Stock market holidays refer to the days on which stock exchanges such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and the Multi Commodity Exchange (MCX) are closed.

Planning your trades and investment in the Indian financial markets requires knowing stock market holidays well in advance. Whether you trade equities on NSE/BSE, derivatives, or commodities on MCX, these holidays affect trading, settlement, and liquidity.

In this article, we will outline the stock market holiday calendar (2026), the impact of the stock market on trading as well as settlements, what to expect for mcx market holidays, and planning tips for traders and long-term investors.

What Are Stock Market Holidays?

Stock market holidays refer to the days on which stock exchanges such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and the Multi Commodity Exchange (MCX) are closed. These trading holidays occur on days when:

- There are no purchase or sale of stocks

- Equity, equity derivatives, and currency segments are also shut.

- Settlement of funds and securities do not take place.

It’s important to distinguish between trading holidays (when no orders are accepted) and settlement holidays (when markets might open, but settlement functions like NSDL/CDSL or bank settlements do not operate).

Stock markets also remain closed on weekends (Saturday and Sunday).

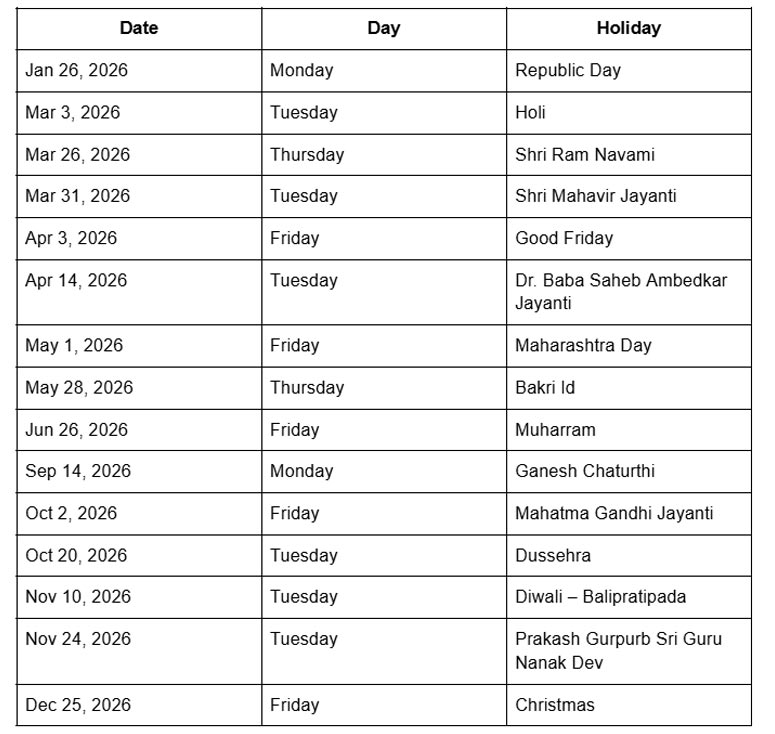

Official Stock Market Holidays in India for 2026

For the 2026 calendar year, the exchanges have announced the list of stock market holidays where markets will remain closed:

These holidays apply to equity and derivatives segments on NSE and BSE.

MCX Market Holidays – Commodities Trading

Commodity markets like MCX (Multi Commodity Exchange) also follow many stock market holidays, but with some differences. The following holidays impact MCX trading:

- Republic Day – Jan 26

- Good Friday – Apr 3

- Mahatma Gandhi Jayanti – Oct 2

- Christmas – Dec 25

Additionally, MCX is automatically closed on weekends and other public holidays that coincide with NSE/BSE closures.

Some holidays like Holi or Ram Navami may affect only equity segments, while commodities might have partial sessions or full closure based on exchange announcements. Always verify with your broker or MCX official calendar before placing trades.

Why Holiday Awareness Matters

It is essential to know stock market holidays for both traders and investors because:

Execution of Trades and Strategies

Holidays impact ordering dates, especially for:

- Intraday Trading

- Futures and options expiration planning

- Positional strategies per session

For example, a trader planning to square off positions before a long weekend should check the holiday schedule in advance to avoid gaps or overnight risks.

Settlement Impact

During market closures:

- Settlements (delivery of shares/commodities)

- Funds transfer between trading and bank accounts

don’t happen. This interrupts the normal T+1 or T+2 settlement cycle.

For delivery traders, investment institutions, and mutual fund transactions, this is particularly important since lack of holiday consideration might result in delays of fund availability or delivery of credits.

Special Case: Muhurat Trading

Some conventional holidays, like Muhurat Trading on Diwali, have special sessions scheduled, even when the exchanges are otherwise shut. Although a holiday closes the main markets, a special short festive session is organized.

Markets Closed vs Partial Trading

Not all holidays impact all market segments equally:

Equity & Derivatives (NSE/BSE)

- Closed for all stock market holidays.

- There is no trading, settlement, or clearing.

Commodities (MCX)

- Closed during major holidays such as Republic Day or Christmas.

- Certain holidays may affect the trading in the mornings, but trading is allowed in the evenings, as notified by the MCX.

- In certain market holidays, there could be the closure of morning sessions with the evening sessions running as usual.

This activity does occur because MCX usually has long night sessions on commodities such as bullion, energy, and metals.

Settlement Holidays vs Trading Holidays

It helps in planning when one is able to distinguish between:

- Trading Holiday: The market will remain completely closed, and no transactions can be performed.

- Settlement Holiday: The markets are open and trading is possible, but the settlement cycle is halted as clearing houses or banks are closed.

Settlement holidays may postpone:

- Funds credit to your bank

- Securities delivery in your Demat

- Withdrawals linked to trading accounts

It is always important to check whether a holiday is a settlement holiday to effectively manage finances.

How to Stay Updated

In order to avoid any unexpected circumstances,

- NSE/BSE holiday calendars must be kept handy.

- Subscribe to notifications from the broker for holiday notices.

- MCX market holidays can be checked from the official MCX calendar.

- Holidays can be integrated with a personal trading calendar.

Planning Ahead: Practical Tips

Plan Trades Around Holidays

If markets close for multiple days due to a festival, plan:

- Position exits/entry well before time

- Risk management approaches concerning gaps

Check Derivatives Expiries

A derivatives expiry day schedule (Tuesdays/Thurdays) with minimal chances of speculation has been provided by SEBI. Trading on dates around holidays ensures the avoidance of unwanted risks..

Fund Liquidity Planning

Settlements may take additional days based on holiday duration and should be planned for when redeeming, transferring, and delivering.

Conclusion

Stock market holidays in India are fixed and announced every year. In 2026, stock market holidays have been announced as 15 trading holidays for NSE, BSE, and in some cases, MCX. This awareness about closing days, including mcx market holidays, helps in better planning for trading, settlements, as well as management of funds.

Being updated means that you could avoid any kind of disruptions in trade and also be able to plan for risks by aligning your investments with market schedules.