Analyst sees near-term volatility but recommends a buy-on-dips strategy for long-term investors.

Varun Beverages (VBL) shares have seen some volatility this week. SEBI-registered analyst Deepak Pal attributed this to three factors: profit booking after its recent upmove, technical support zone buying near ₹480 levels, and broader market weakness.

What’s the road ahead for Varun Beverages, one of the largest bottling partners of food and beverage giant PepsiCo? Pal believes that its strong fundamentals as a leader in the beverages segment continue to support long-term bullish sentiment.

Technical View (Daily Chart)

VBL stock corrected sharply but managed to hold above the 200-day EMA (around ₹490–₹495), which is a key support zone.

Technical indicators, such as the Parabolic SAR, indicate selling pressure, still positioned above the price candles. The Moving Average Convergence Divergence (MACD) is showing weakness with a bearish crossover, indicating a downward momentum. And the Relative Strength Index (RSI) at 46 is hovering near the neutral zone, neither overbought nor oversold, suggesting consolidation.

Short-Term Outlook (1–4 weeks)

Pal identified immediate support at the ₹480–485 levels. If this zone holds, a short-term pullback towards ₹510–515 may be likely. However, a breakdown below ₹480 could drag the stock towards ₹460 levels. He advised short-term traders to remain cautious and trade with a strict stop-loss.

Long-Term Outlook (3–6 months)

Despite near-term weakness, the long-term trend remains positive as the stock is still holding above its major support zones. Pal recommended that investors consider a buy-on-dips strategy around the ₹480–490 levels, with an eye on targets of ₹540–550 over the medium term.

What Is The Retail Mood?

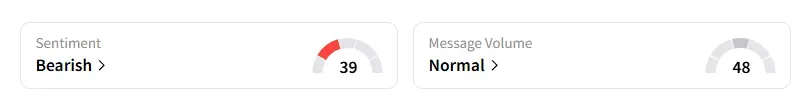

Data on Stocktwits shows that retail sentiment has been ‘bearish’ on this counter for a few weeks.

VBL shares have declined 22% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<