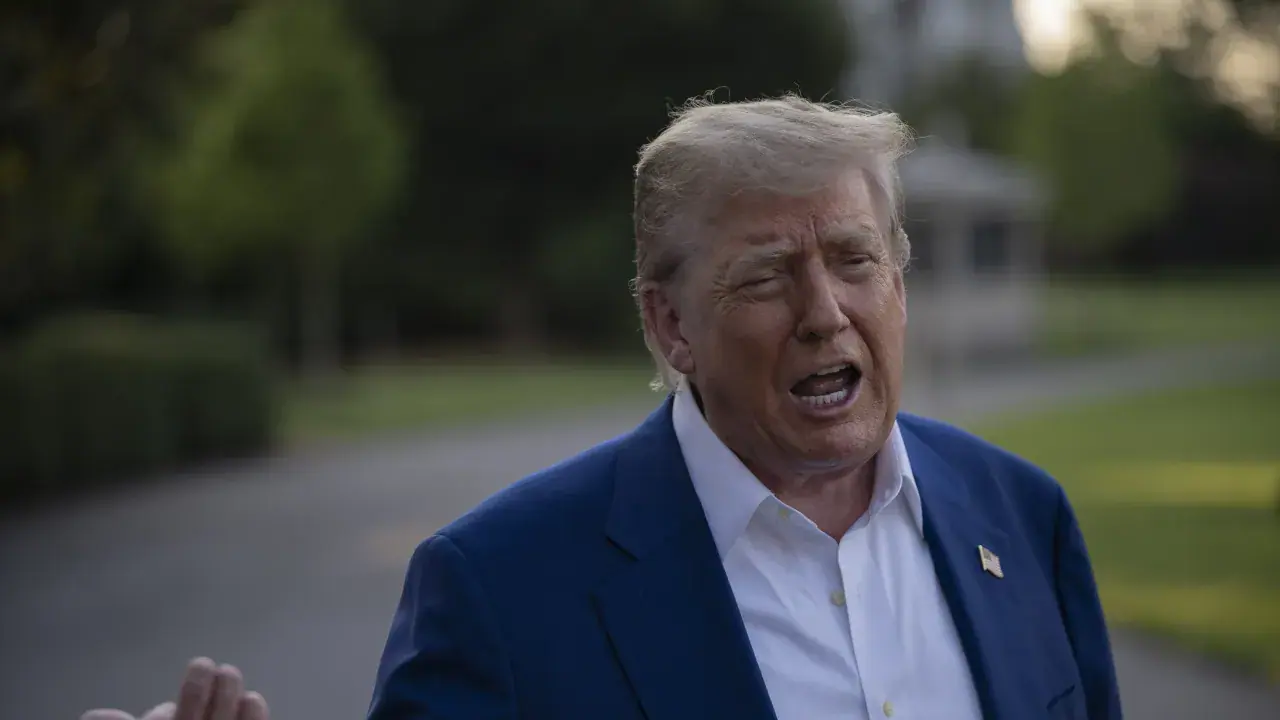

U.S. President Donald Trump has been pushing lawmakers to pass the tax bill by the end of the week.

The U.S. government will risk defaulting on some of its $36 trillion in debt sometime between mid-August and early October unless Congress raises the cap on Washington’s borrowing limit, the Bipartisan Policy Center think tank projected on Wednesday.

Analysts now estimate the U.S. debt limit ‘X’ date, the day the U.S. could run out of money, will fall between Aug. 15 and Oct. 3, narrowing the previous range of mid-July to early October.

“Congress must address the debt limit ahead of the August recess,” said Margaret Spellings, president and CEO of the Bipartisan Policy Center. “They need to act soon to prioritize our nation’s financial stability and reassure global markets that we take this responsibility seriously.”

U.S. equity markets were looking at weak opening amid Federal Chair Jerome Powell’s testimony to Congress and disagreement over what happened when the U.S. struck Iran. The SPDR Dow Jone Industrial Average ETF (DIA) was only 0.04% higher during pre-market trade. Meanwhile, the SPDR S&P 500 ETF (SPY) was up 0.18% and the Invesco QQQ Trust Series 1 (QQQ), which tracks the tech-heavy Nasdaq-100, gained nearly 0.4%.

The U.S. has never defaulted on its debt, and global financial markets become jittery if there is even a whiff of that potentially occurring.

The debt ceiling was reinstated in January this year after a temporary suspension under 2023’s Fiscal Responsibility Act – the showdown has pushed the U.S. to the brink of default and hurt its credit rating. Since Jan. 17, the Treasury has been using emergency accounting tools to keep paying bills.

"We don't give out a date but I can tell you we're getting close to the warning track," Treasury Secretary Scott Bessent told reporters on Tuesday,

The analysts echoed Bessent’s comments, stating that the precise ‘X’ date depends on several factors, including the flow of tax receipts. For instance, higher-than-estimated tax revenue in April, paired with steady quarterly tax revenues in June and a relatively stable economy, bought Congress additional time to address the debt limit.

This year, there are other factors that could play into the deadline, including a slowing economy and fluctuation s in tariff revenue.

According to Bessent, "the court's interfering in the President's right to set the trade agenda because we would have to refund this very substantial tariff income," which could also impact government funds.

U.S. President Donald Trump has been pushing lawmakers on both sides to make sure his ‘Big, Beautiful, Bill’ gets passed this week. “To my friends in the Senate, lock yourself in a room if you must, don’t go home, and GET THE DEAL DONE THIS WEEK,” he said in a Truth Social post Tuesday. “NO ONE GOES ON VACATION UNTIL IT’S DONE.”

The recently released Senate version of the bill raises the debt ceiling by $5 trillion, compared with $4 trillion in the House version.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Trump Presses Congress To Pass Tax Bill And ‘Get The Deal Done’ This Week After Iran-Israel Ceasefire