He stated that U.S. liquidity had also been constrained by the two government shutdowns and by inflows into the U.S. Treasury, which had nowhere to go.

- The former Goldman Sachs managing director said that gold's recent rally “sucked all the marginal liquidity” out of the system, leaving nothing to flow into Bitcoin.

- He brushed off speculation that the crash was because of Binance, or its founder, Chanpeng ‘CZ’ Zhao, nor does he believe that outflows from ETFs are why the crypto market fell.

- Pal rejected fears tied to Kevin Warsh’s Fed nomination, stating his hawkish stance is a “false narrative.”

Founder and CEO of Global Macro Investor, Raoul Pal, said on Sunday that Bitcoin (BTC) and crypto are “broken”. According to him, Bitcoin’s crash over the weekend was because gold “sucked all the marginal liquidity” out of the system that would have otherwise flowed into BTC.

Pal, known for nailing the 2011 peak and the 2025 rally, has predicted that the apex cryptocurrency may touch $250,000 this year. The former Goldman Sachs managing director said in a post on X that he remains bullish on Bitcoin in the long run and expects the impending government shutdown to be last liquidity hurdle that the crypto market has to overcome.

Bitcoin’s price fell 2.2% in the last 24 hours and was trading at around $76,300, levels not seen since November 2024. The apex cryptocurrency has crashed by around $13 million since Friday, leading to mass liquidations and increased uncertainty.

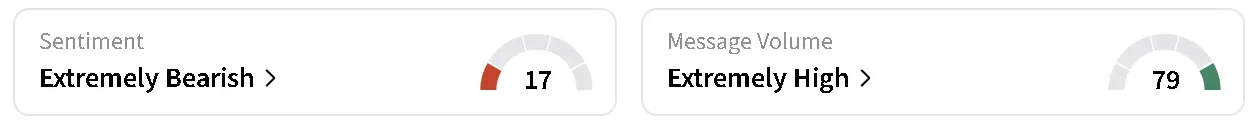

On Stocktwits, retail sentiment around the apex cryptocurrency dropped to ‘extremely bearish’ from ‘bearish’ over the past day as chatter remained at ‘extremely high’ levels.

Why Is Crypto Crashing?

According to Pal, the crash was due to a crunch in U.S. liquidity, rather than any issues specific to the crypto market. He brushed off speculation that the crash was because of Binance, or its founder, Chanpeng ‘CZ’ Zhao. Neither does he believe that ETF outflows, such as BlackRock’s iShares Bitcoin Trust (IBIT), are why the crypto market fell.

“The rally in gold essentially sucked all marginal liquidity out of the system that would have flowed into BTC and SaaS,” he wrote, pointing to the correlation of the drop between the crypto and software-as-a-service (SaaS) sectors. “There was not enough liquidity to support all these assets, so the riskiest got hit.”

He stated that U.S. liquidity had been constrained by the two government shutdowns and by inflows into the U.S. Treasury, which had nowhere to go. “This is the current air pocket we are facing, and it's causing brutal price action. No liquidity for our beloved crypto yet,” Pal said.

Traders Left With ‘Nowhere To Run’

Most have reported that the crypto market crashed following President Donald Trump’s announcement of Kevin Warsh as his pick to take the helm at the Federal Reserve after Jerome Powell steps down in May. Seen as a “safe pick” that would preserve the central bank’s autonomy, spot gold and silver – seen as safe-haven assets – also crashed over the weekend.

iShares Silver Trust (SLV) was the top trending ticker on Stocktwits at the time of writing, followed by Bitcoin, the SPDR S&P 500 ETF Trust (SPY), the Invesco QQQ Trust Series 1 (QQQ) and the SPDR Gold Shares ETF (GLD) are traders debated macro volatility. All saw chatter in ‘extremely high’ territory over the past 24 hours.

One user complained that the downtrend across all markets left traders with “nowhere to run.”

Another said it’s the right time to buy, with fear and uncertainty being spread across social media and news.

Pal disagrees with the Kevin Warsh thesis, stating that the new Fed Chair nominee’s hawkish positioning is a false narrative. “Warsh's job and his mandate is the run the Greenspan era playbook. Trump has said this, as has Bessent,” he said.

According to Pal, Warsh will cut rates and “get out of the way” of Trump and Treasury Secretary Scott Bessent, who will run liquidity through the banks.

Read also: MSTR, BMNR Dominate Retail Chatter After Bitcoin’s Weekend Selloff, While GME Stock Rallies

For updates and corrections, email newsroom[at]stocktwits[dot]com.<