For the full year, Tandem reported $1.015 billion in worldwide sales and over 126,000 pump shipments.

- The company's Q4 revenue of $290.4 million beat estimates, while U.S. revenue reached $210.5 million.

- Tandem guided to $1.065 billion-$1.085 billion in revenue, incorporating $70 million-$80 million in pay-as-you-go headwinds in the U.S.

- The insulin pumpmaker emphasized a shift toward a pharmacy-based, recurring revenue model.

Shares of Tandem Diabetes Care, Inc. (TNDM) jumped about 5% after hours on Thursday as investors looked past a fourth-quarter (Q4) earnings miss and focused on record revenue, margins, and the insulin pumpmaker's shift toward a recurring, pharmacy-based revenue model.

TNDM stock fell over 2% in Thursday’s regular session.

Strong US Demand Drives Growth

Tandem reported Q4 revenue of $290.4 million, surpassing consensus estimates of $277.2 million and marking the strongest quarter in the company’s history. U.S. revenue reached $210.5 million, while worldwide pump shipments totaled 38,000, including 27,000 units in the U.S.

The company reported a Q4 loss per share of $0.01, narrower than the $0.09 analysts had expected. However, it posted operating income of $8.3 million, or 3% of sales, alongside a record 58% gross margin.

“Momentum built across the year and culminated in Q4 results where we set multiple records while delivering double-digit growth and improved profitability,” CEO John Sheridan said on the earnings call, adding that Tandem surpassed $1 billion in annual worldwide sales for the first time.

Tandem Full-Year Sales Top $1B

For the full year, Tandem reported $1.015 billion in worldwide sales, more than 126,000 pump shipments, and gross margin expansion to 54%.

During 2025, the company began the global commercial rollout of t:slim X2 integration with Abbott’s FreeStyle Libre 3 Plus sensor, launched Android mobile control for the Tandem Mobi system, and initiated direct commercial operations in select European countries. It also applied for FDA approval to expand Control-IQ+ for use by women with diabetes during pregnancy.

Tandem guided to 2026 revenue of $1.065 billion to $1.085 billion, below consensus of $1.10 billion. However, the company said that the outlook reflects intentional headwinds tied to its transition to a pay-as-you-go reimbursement model in the U.S. pharmacy channel.

U.S. sales are projected at $730 million to $745 million, incorporating a $70 million to $80 million headwind from the pay-as-you-go shift, while international sales are expected to reach $335 million to $340 million.

CFO Leigh Vosseller said on the call that the pay-as-you-go model removes upfront pump costs for patients and improves access, while gradually reshaping the business toward recurring, more predictable revenue. She added that this benefit may not be fully visible in 2026 sales figures.

Margins Set To Improve In 2026

Tandem forecast gross margin of 56% to 57% and an adjusted EBITDA margin of 5% to 6% for 2026. The company said pump shipments, rather than revenue growth, will be the “clearest indicator” of progress in 2026, with U.S. shipments expected to rise 10% to 11%.

On the call, Sheridan noted upcoming product and pipeline milestones, including broader sensor integrations, international scaling of the Mobi platform, and plans to launch a tubeless Mobi option later in 2026. He also reiterated the company’s plans to advance toward a fully closed-loop insulin delivery system.

How Did Stocktwits Users React?

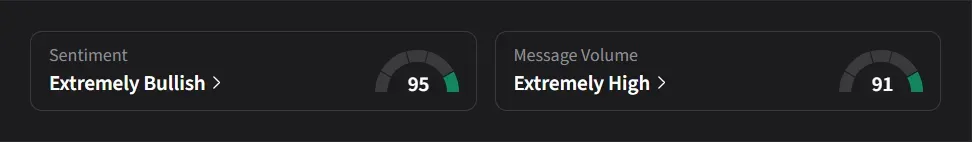

On Stocktwits, retail sentiment for TNDM was ‘extremely bullish’ amid a 1,050% surge in 24-hour message volume.

One user expects the stock to cross the $30 level soon.

Another user said, It's all about what's ahead. I think tomorrow it crosses $20.”

TNDM stock has declined 16% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<