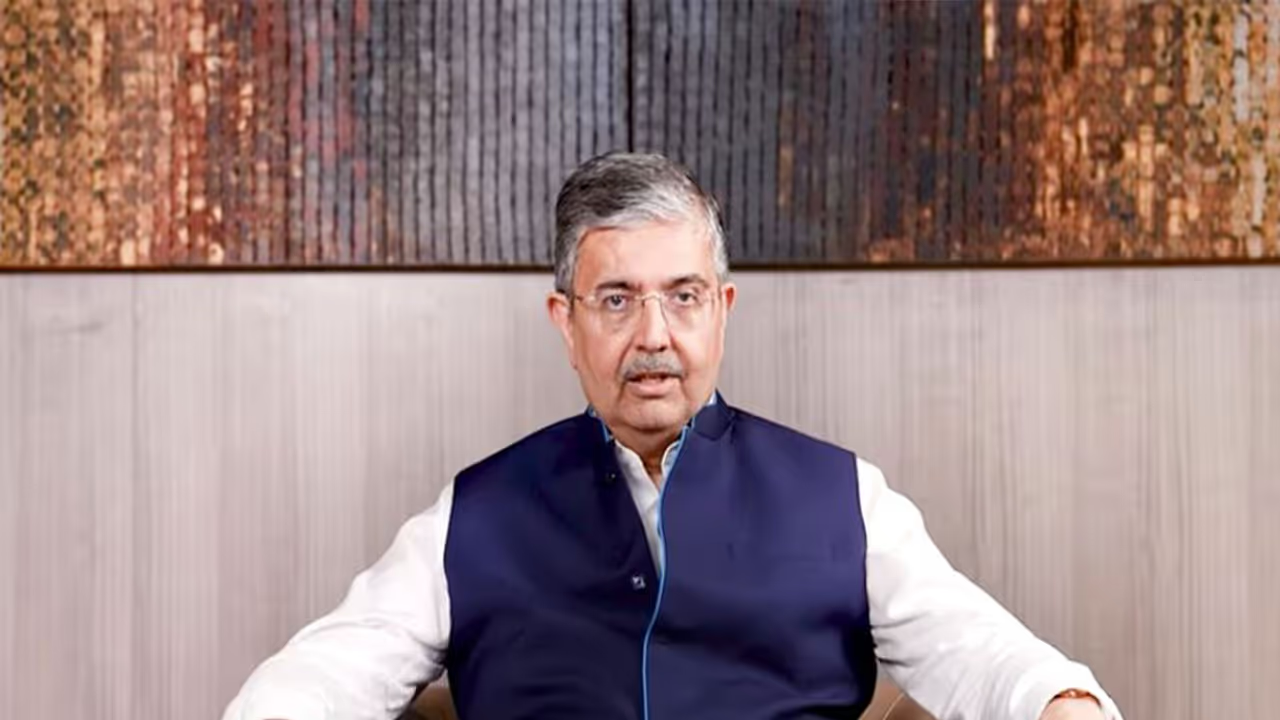

Uday Kotak warns Indian businesses as the rupee weakens past Rs 90/dollar. He notes aggressive foreign selling has resulted in zero dollar returns for the Nifty in a year, urging firms to shake out of their comfort zone.

Uday Kotak's Warning on Rupee Depreciation

As the rupee weakens towards Rs 90 per dollar, Uday Kotak, Founder & Director of Kotak Mahindra Bank has urged Indian businesses to break out of their comfort zone, warning that foreign investors appear to be calling the shots in current market dynamics. Despite steady domestic buying, Kotak flagged that aggressive overseas selling has left the Nifty delivering zero dollar returns over the past year. In a post on social media X, Kotak added, "₹@90. The proximate reason: foreign selling of Indian stocks both FPI & PE under FDI. Indian investors buying. Time will tell who is smarter. For now foreigners seem smarter. 1 year nifty $ return is 0. But this a long game. Time for Indian business to shake out of comfort zone."

Rupee Hits All-Time Low Amidst Market Sell-Off

At the time of writing this report on Wednesday, the exchange rate of US dollar and Indian rupee was Rs 90.26, extending its depreciation run through sessions now, and in the process hitting a fresh all-time low for the Indian currency. So far this year, the currency has depreciated by over 5 per cent on a cumulative basis.

In the cash market, FIIs continued to be net sellers of Indian equities with net outflows of Rs 3,642 cr, countered by DIIs who net bought shares worth Rs 4,646 cr on Tuesday. Indian benchmark indices Nifty 50 and Sensex closed in the red for the third consecutive trading session on Tuesday as selling pressures persisted across sectors and the Rupee further weakened against the Dollar.

Factors Behind the Decline

Financial market Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities, said that the Rupee was pressured by the absence of a confirmed India-US trade deal and "repeated delays in timelines." "Markets now want concrete numbers rather than broad assurances, leading to accelerated selling in the rupee over the past few weeks," Trivedi added. "Muted RBI intervention has also contributed to the swift depreciation. With the RBI policy announcement on Friday, markets expect clarity on whether the central bank will step in to stabilize the currency. Technically, the rupee is deeply oversold, and a move back above 89.80 is essential for any meaningful recovery."

Sectoral Impact of a Weaker Rupee

Explaining the possible outcomes of the weakness of INR, Sunny Agrawal, Head - Fundamental Research at SBI Securities, said that the sectors which can benefit are export-dependent like Shrimp, Textile, IT, Pharma, Engg, Metals, Auto Anc etc. On the other hand import import-dependent sectors will face cost pressure, such as FMCG, Plastic polymers, Oil and Gas, etc, he added.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)