The company received approval from the PHMSA to proceed with its restart plan for the Las Flores Pipeline System in California.

- The Las Flores Pipeline System is central to the Santa Ynez Unit, which produces crude oil and natural gas from platforms located off the coast of California.

- PHMSA also reaffirmed that the pipeline connecting the Santa Ynez Unit to the Pentland Station terminal qualifies as an interstate facility.

- The California Coastal Commission had blocked the restart of the subsea pipeline on environmental grounds.

Shares of Sable Offshore Corp. (SOC) surged more than 20% on Tuesday after the company received federal approval to restart a key pipeline system in California, which is central to the company’s only producing asset.

In an SEC filing, Sable Offshore announced that it received approval from the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) to proceed with its restart plan for the Las Flores Pipeline System, covering Lines CA-324 and CA-325.

The regulator approved the plan after reviewing startup procedures and confirming compliance through a field inspection. PHMSA also reaffirmed that the pipeline connecting the Santa Ynez Unit to the Pentland Station terminal qualifies as an interstate facility, placing it under exclusive federal oversight.

The Santa Ynez Unit produces crude oil and natural gas from platforms located off the California coast.

Regulatory Challenges

The development is significant after opposition from the California Coastal Commission, which blocked the restart of the subsea pipeline on environmental grounds. Sable had argued that the state agency lacks legal authority over the pipeline. The shift effectively removes state and local permitting control and transfers oversight to the federal regulator.

Sable had acquired the Santa Ynez offshore production facilities from ExxonMobil and restarted production on one platform after a nearly decade-long shutdown following an oil spill in 2015.

How Did Stocktwits Users React?

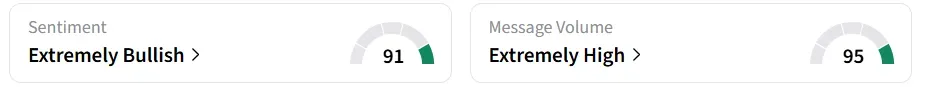

Retail sentiment for SOC remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes. SOC was among the top trending tickers on the platform.

One user expects the stock to climb past $20.

Year-to-date, the stock has been under heavy selling pressure, declining by more than 60%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<