The Finance Ministry has extended the deadline for revising income-tax returns to March 31, 2026, with a fee. The original filing deadline for ITR-1 and ITR-2 remains July 31, 2026.

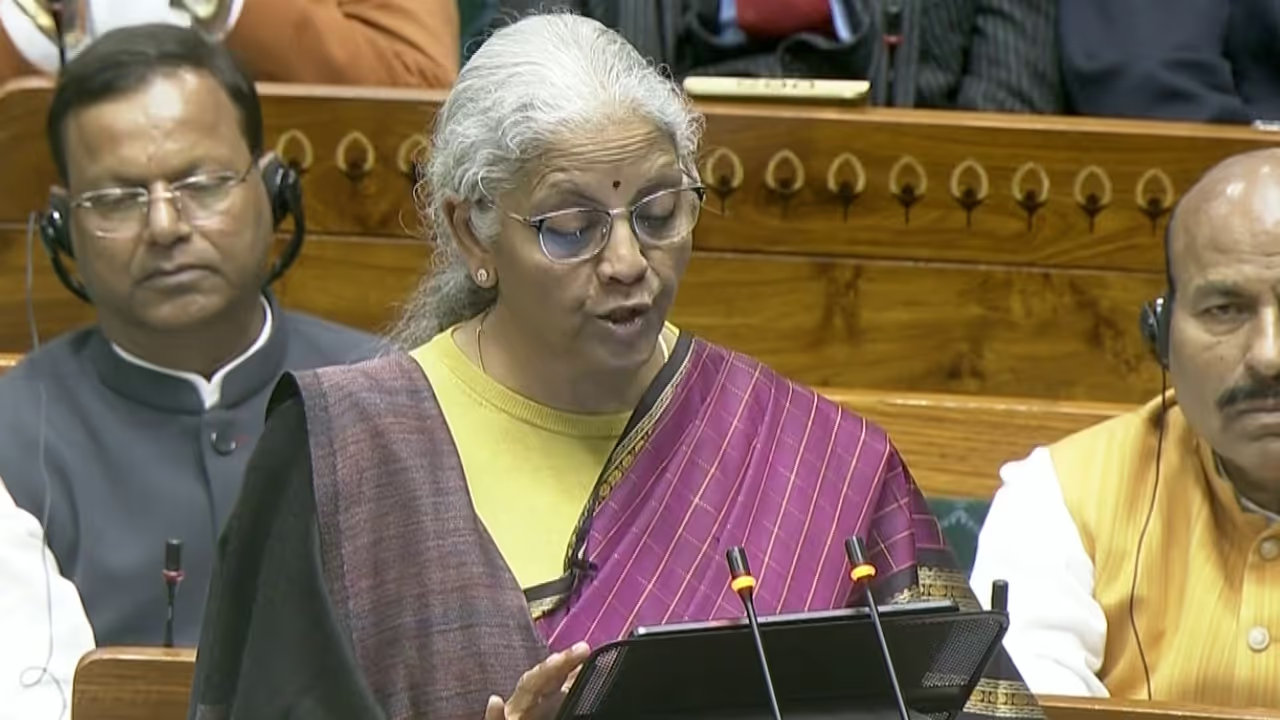

Finance Minister Nirmala Sitharaman on Sunday announced that taxpayers will now have extra time to revise their income-tax returns. The deadline for ITR revisions has been extended to March 31, 2026, with a small fee applicable. However, the original filing deadline for ITR-1 and ITR-2 remains July 31, 2026, giving clarity to salaried individuals and small taxpayers.

Fiscal Deficit on a Glide Path

The Finance Minister said India's fiscal deficit for FY27 is projected at 4.3% of GDP, slightly lower than FY26's 4.4%, showing a continued effort to keep public finances under control while supporting growth.

Debt-to-GDP Ratio to Improve

The government aims to bring the debt-to-GDP ratio down to 55.6% in FY27, from 56.1% in FY26. This reflects India's push to strengthen fiscal stability while continuing investments in key development areas.

Balancing Growth and Responsibility

These measures are designed to strike a balance between easing compliance for taxpayers and maintaining fiscal discipline. By providing flexibility in tax filings and keeping debt under check, the government signals a steady approach toward long-term economic stability.