The company has posted its best-ever quarterly results, with net profit up 35.6% and strong EBITDA guidance for FY26. The stock has rallied 28% in the last week amid upbeat investor sentiment.

Waaree Energies shares rose 7% in Wednesday’s trade after the solar major reported its “strongest-ever” quarterly performance.

In the last one week alone, the stock has surged 28%, driven by optimism over earnings and future growth projections.

In its March quarter filings, the company reported a consolidated net profit of ₹644.47 crore, up 35.6% year-on-year.

Revenue from operations climbed 36.4% to ₹4,003.94 crore, fuelled by rising demand in its solar EPC business and the ramp-up of new manufacturing capacities.

Operating margins saw a robust expansion, rising to 25.6% from 16.3% in the same quarter last year.

The company has also issued an ambitious EBITDA guidance for FY26, projecting earnings in the range of ₹5,500 crore to ₹6,000 crore — a sharp increase from the ₹3,123 crore posted in FY25.

CEO Amit Paithankar highlighted progress in the company’s U.S. operations, stating, “Our 1.6 GW module manufacturing facility in Brookshire, Texas, USA, is now operational. This strengthens our commitment to the American market and highlights our local-for-local manufacturing approach."

The timing is strategic: earlier this week, the U.S. imposed steep tariffs on solar imports from Southeast Asia — a move that could significantly benefit Waaree by reducing competition in the U.S. market.

Waaree’s board has also proposed a final dividend of ₹5 per share, pending shareholder approval.

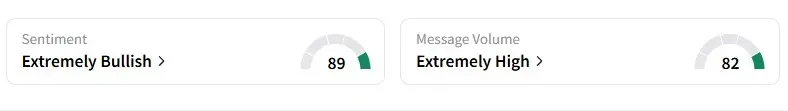

Data on Stocktwits shows retail sentiment remains 'extremely bullish' on Waaree Energies.

Waaree Energies is down 1 % year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<