Your Home Loan interest rate not only determines the amount of your monthly instalment but also affects the total cost of your loan over time.

Purchasing a home is one of the most significant financial decisions in a person’s life. Whether you are buying your first apartment, constructing a new house, or investing in a second property, financing the purchase often requires a House Loan. One of the most critical aspects to understand when applying for a Home Loan is the type of interest rate you choose.

Your Home Loan interest rate not only determines the amount of your monthly instalment but also affects the total cost of your loan over time. Broadly, there are two types of interest rates available in the market, fixed and floating. Each comes with its own benefits, risks and ideal use cases.

In this article, we break down how each rate works, compare their advantages and limitations and help you decide which option is right for you.

What Is a Home Loan Interest Rate?

A Home Loan interest rate is the rate at which interest accrues on the amount you have borrowed. Interest amount is the cost you pay to the bank or financial institution for borrowing money to buy or construct a home. The interest rate is expressed as a percentage of the loan amount and is applied to calculate your monthly repayment or Equated Monthly Instalment (EMI).

Leading banks like ICICI Bank offer both fixed and floating rate options, allowing borrowers to select what fits their financial goals and risk preferences.

Types of Home Loan Interest Rates

1. Fixed Interest Rate

A fixed interest rate means the interest rate on your loan remains constant for a specified period, or sometimes for the entire loan tenure. Your EMI does not change, even if market rates fluctuate.

Example:

If you take a ₹40 lakh loan at a 9% fixed rate for 15 years, your EMI will remain the same every month throughout the tenure, irrespective of whether market rates rise or fall.

Advantages of Fixed Interest Rate:

Predictable EMIs: The biggest advantage is stability. Your monthly outflow remains constant, making budgeting easier.

Protection from Rate Hikes: You are shielded from rising market interest rates, which can increase EMIs for floating-rate borrowers.

Ideal for Long-Term Planners: If you prefer certainty over potential savings, this option provides peace of mind.

Limitations:

No Benefit in Rate Drops: If the market interest rates fall, your EMI remains unchanged, meaning you miss out on potential savings.

2. Floating Interest Rate

A floating interest rate (also known as a variable rate) changes based on market conditions, often linked to the Reserve Bank of India’s repo rate or the lender’s benchmark rate.

Example:

If your loan is linked to the bank’s External Benchmark Lending Rate (EBLR), a change in the repo rate can affect your loan interest rate directly.

Advantages of Floating Interest Rate:

- Benefit from Rate Reductions: If market rates decline, your EMI or loan tenure reduces, saving you money.

- Transparent Adjustments: Floating rates are usually benchmark-linked, which makes rate changes more transparent and timely.

Limitations:

- Uncertainty: Since rates can fluctuate, it may be harder to predict your EMIs over the long term.

- Possible Rate Hikes: If market interest rates rise, your monthly EMI or tenure may increase.

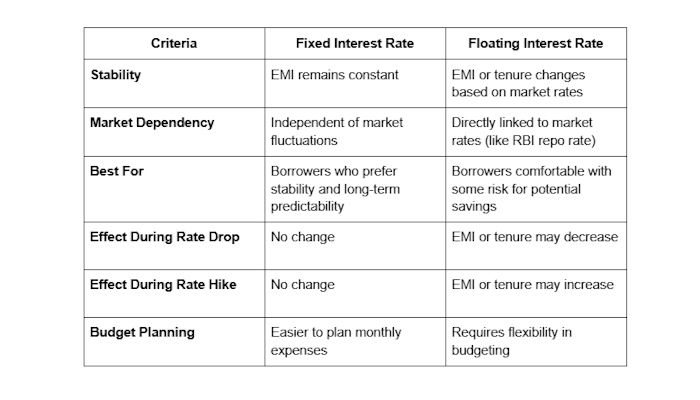

Fixed vs Floating Home Loan Interest Rate: A Comparison

Factors Influencing Home Loan Interest Rates

Your Home Loan interest rate depends on several personal and market-based factors. Here are the key ones:

1. Credit Score

A higher credit score (700 and above) reflects strong repayment discipline and can help you secure a lower interest rate.

2. Loan Amount and Tenure

Larger loans or longer tenures may attract slightly different rates due to increased risk for the lender.

3. Type of Property

Rates may vary depending on whether the property is under construction, ready to move, or from resale.

4. Borrower’s Profile

Banks assess your employment type, income stability and existing financial obligations before deciding on a rate.

5. Market Conditions

Changes in the RBI’s repo rate or inflation directly influence lending rates.

How to Choose Between Fixed and Floating Rates

When deciding between fixed and floating interest rates for your House Loan, consider the following factors:

- Market Trends: If rates are currently low and likely to rise, a fixed rate can provide protection. Conversely, if rates are high but expected to fall, a floating rate could save you money.

- Loan Tenure: For shorter loans (less than 5 years), a fixed rate can offer stability. For longer tenures, floating rates often turn out to be more cost-effective.

- Risk Appetite: If you prefer certainty and fixed budgeting, go for a fixed rate. If you are comfortable with small fluctuations, floating is more flexible.

- Income Stability: Salaried professionals with predictable income may prefer floating rates, while self-employed individuals might prefer fixed rates for easier expense management.

Using a Home Loan Interest Rate Calculator

Before making a decision, you can use a Home Loan interest rate calculator available on the websites of major banks like the ICICI Bank to simulate your EMI for both fixed and floating rates.

You simply need to:

- Enter your loan amount, tenure and rate type (fixed or floating).

- View the estimated EMI and total repayment amount.

- Adjust the inputs to compare scenarios and find what is suitable for your budget.

The calculators help you understand how interest rate variations can impact your EMI and total loan cost over time.

This allows you to make informed choices before applying for a House Loan.

Tips to Manage Your Home Loan Smartly

Regardless of which rate you choose, responsible loan management ensures long-term financial health.

- Make Prepayments When Possible: Reduces total interest outflow.

- Monitor Market Trends: If you have a floating rate, stay updated on RBI rate changes.

- Balance Tenure and EMI: Choose a tenure that balances affordability with total interest cost.

- Negotiate Rate Revisions: If market rates fall, check with your lender for a downward revision on your existing rate.

Final Thoughts

Choosing between fixed and floating Home Loan interest rates is not just a financial decision, it reflects your comfort with stability versus flexibility.

A fixed rate provides peace of mind and predictable repayments, while a floating rate offers opportunities to save when the market is favourable.

By assessing your financial goals, market outlook and risk appetite, you can make a well-informed choice. Whether you value consistency or adaptability, the key is to choose a House Loan structure that aligns with your long-term financial comfort and peace of mind.