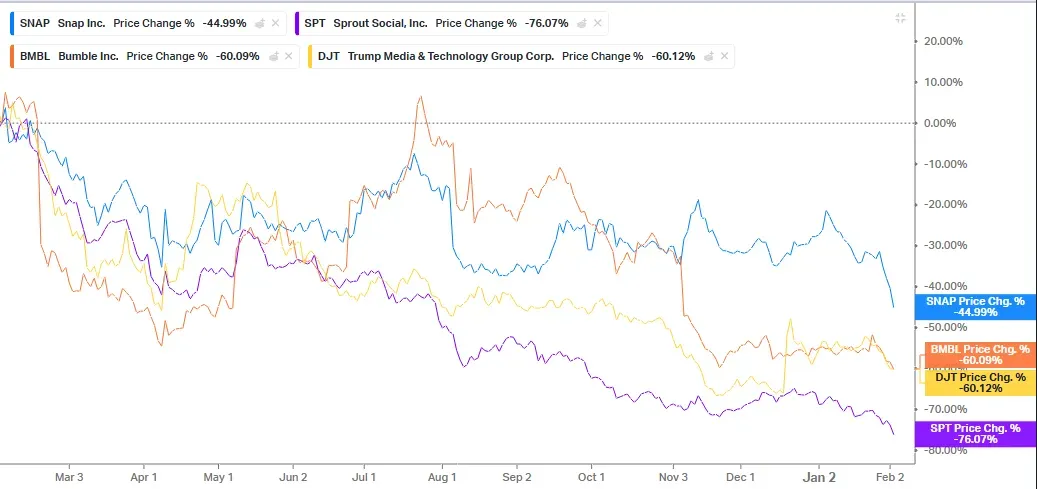

Snap shares have fallen nearly 45% over the past 12 months, only better than DJT, Sprout Social and Bumble over the same period.

Shares of Snap have been one of the worst performing among the major social media firms over the past twelve months as uneven advertisement revenue and decline in its users weigh on its stock performance.

At the time of writing, shares of Snap have fallen nearly 45% over the past 12 months, only better than DJT, Sprout Social and Bumble, according to data from Koyfin.

| Company Name | Stock Price % Change Over Past 12 Months (As of 12:47 AM ET, Feb. 3) Data from Koyfin |

| Meta Platforms | - 0.25% |

| Hello Group | - 8.4% |

| Match Group | -14.98% |

| - 18.08% | |

| - 37.63% | |

| Weibo Corporation | 2.05% |

| NetEase | 14.39% |

| Yalla Group | 73.17% |

At the time of writing, Snap stock was down nearly 6% and was among the trending stocks on the Stocktwits platform. Snap saw a 778% rise in its weekly message volume by users on Stocktwits.

Snap’s Q4 Earnings Due

Snap is expected to post a fourth quarter (Q4) revenue of $1.70 billion, a 9% jump from the same quarter a year-ago, according to data from fiscal.ai.

Wall Street expects the company to post a profit of $0.15 per share, almost flat from the same year-ago quarter. The company had missed profit estimates for the third and second quarter of 2025.

Earlier, Roth Capital said it remains cautious on Snap shares heading into earnings as it sees sequential decline in users to weigh on any revenue or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) upside. It raised the firm's price target on Snap to $10 from $9 and kept a ‘Neutral’ rating on the shares.

UBS said that the Q4 earnings outlook for advertising-driven companies’ points to slimmer beats after a slow October tied to a government shutdown, followed by a rebound in November and December.

Retail Chatter On Stocktwits

Retail sentiment around SNAP trended in ‘extremely bullish’ territory amid ‘extremely high’ message volume.

One Stocktwits user said that they are long on Meta Platforms and short on Snap.

Another bearish user predicted the Snap stock to hit $4 on Wednesday.

Another user said that they sold SNAP stock with a $2000 loss.