Piper Sandler downgraded Workday to Underweight, citing concerns about slowing application demand and AI-driven reductions in headcount.

Workday Inc.’s (WDAY) shares fell nearly 4% in Thursday’s midday trade after analysts at Piper Sandler downgraded the stock over concerns about the company’s near-term growth outlook.

According to The Fly, Piper Sandler downgraded the Workday stock to ‘Underweight’ from ‘Neutral’ and reduced the price target to $235 from $255. The new price target for WDAY stock implies an upside of less than 2% from current price levels.

The downgrade follows Piper’s latest survey of Chief Information Officers (CIO), which revealed growing concerns over the impact of artificial intelligence on enterprise software demand.

The brokerage’s survey found that more than half of CIOs now expect AI to negatively affect hiring plans, marking the first time that sentiment has crossed the 50% threshold.

The firm noted that while enthusiasm remains high for AI infrastructure, appetite for broader application software, where Workday operates, appears to be waning.

The firm expressed concern over Workday’s per-employee pricing model, suggesting it could become a liability as businesses reassess headcount and IT budgets in the face of AI disruption.

Workday, which provides human capital and financial management software to large organizations, is not alone in feeling pressure from AI-driven shifts in enterprise planning.

While the tech sector broadly benefits from AI tailwinds, legacy software-as-a-service (SaaS) providers may find themselves squeezed as budgets pivot to infrastructure and model development.

In the first quarter (Q1), Workday’s operating income slumped 39% year-on-year (YoY) to $39 million, impacted by restructuring expenses of $166 million.

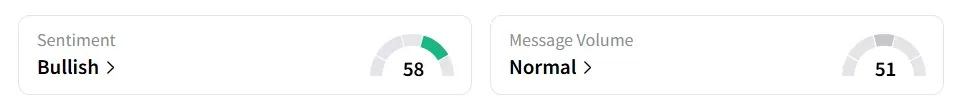

On Stocktwits, retail sentiment around Workday improved to ‘bullish’ from ‘neutral’ territory the previous day amid ‘normal’ message volume levels.

Workday stock has lost over 10% year-to-date but has gained more than 3% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<