DJT shares are down 25% year-to-date and have erased gains from a recent nuclear energy deal, as fundamentals turn weaker.

- Stocktwits users express frustration with the sharp slide in DJT over recent weeks.

- Rally after Trump Media’s $6 billion deal with nuclear research firm Tae Technology fizzles.

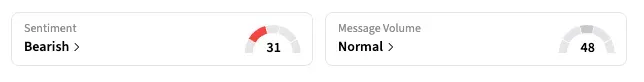

- Retail sentiment remains ‘neutral.’

Trump Media & Technology Group Corp. shares fell 9.7% Tuesday to slip below $10 for the first time, leaving retail investors frustrated and questioning the merits of holding the stock.

Shares ended at $9.91, breaching the previous low of $10.33 from Nov. 21. Trump Media began trading in March 2024 following its merger with a special purpose acquisition company (SPAC).

Trump Media (DJT) shares have tended to move more on headlines tied to President Donald Trump than on company-specific business updates. But the recent sharp slide, coupled with steadily deteriorating fundamental performance, appears to have eroded investor confidence.

Several Stocktwits users voiced frustration with the stock, predicting further downside amid renewed discussions about Trump’s involvement following the release of new documents in the Jeffrey Epstein case.

“We have a president who creates pump and dumps and scams his own supporters with them,” said a user, while another called DJT a “scam stock.”

“Anyone who looks at this stock and thinks it's a good investment has no business dabbling in the market. Stick to index funds,” said one user.

The retail sentiment for DJT was ‘neutral’ as of late Tuesday, unchanged from the previous day, although 24-hour message volume jumped by over 1,000%.

Trump Media comprises the Truth Social platform, the video streaming service Truth+, and the fintech unit Truth.Fi, as well as holding over $2 billion worth of Bitcoin.

In December, the company agreed to merge with nuclear technology company, TAE Technologies in a $6 billion deal, effectively pivoting Trump Media’s core business. The company’s stock jumped about 50% at the time, but quickly lost steam.

DJT shares are down 25% year-to-date, returning to levels before the deal announcement.

Trump Media has yet to set a date for its fourth-quarter results.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<