Vanda’s shares have surged since mid-November ahead of a pivotal FDA decision on tradipitant for motion sickness, a binary event that could unlock a new market and drive further upside, with additional regulatory catalysts ahead.

- Vanda shares have rallied about 62% since mid-November, erasing the stock’s losses for the year amid a series of news flows.

- Tradipitant previously failed in gastroparesis but is now under FDA review with labeling discussions underway.

- Approval could open a motion-sickness market estimated at $670 million in 2025.

Vanda Pharmaceuticals (VNDA) is facing a moment of reckoning as it awaits an FDA nod for its motion-sickness treatment candidate. After a so-so performance for much of the year, the Vanda stock rally kicked off in the middle of November and has been going strong ever since.

Between Nov. 14 and Friday’s trading session, the stock has gained about 62%, wiping out the year's losses.

Binary Event Beckons

More than 13 years after licensing NK-1R from Lilly (LLY) for a $1 million upfront payment—and over a year after the FDA rejected its application in gastroparesis—Vanda is once again knocking on the regulator’s door, this time seeking approval for motion sickness. Vand has since rechristened the drug candidate as tradipitant.

Last September, the drug regulator issued a Complete Response Letter (CRL) to the new drug application (NDA) for tradipitant for treating symptoms of gastroparesis. A CRL is a letter stating that the agency will not approve a regulatory application in its current form.

Reacting to the decision, Vanda said:

“The CRL was conclusory in nature, generally disregarded the evidence provided and instead suggested that Vanda conduct additional studies with a design and duration inconsistent with the advice of key experts in the field and not appropriate based on the scientific understanding and natural course of the disorder.”

Vanda has looked past the disappointment and is hoping for good news. Providing a regulatory update on tradipitant as a preventive treatment for motion sickness-induced vomiting in late November, Vanda stated that the Prescription Drug User Fee Act (PDUFA) target date of Dec. 30 for completion of the review remained unchanged. It also confirmed that the FDA recently issued comments on the proposed labeling and that labeling discussions have formally commenced. If approved, Vanda will have the distinction of delivering the first new pharmacologic treatment for motion sickness in over four decades.

According to Mordor Intelligence, the total addressable opportunity for motion sickness is around $670 million in 2025. This is expected to grow at a 3.1% compounded annual growth rate (CAGR), reaching $781 million by 2030.

Tradipitant earlier produced positive results in a study that evaluated it as a treatment option for the prevention of nausea and vomiting induced by GLP-1 receptor agonist Wegovy in overweight and obese adults.

In other recent developments, Vanda announced in early December that the FDA had lifted the partial clinical hold on the tradipitant protocol, which had limited the doses that could be administered. This decision allows Vanda to extend clinical studies of tradipitant in motion sickness.

In mid-December, the company said it had submitted a Biologics License Application (BLA) for imsidolimab to treat generalized pustular psoriasis (GPP). It expects to end the year with $260 million to $290 million in cash.

Founded in 2003, Vanda focuses on new technologies, including genetics and genomics, for drug discovery, clinical trials, and commercial positioning. The company sells Hetlioz as a treatment for sleep-wake disorder, Fanapt, an antipsychotic medication, and Ponvory for relapsing multiple sclerosis. Vanda generates net product sales of $158.9 million for the first nine months of 2025, marking 9% year-over-year (YoY) growth.

Upcoming Catalysts

Apart from the imminent FDA decision, the company has a slew of catalysts that can propel the stock higher if they pan out favorably. Key among the catalysts are:

-FDA decision date for Feb. 21, 2026, for Bysanti (milsaperidone) NDA for bipolar I disorder and schizophrenia

-Re-review of the supplemental NDA for Hetlioz for the treatment of jet lag disorder by Jan. 7, 2026

What Analysts and Retail Traders Feel About Vanda

Initiating coverage of Vanda stock with a ‘Buy’ rating and a $11 price target in early November, B. Riley said Vanda is a commercial-stage turnaround story trading at a "historic discount,” the Fly reported. The company is heading into two potential approvals within three months and "clearing of multiple overhangs that have kept investors on the sidelines,” the firm said.

Source: Fiscal.ai<

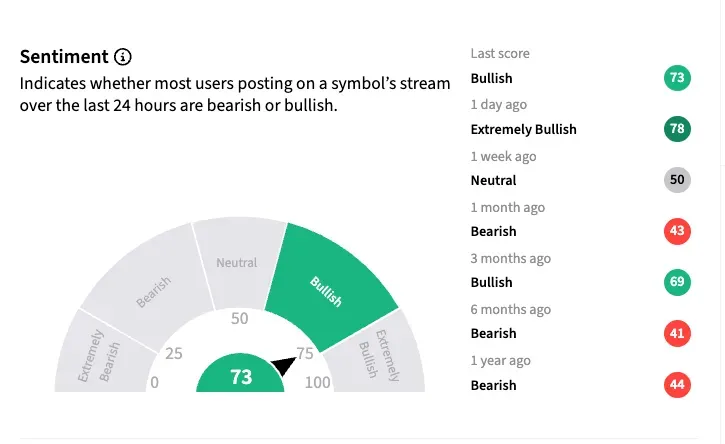

On Stocktwits, retail traders are ‘bullish’ about Vanda as of early Monday.

A retail watcher was already bracing for $10+ level early this week, anticipating “good news.” Another user said that, irrespective of the FDA decision, the company has other sales and opportunities to limit downside. Citing “big upside potential,” they said they added more shares.

In premarket trading on Monday, the stock climbed over 4% to $7.35.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<