French drugmaker Sanofi agreed to acquire vaccine maker Dynavax in a $2.2 billion deal.

- Sanofi’s $15.50-per-share offer to buy all outstanding Dynavax shares values the company at roughly $2.2 billion, representing about a 40% premium to Tuesday’s closing price

- The acquisition is expected to close in the first quarter of 2026 and will not impact Sanofi’s 2025 financial guidance

- Sanofi will add Dynavax’s marketed adult hepatitis B vaccine, HEPLISAV-B, and a differentiated shingles vaccine candidate to its global vaccines portfolio.

Shares of Dynavax Technologies Corp. (DVAX) jumped nearly 38% in premarket trading on Wednesday after French drugmaker Sanofi agreed to acquire the vaccine maker in a $2.2 billion deal aimed at strengthening its adult immunization portfolio.

DVAX stock is on track to open at its highest levels since August 2022.

Terms Of The Deal

Sanofi’s $15.50-per-share offer to buy all outstanding Dynavax shares values the company at roughly $2.2 billion, representing about a 40% premium to Tuesday’s closing price of $11.13. The transaction, approved by Dynavax’s board, will be funded with Sanofi’s available cash. The acquisition is expected to close in the first quarter of 2026 and will not impact Sanofi’s 2025 financial guidance.

Sanofi Adds To Vaccine Portfolio

The deal will add Dynavax’s marketed adult hepatitis B vaccine, HEPLISAV-B, and a differentiated shingles vaccine candidate to Sanofi’s global vaccines portfolio. The acquisition also includes Dynavax’s shingles vaccine candidate, Z-1018, which is in phase 1/2 clinical development, along with additional early-stage vaccine programs.

HEPLISAV-B is already sold in the U.S. and is notable for its two-dose regimen administered over one month, allowing for faster and higher levels of seroprotection compared with traditional hepatitis B vaccines that require three doses over six months.

“Dynavax enhances Sanofi’s adult immunization presence by adding differentiated vaccines that complement Sanofi’s expertise,” said Thomas Triomphe, Executive Vice President, Vaccines, Sanofi.

Hepatitis B is a severe liver infection caused by the HBV virus, which can cause abdominal pain, fever, joint pain, loss of appetite, vomiting, extreme tiredness, and, in some cases, jaundice. According to the press release, nearly 100 million adults born before 1991 remain unvaccinated against hepatitis B in the U.S. alone, leaving them at risk of chronic infection that can lead to cirrhosis and liver cancer.

How Did Stocktwits Users React?

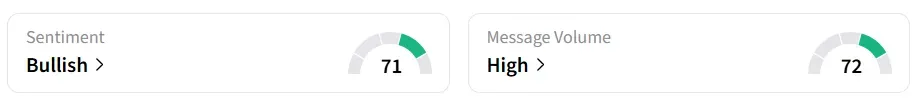

Retail sentiment for DVAX on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes. DVAX was also among the top trending tickers on Stocktwits at the time of writing.

Meanwhile, retail sentiment for Sanofi-Aventis remained in the ‘bearish’ zone over the past 24 hours. SNY was up 0.1% in premarket.

One user spoke out on Sanofi’s acquisition rationale. In their view, Dynavax’s licensing agreement with Vaxart last month may have prompted Sanofi to move ahead with this acquisition.

Dynavax and Vaxart signed an exclusive global licensing and collaboration agreement for Vaxart’s oral COVID-19 vaccine candidate in November. Dynavax is set to pay $25 million upfront and invest $5 million in Vaxart.

Year-to-date, DVAX shares have declined over 13%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<