According to reports, the NBFC is expected to post strong Q1 results. However, the stock was down 4% on Friday.

Shriram Finance shares fell by over 4% on Friday, ahead of the company's earnings announcement. It is expected to post double-digit growth in net interest income (NII) for Q1FY26, supported by strong loan growth, according to reports. Profit after tax is estimated to grow 7% to ₹2,131 crore.

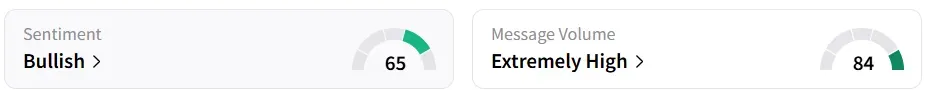

Retail sentiment on Stocktwits remained ‘bullish’, amid ‘extremely high’ message volumes.

Technically, the stock is currently trading just below a critical support zone of ₹620 - ₹660, having corrected over 11% from its all-time high of ₹718.10 hit in September last year, said SEBI-registered analyst Rohit Mehta.

The stock is testing this support after forming a rounding bottom pattern, but recent price action indicates a sideways to weak bias, Mehta noted.

A sustained bounce from this level could trigger a potential trend reversal, while a breakdown below ₹620 may lead to further downside.

Fundamentally, the company remains in a strong position, with a 5-year profit CAGR of 26.7% and a dividend payout of 21.4%. However, recurring concerns surrounding its low interest coverage ratio and declining promoter stake over the last three years have dampened sentiment, Mehta said.

Last quarter, the company reported a 20.8% increase in revenue and a 5.5% rise in financing profit. However, both profit before tax (PBT) and EPS slumped sequentially, indicating some short-term weakness.

Overall, a strong Q1 showing could potentially lead to the stock rallying above ₹660.

Year-to-date, the shares have gained 5.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<