Nvidia has made history by becoming the world’s first $5 trillion company after its shares surged 4.91% to $210.90 on Wall Street. The milestone reflects strong investor confidence in Nvidia’s dominance in artificial intelligence technology.

US-based AI chipmaker Nvidia made history on Wednesday by becoming the world's first $5 trillion company after its shares surged 4.91% to $210.90 on Wall Street. The milestone was achieved as investors remained confident that AI will deliver a new wave of innovation and growth.

With Nvidia's market capitalisation past the never-before-seen threshold, the milestone reflects strong investor confidence in chipmaker's dominance in the artificial intelligence tech.

Nvidia's stock surge

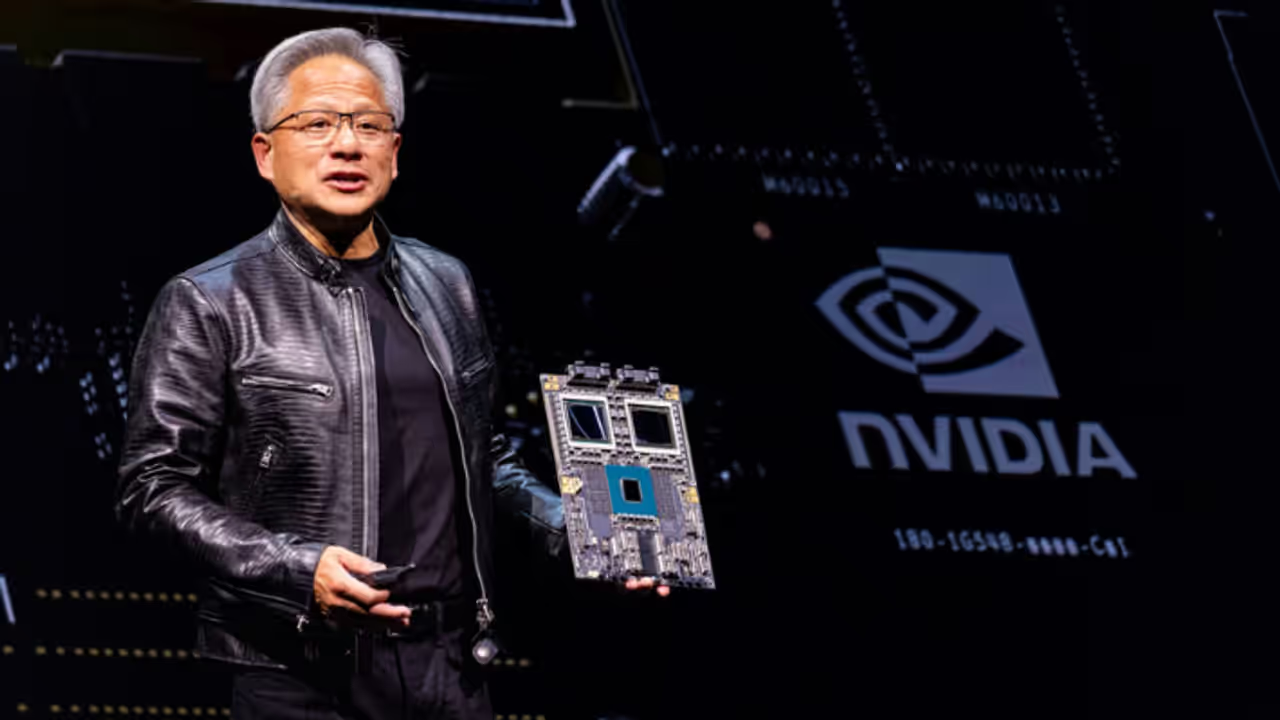

According to a report in Wall Street Journal, The chipmaker's shares on Wednesday climbed past $210, surpassing the $205.76 mark required for a $5 trillion valuation. Nvidia's stock surge has been driven by growing excitement over the potential of artificial intelligence and a wave of new partnerships with major companies such as OpenAI, Oracle, Nokia, and Eli Lilly. Investor enthusiasm following CEO Jensen Huang’s speech in Washington, D.C., also added momentum to the rally this week.

US stocks hit record highs amid AI-fueled rally

US stock markets surged to record highs on Tuesday, powered by strong gains in the technology sector. The rally pushed Apple and Microsoft to market valuations of over $4 trillion each, following notable rises in their share prices, according to a CNBC report.

The sharp climb in stocks reflects continued investor enthusiasm for artificial intelligence, which has triggered record-breaking deals, spending, and valuations across global markets. Analysts say the AI trade remains the biggest driver of Wall Street's current momentum.

Experts warn of bubble risks

Despite the bullish sentiment, concerns over a potential market bubble are growing. Earlier this month, both the International Monetary Fund (IMF) and the Bank of England warned that global stock markets could face turbulence if investor appetite for AI weakens.

Cathie Wood as quoted by CNBC acknowledged the risk of a short-term 'reality check' in AI valuations but rejected fears of an imminent bubble. "If our expectations for AI are correct, we are at the very beginning of a technology revolution," Wood told CNBC during the Future Investment Initiative (FII) conference in Riyadh, Saudi Arabia.

(With inputs from AFP)