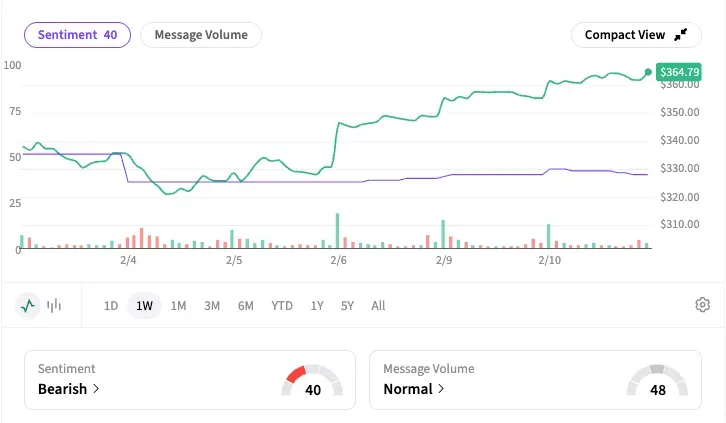

Stocktwits sentiment for TSMC drops to ‘bearish’ following a sharp rally.

- TSMC reported 37% growth in January sales, signaling robust demand from top chip customers.

- TSMC stock has gained 12% in the last four sessions and is currently at a record high.

- Some retail investors believe the levels are optimum for cashing out.

U.S.-listed shares of Taiwan Semiconductor Manufacturing Co. gained 1% in early premarket trading on Wednesday, continuing its sharp rally amid steady business gains.

The stock gained for four sessions straight (about 12%) to hit a fresh record on Tuesday.

On Tuesday, the Taiwanese chip manufacturer said its January revenue increased 37% year over year to NT$401.6 billion ($12.73 billion). That leap is a fair way above the company’s full-year growth outlook of 30%.

AI Demand Remains Key Catalyst

The performance underscores surging demand for advanced chips from customers such as Nvidia and Apple, also serving as a proxy that AI demand is far from tapering.

Last month, TSMC outlined plans to spend up to $56 billion on capital expenditures this year, increasing 30% from 2025, for capacity expansion. Executives said at the time that capital spending would remain elevated for the next three years.

Retail Sentiment Turns Cautious

However, on Stocktwits, the retail sentiment soured.

“$TSM bull trap. Negative divergence. Pros don’t buy ATHs (all-time highs), but (are) happy to sell their inventory at ATHs,” a user said, while another said they shorted shares.

Tariff Exemption Boost

Meanwhile, big U.S. technology companies are set to be exempt from upcoming tariffs on semiconductors, the Financial Times reported, citing unnamed sources. The carve-out is tied to TSMC's pledge to invest a total of $165 billion in U.S. manufacturing, allowing the company to allocate exemptions to its American customers, according to the FT.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<