There are a variety of credit cards available in the market. So, people at times get confused about which credit card to apply for. Here are the steps to help you to choose the best credit card.

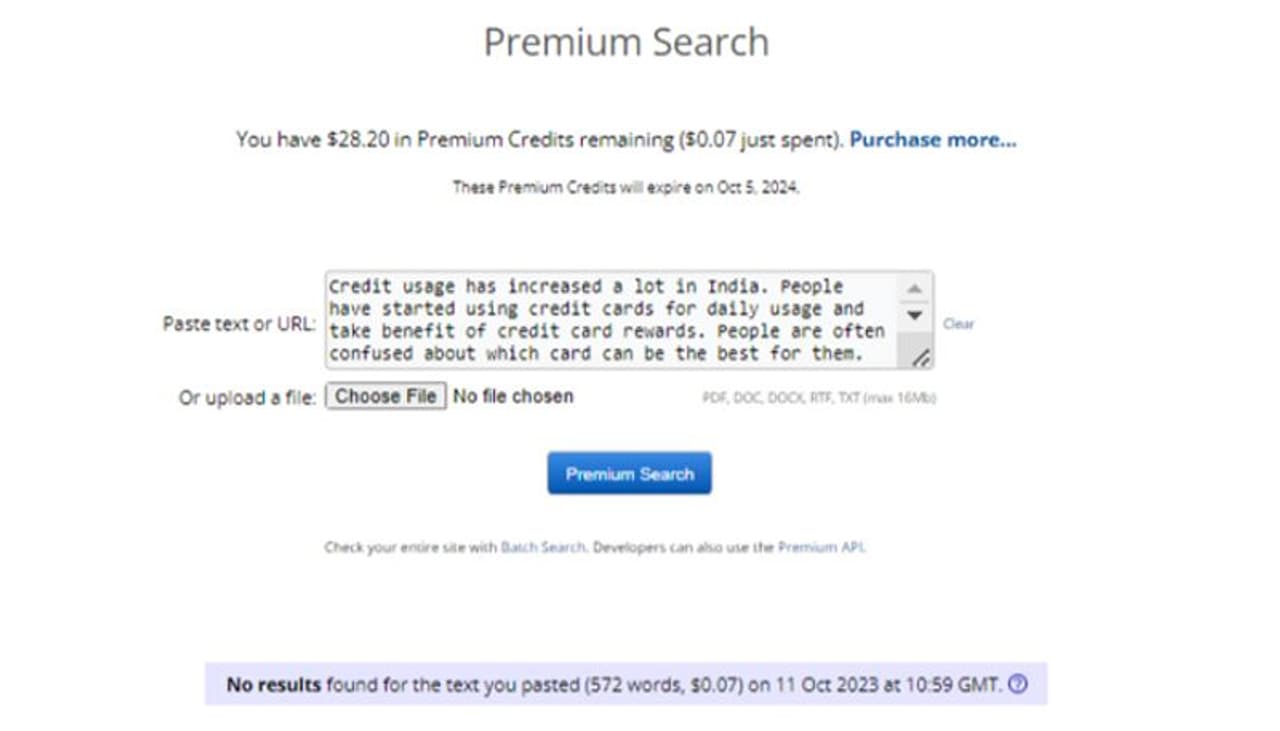

Credit usage has increased a lot in India. People have started using credit cards for daily usage and take benefit of credit card rewards. People are often confused about which card can be the best for them. This at times depends on the credit score you carry.

A person with a high credit score can good credit cards with good rewards. Whereas for a person with a low credit score, it is tough to get a credit card. You can get a free credit score online. In this article, we will understand how can you choose the right credit card.

How to select the right credit card?

There are a variety of credit cards available in the market. So, people at times get confused about which credit card to apply for. Here are the steps to help you to choose the best credit card.

1. Check your Credit Score

Firstly, have a check on your credit score. A credit score plays an important role in selecting the right credit card. Banks before issuing you a credit card assess your credit score and credit history. Moreover, all top reward credit cards require you to have a good credit score.

You can get free credit score from credit bureaus like TransUnion Cibil, Equifax, and Experian. If you have a good credit score don’t start applying to too many credit cards as this will affect your credit score.

2. Assess your Spending Patterns

Your spending pattern plays an important role in choosing the right credit card. If you travel a lot then you should go for a travel credit card. If you are going out for frequent dinners at various restaurants then a dining credit card will be beneficial to you. Select the card as per your spending habits so you can get the best rewards and discounts.

3. Determine your needs

Determine your need for applying for a credit card. You shall analyse why you need a credit card. An individual generally applies for a credit card for the following needs: -

- For Credit Score Improvement

If you don’t have a credit history then you can start by getting a basic credit card. A credit card with no annual fees will be suitable for this. This will help to build your credit as well as improve your credit score

- To Transfer the Outstanding Balance

If you are planning to transfer the outstanding balances of many credit cards, then a credit card with a low-interest rate is a good option. This will reduce your debt burden

- To Shop for expensive items

Many people want the credit card to buy expensive items on EMI. For this, it's better to have a credit card with rewards for retail shopping or departmental stores.

4. Do Your Research

Conduct your own research. There are many websites available online where you can compare credit cards based on their features and benefits. This will assist you in the right selection of cards.

5.Apply for the card

After you have done all your research and determined your needs now is the time to apply for a credit card. You can go on the bank’s website, check the offers and apply for the card that best suits your needs.

Conclusion

Choosing the right credit card is important. You can select the right credit card based on your needs, credit score and spending habits. Compare various credit cards that suit your needs and go for the best one.

Disclaimer: This is a featured content