UBS says On Holding will gain more market share in 2026 as its brand awareness rises.

- UBS said its 11th annual global athletic wear survey shows that On Holding's global aided awareness is just 15%.

- Meanwhile, Nike’s brand awareness is 91%, and Under Armour’s is 53%.

- UBS maintained a ‘Buy’ rating on the company’s shares, with a price target of $85.

On Holding AG (ONON) is poised to gain more market share in 2026 due to rising brand awareness, according to UBS. The analyst said that its 11th annual global athletic wear survey shows On Holding "has big growth potential,” according to TheFly.

This is despite lower global brand awareness than that of industry leaders such as Nike (NKE) and Under Armour (UAA).

UBS reiterated its ‘Buy’ rating on ONON stock and maintained a price target of $85, reaffirming that it is “very bullish" on the Roger Federer-backed company.

Rising Brand Awareness

UBS’s latest survey shows that On Holding's global aided awareness is just 15%, much lower than Nike’s (NKE) 91% and Under Armour’s (UAA) 53%. Yet, it believes the company’s brand awareness is rising.

On Holding’s global purchase intentions and Net Promoter scores also look solid, the firm added.

At the recent World Athletics Championships in Tokyo (2025), athletes sponsored by On Holding won three gold medals and one silver medal, putting the company on the global map. On Holding also sponsors Hellen Obiri, the record-winning champion of the 2025 New York City Marathon, who Nike previously sponsored.

The company also forged collaborations with Zendaya and Burna Boy this year.

Financial Standing

On Holding reported strong third-quarter (Q3) 2025 results, driven by solid global demand and the execution of its premium strategy.

Net sales for the quarter rose 24.9% year-on-year to CHF 794.4 million ($1 billion). Apparel sales dominated, increasing 86.9%, while Asia-Pacific posted a fourth straight quarter of triple-digit constant currency growth. Adjusted EBITDA for the quarter also grew nearly 50%, and net income margin expanded to 15%.

How Did Stocktwits Users React?

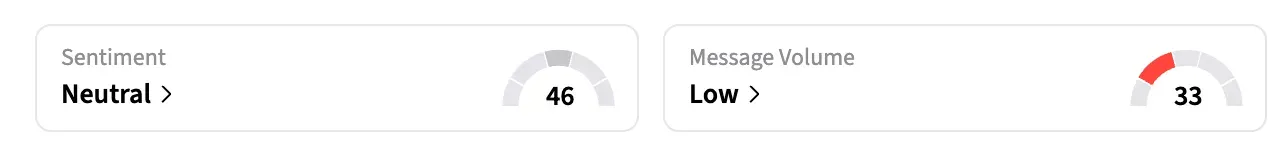

On Stocktwits, retail sentiment around ONON shares jumped to the ‘neutral’ territory from ‘bearish’ a day ago amid ‘low’ message levels.

Shares of ONON are down over 15% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

(1 CHF = $1.27)