Maase will pay roughly RMB1.1 billion ($157 million) to secure 100% of Times Good’s equity, which controls the Huazhi Group.

- Huazhi Group brings high-performance computing resources and advanced AI algorithm development to MAAS.

- MAAS plans to integrate Huazhi’s computing prowess with its own technology to establish a vertically integrated platform.

- The acquisition deal is expected to be completed by late February.

Maase Inc. (MAAS) announced on Friday that it has agreed to acquire full ownership of Times Good, a holding company for Huazhi Future (Chongqing) Technology Co.'s operations.

The deal represents a strategic push as MAAS seeks to broaden its presence in advanced AI and computing infrastructure. MAAS will pay roughly RMB1.1 billion ($157 million) to secure 100% of Times Good’s equity, which controls the Huazhi Group. The payment combines 87,400,144 newly issued Class A ordinary shares and $26 million in cash, to be paid within a year of closing.

The newly issued shares will be locked up for five years after the deal is finalized, which is expected by late February 2026. Following the announcement, Maase's stock traded over 9% higher on Friday morning.

What Did Stocktwits Users Say?

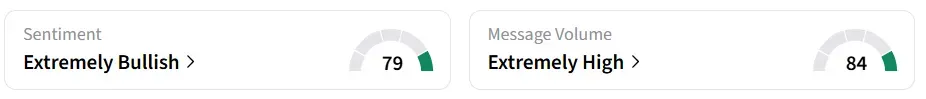

On Stocktwits, retail sentiment around the stock leapt to ‘extremely bullish’ from ‘extremely bearish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘low’ levels in 24 hours.

A bullish Stocktwits user lauded the acquisition.

Another user said that the company offered a unique combination of infrastructure and AI.

Huazhi Group brings high-performance computing resources and advanced AI algorithm development to MAAS. Its systems support training and rollout of AI applications, aiding large enterprises in digital transformation.

Building A Full Technology Stack

MAAS plans to integrate Huazhi’s computing clusters, algorithm frameworks and data expertise with its own technology to establish a vertically integrated platform.

This would span from foundational computing and intelligence capabilities to smart hardware and full-scenario services, giving the company a hold over every major component of its AI ecosystem.

MAAS stock has declined by over 57% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<