GameStop CEO Ryan Cohen last week signaled that the company is considering an acquisition of a publicly listed retailer.

- GameStop shares jumped by over 8% on Monday.

- Burry recently disclosed a long position in GME and has outlined potential targets.

- Stocktwits users discussed Burry’s picks, while speculating their own.

GameStop Corp is in the news again after its CEO, Ryan Cohen, said last week that the video games retailer is eyeing a “big” acquisition in the public-listed retail universe. Since then, several names have been floating as potential targets, with the GME stock jumping higher on the plan.

Cohen is likely trying to deploy GameStop's growing cash pile (nearly $9 billion, as of the last quarter), pivot the business as it lessens its physical footprint, and revive the company’s shares.

“The Big Short” investor Michael Burry, who recently disclosed a long position, on Monday speculated about several potential targets that GameStop should be evaluating, according to a report in Seeking Alpha.

Burry’s Top Picks For GameStop

Burry’s top picks are smart home and security company ADT, Inc., and online furniture and home goods seller Wayfair, Inc. Stocktwits sentiment for both jumped a zone higher to ‘extremely bullish’ and ‘bullish,’ respectively, after the investor’s signal.

Burry said GameStop is likely to go for a leveraged buyout (an acquisition funded primarily with borrowed money) in a strategy he called "Instant Berkshire," with the aim to create a portfolio of companies with high growth potential.

He listed Assured Guaranty, Penske Automotive Group, Mattel, Sprouts Farmers Market, and SiriusXM. He also mentioned casino and resort operators Wynn Resorts and MGM Resorts as potentially interesting alternatives to Wayfair.

Retail Speculates on eBay, Others

Speculation also picked up on Stocktwits. A user said eBay would probably make the most sense for GameStop. GameStop doesn’t have a direct business relationship with eBay. However, eBay has expanded into collectibles, including trading cards, which aligns with GameStop’s recent expansion into movie- and TV-related merchandise and trading cards.

A user outlined Corsair Gaming and Peloton as potential targets, besides Burry’s pick, Wayfair, while discussing the advantages for each of those names.

Some even joked that it could be Target or even SpaceX.

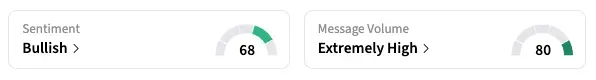

GameStop shares gained 8.3% on Monday, its sharpest jump in eight months. On Stocktwits, the retail sentiment remained ‘bullish,’ unchanged from the previous day, while 24-hour message volume surged by 540%.

Monday’s rally pushed GameStop shares up 29% for the year so far. The stock fell 36% last year, a rough stretch that saw names such as Opendoor Technologies and Kohl’s emerge as part of a new crop of meme stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<