Bank of America Securities views Vistra’s core business of baseload generation and competitive retail as well-positioned to benefit from tightening markets, increasing demand, and retail growth, regardless of data center deals.

Vistra’s (VST) stock was down over 2% in pre-market trade after Bank of America (BofA) Securities upgraded the energy company’s shares to ‘Buy’ from ‘Neutral’ but lowered the price target to $152, down from $164.

The brokerage noted that Vistra’s shares have declined 27% in the last few weeks due to concerns about the absence of new data center announcements that could drive energy demand, according to TheFly.

Vistra shares have been under pressure since January after Chinese startup DeepSeek's AI model led investors to question whether AI will require vast amounts of computing power and electricity as once expected.

Although Vistra reported strong fourth-quarter (Q4) earnings and reaffirmed its 2025 guidance, the market response was mixed, with analysts raising concerns about its future growth potential amidst increasing competition and changing energy demands.

However, BofA views the company’s baseload generation and competitive retail business as well-positioned to benefit from tightening markets, increasing demand, and retail growth, regardless of data center deals.

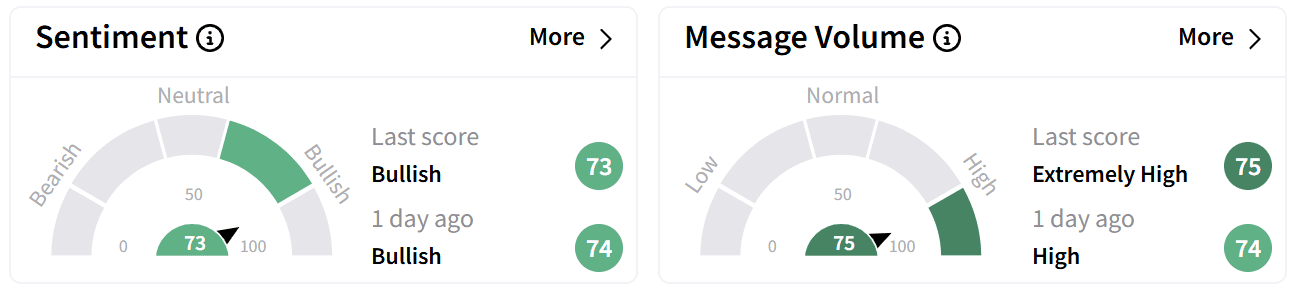

Retail sentiment on Stocktwits around Vistra’s stock remained ‘bullish,’ with message volume spiking to ‘extremely high’ levels.

According to platform data, retail chatter around the stock has more than doubled in the last 24 hours.

Many users expressed their frustration at the impact of the uncertainty around tariffs on the stock.

While Vistra’s stock is down 11% this year, its value has more than doubled over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Okta Stock Surges Pre-Market As Q4 Earnings Impress Wall Street, Triggers Wave Of Price Target Hikes – Retail Sentiment Flips Bullish