The firm has already brought in Kekst CNC as a global communications advisor to help change the narrative building in international media. It has also roped in American law firm Wachtell, Lipton, Rosen and Katz to fight back against the Hindenburg report.

Adani group firm Adani Ports and SEZ paid Rs 1,500 crore loan and promised to repay more as the embattled conglomerate mapped a comeback strategy after a sellout triggered by a damning report by US-based Hindenburg Research.

On Monday, Adani Ports and SEZ paid SBI Mutual Funds' due amount of Rs 1,500 crore and will also pay another Rs 1,000 crore of commercial papers due in March (as per the payment scheme). "This part prepayment is from the existing cash balance and funds generated from the business operations," the spokesperson said.

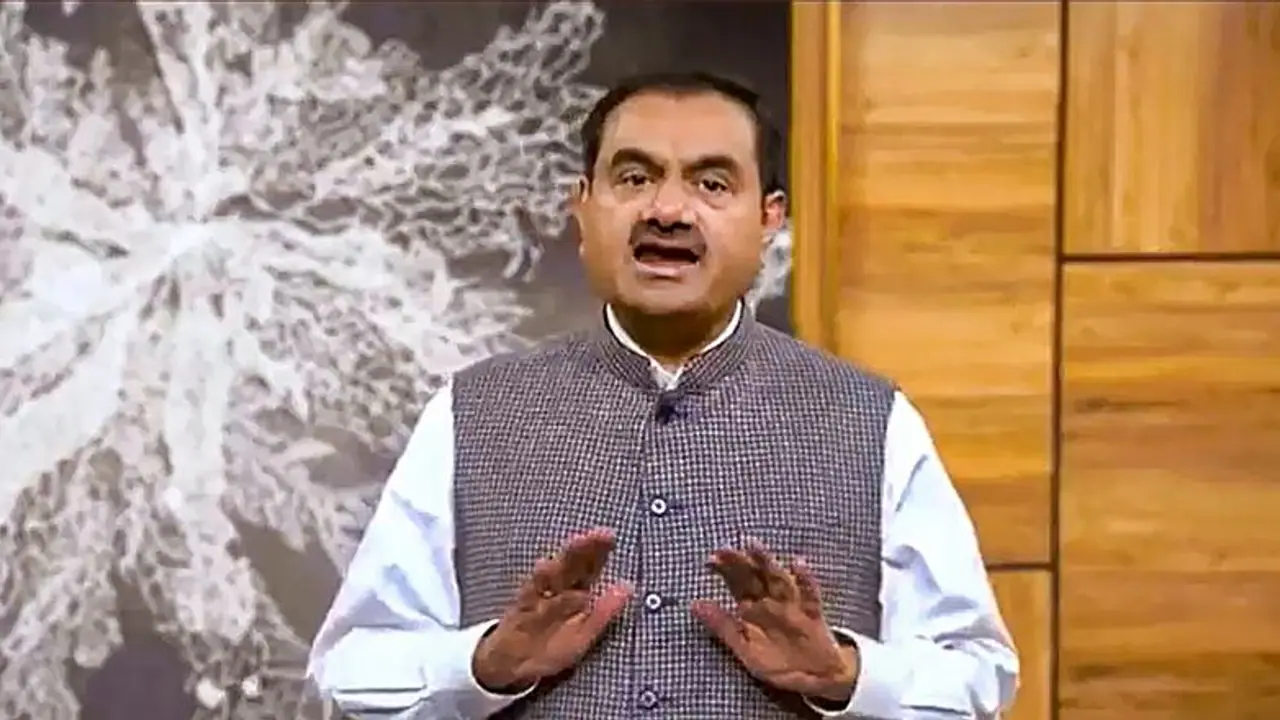

Also read: Gautam Adani’s net worth dips below $50 billion as Hindenburg report hits Adani Group's fortune

The apple-to-airport conglomerate is hoping to claw back the narrative with payback and calm jittery investors and lenders who were spooked by allegations of accounting fraud and stock manipulations. Adani group has denied all the allegations.

The firm has already brought in Kekst CNC as a global communications advisor to help change the narrative building in international media. It has also roped in American law firm Wachtell, Lipton, Rosen and Katz to fight back against the Hindenburg report.

As of September 2022, Adani group's gross debt stood at Rs 2.26 lakh crore and had cash of Rs 31,646 crore. Adani group has been on an overdrive to address investor concerns around debt.

Also Read | All GST compensation dues worth Rs 16,982 crore will be cleared, announces Nirmala Sitharaman

It has called off a plan to acquire a coal plant of DB Power for over Rs 7,000 crore and is drawing up a roadmap detailing the repayment schedule of existing debt. APSEZ on February 8 said it will repay Rs 5,000 crore debt in year financial year starting April and the group would also repay a USD 500 million bridge loan due next month.

Earlier this month, French oil major TotalEnergies said it would wait for the result of an independent audit before proceeding with investing in Adani Group's USD 50 billion plans to make green hydrogen.

According to Bernstein Research, Adani Green is capable of paying off all its debt of Rs 22,000 crore due in the financial year ending in March 2025, if it divests some renewable energy assets, seeks fresh equity capital from existing investors, or cancels some planned projects and avoids bidding for new ones.

(With inputs from PTI)