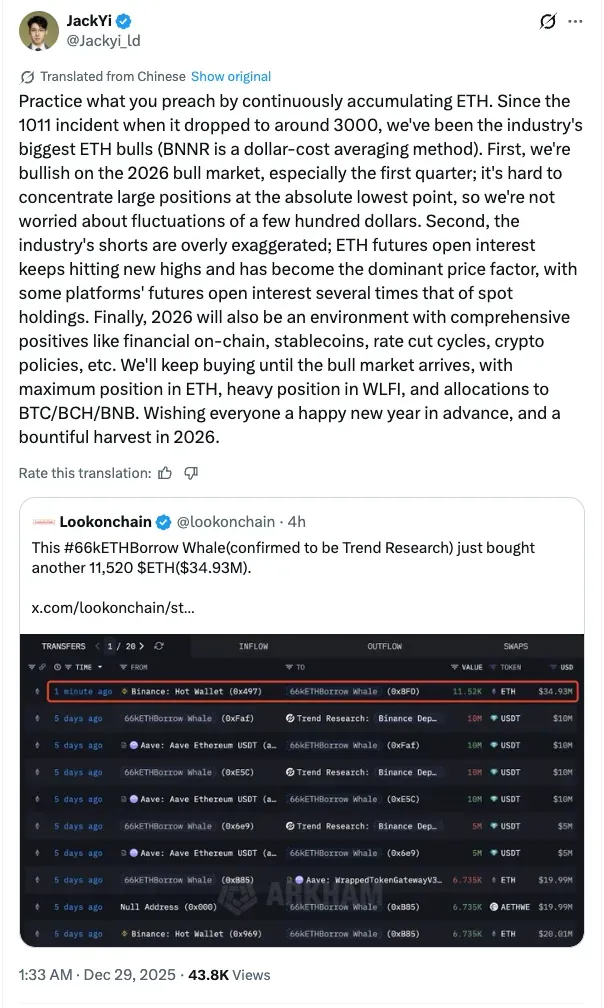

Lookonchain revealed that the Trend research "66k ETH borrow" added $121 million in Ethereum value.

- Trend Research partner JakeYi said the firm has been a major Ethereum bull since the October 11 “1011 incident.”

- Trend Research buys Ethereum through leveraged DeFi purchases, whereas BMNR uses a balance-sheet-funded corporate treasury.

- Ethereum traded near $2,960 with retail sentiment on Stocktwits in ‘bearish’ territory, while BMNR shares ticked higher in pre‑market early Monday, despite extremely bearish sentiment.

Trend Research partner Jack Yi announced Monday that the firm is a major Ethereum (ETH) bull, rivaling industry giant BitMine Immersion Technologies, Inc. (BMNR).

JakeYi, a partner at Trend Research, wrote on X that the group has remained among the industry's largest Ethereum bulls since the October 11 drawdown, the so-called "1011 incident," when Ethereum briefly fell to around $3,000 during a sharp market selloff.

JakeYi suggested that private companies and large holders who don't necessarily disclose their positions can also have significant amounts of ETH exposure. His view is based on a dollar-cost averaging strategy, not trying to time market bottoms.

He described the move as a long-term conviction bet rather than a short-term trade, claiming that structural positioning and futures market dynamics are more important than short-term price fluctuations.

Ethereum (ETH) was trading at $2,959.94, up 0.9% in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory over the past day. Chatter around the coin dipped from ‘normal’ to ‘low’ levels over the last 24 hours.

Leveraged Accumulation Vs. Corporate Treasury Buying

Trend Research built its Ethereum position by borrowing money, primarily from DeFi lending platforms, to steadily add ETH and increase its exposure without selling other assets. BitMine Immersion Technologies (BMNR), on the other hand, has grown its Ethereum holdings through more traditional corporate treasury channels. It funds purchases directly from its balance sheet rather than relying on a lot of DeFi leverage.

BMNR closed at 28.31 and was trading at 28.66, up 1.24% in pre-market trading on Monday. On Stocktwits, retail sentiment around BMNR remained in ‘extremely bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

Lookonchain, an on-chain tracker, reported that the "66k ETH borrow" wallet added more ETH on Monday. Lookonchain said the entity added 40,975 ETH, worth about $121 million. This was part of a buying campaign that started in early November. The wallet has bought about 569,247 ETH worth about $1.69 billion since November 4. As of Wednesday, about $881.5 million of that money had been borrowed through Aave.

Read also: Solana Co-Founder Calls California’s Proposed 5% Billionaire Tax Measure ‘Dumb’ – Warns Of Capital Flight

For updates and corrections, email newsroom[at]stocktwits[dot]com.<