Revenue has slowed, and investors and analysts now question whether new catalysts, such as robotaxis, can offset operational strain.

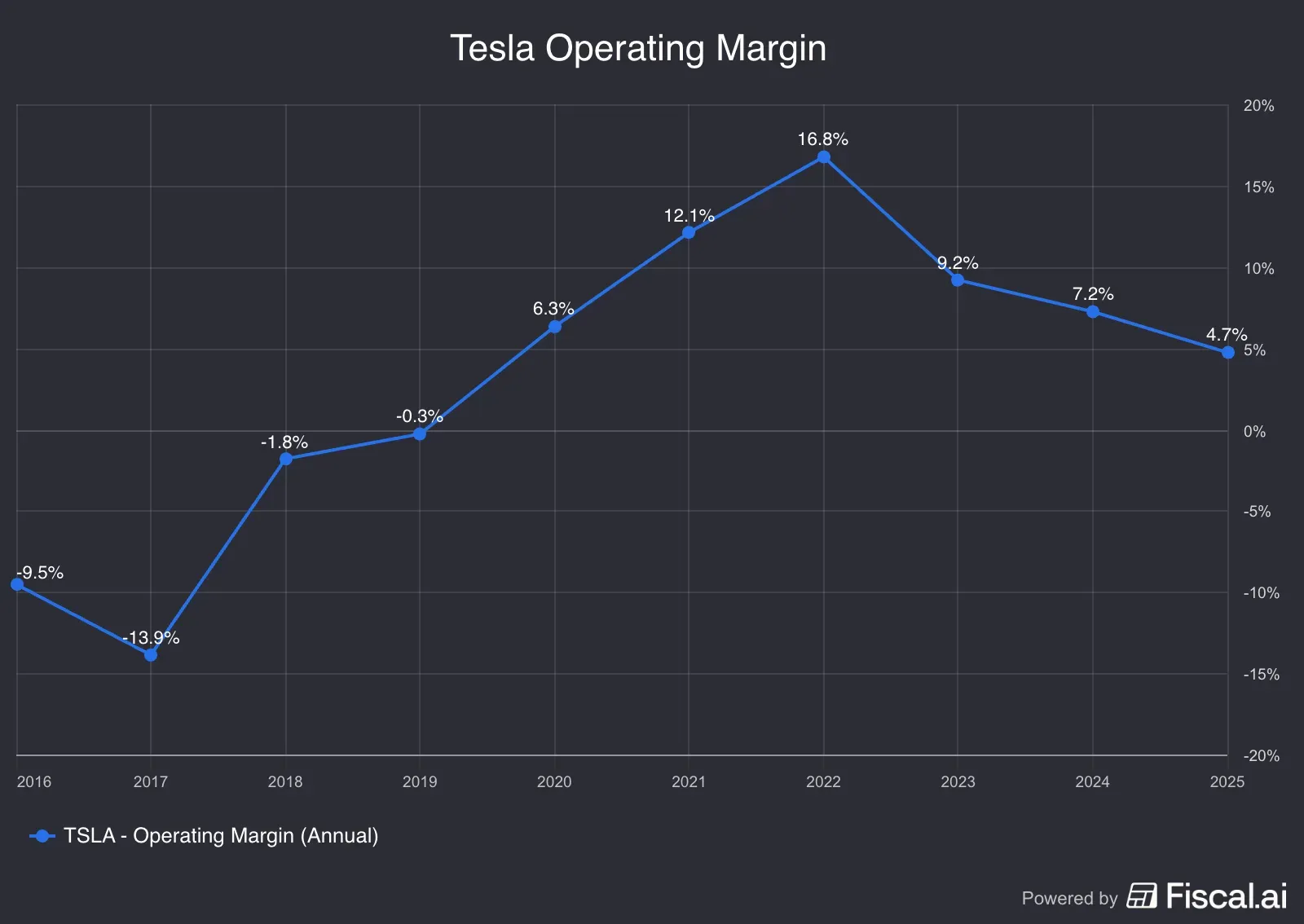

- Deliveries remain below the level needed to revive revenue, and margins have slid from nearly 17% to under 5%.

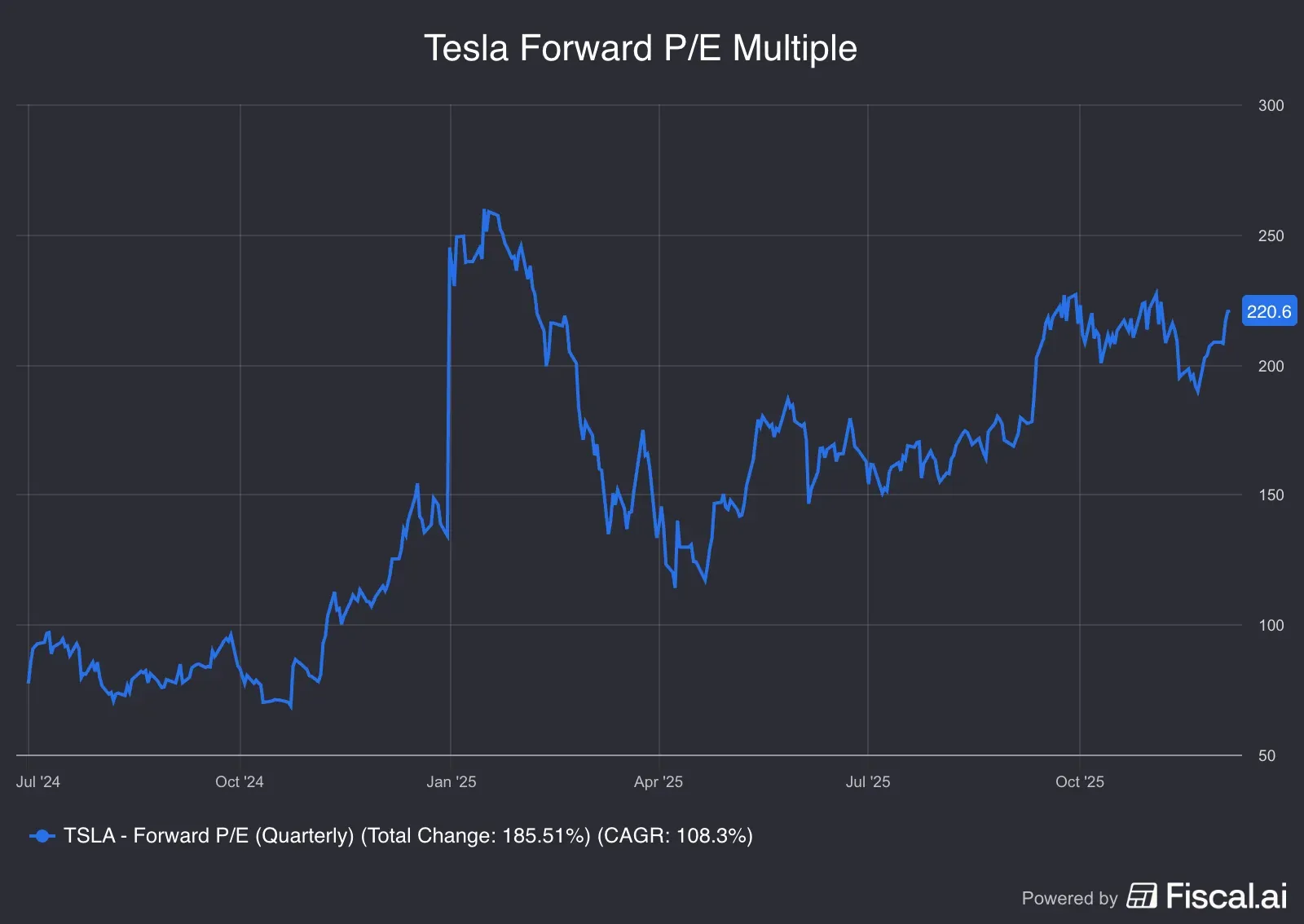

- Even longtime bulls are cautious as Tesla trades at 220× forward earnings and well above long-range EBITDA estimates.

- Investor hopes now rest on robotaxi progress, but retail sentiment is muted and engagement remains low.

Tesla entered the year with all the makings of a blockbuster comeback. After Donald Trump's election win in 2024, investors were convinced the EV giant would ride a wave of political tailwinds — helped, in no small part, by the extraordinary support CEO Elon Musk had thrown behind the Republican ticket. But things did not go as smoothly as expected.

Musk spent an estimated $288 million to help elect Trump and other GOP candidates, according to a Washington Post analysis, making him the largest individual donor of the entire 2024 cycle. Confidence in Tesla soared.

But that optimism evaporated almost as quickly as it formed. Soon after the election, Musk was pulled into the new Department of Government Efficiency (DOGE), a high-profile initiative aimed at slashing federal waste. For Tesla shareholders, the optics were alarming: Musk was spending long stretches in Washington rather than at the company's Austin headquarters, all while his increasingly contentious political commentary — including vocal support for far-right European parties — began weighing heavily on Tesla's global brand.

Sales slid. Boycotts intensified. Protesters even torched vehicles. The stock followed suit, crashing from its all-time intraday high of $488.54 on Dec. 17 — in the euphoria immediately following Trump's victory — to $214.25 by April 7.

Rattled by the reaction, Musk abruptly exited DOGE to refocus on Tesla, briefly calming markets. But stability didn't last. The White House's sweeping "One Big Beautiful" tax and spending bill delivered a decisive blow, effectively ending the Biden-era EV credits of up to $7,500 and piling on fresh pressure from Trump's aggressive tariff blitz. Musk blasted the bill, prompting a very public and very bitter feud with Trump — a development that only deepened investor anxiety.

Still, Musk found a way to reignite optimism among his fanbase. He doubled down on Full Self-Driving upgrades, new Optimus demonstrations, and steady progress on Robotaxis, pushing a narrative that Tesla's next era — powered by autonomy, AI, and humanoid robots — would unlock massive long-term value.

He also secured a historic trillion-dollar pay package, contingent on extremely ambitious milestones. The approval gave investors one critical reassurance: Musk, after months of distraction, would now be more committed to Tesla's future than ever before.

It’s Been A Bad 2025 For TSLA

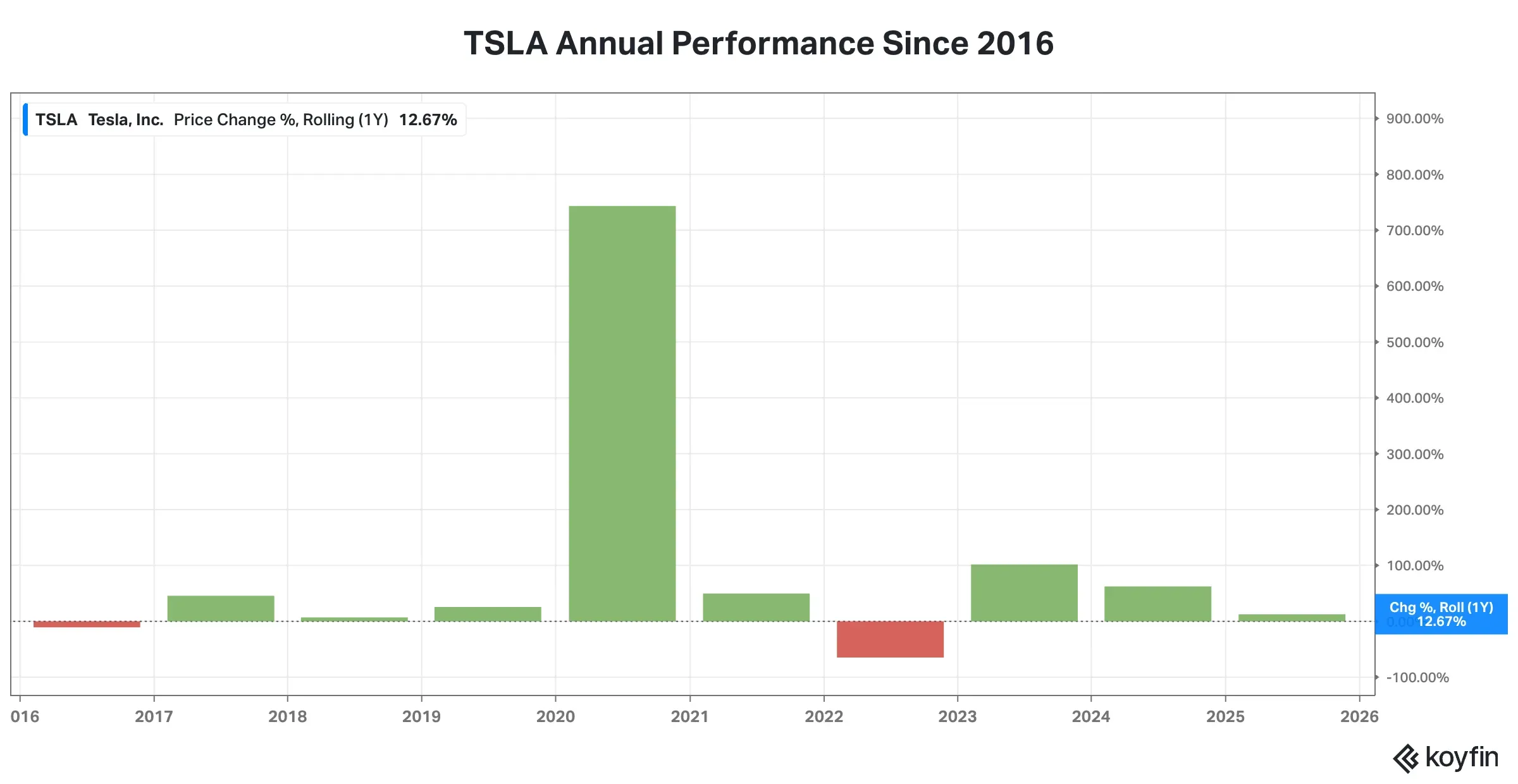

Even so, the stock spent the year whipsawing violently — deep in the red for months, clawing its way back into positive territory, and still on track for its weakest annual performance since 2022, when shares collapsed 65% as inflation-induced economic uncertainty tipped the market into bear territory. Tesla’s stock is up merely 12.7% this year, underperforming the SPDR S&P 500 ETF (SPY), which is up 17% year-to-date (YTD), and the worst performer among the “Magnificent Seven” list.

Source: Koyfin<

Why Did Tesla Stutter In 2025?

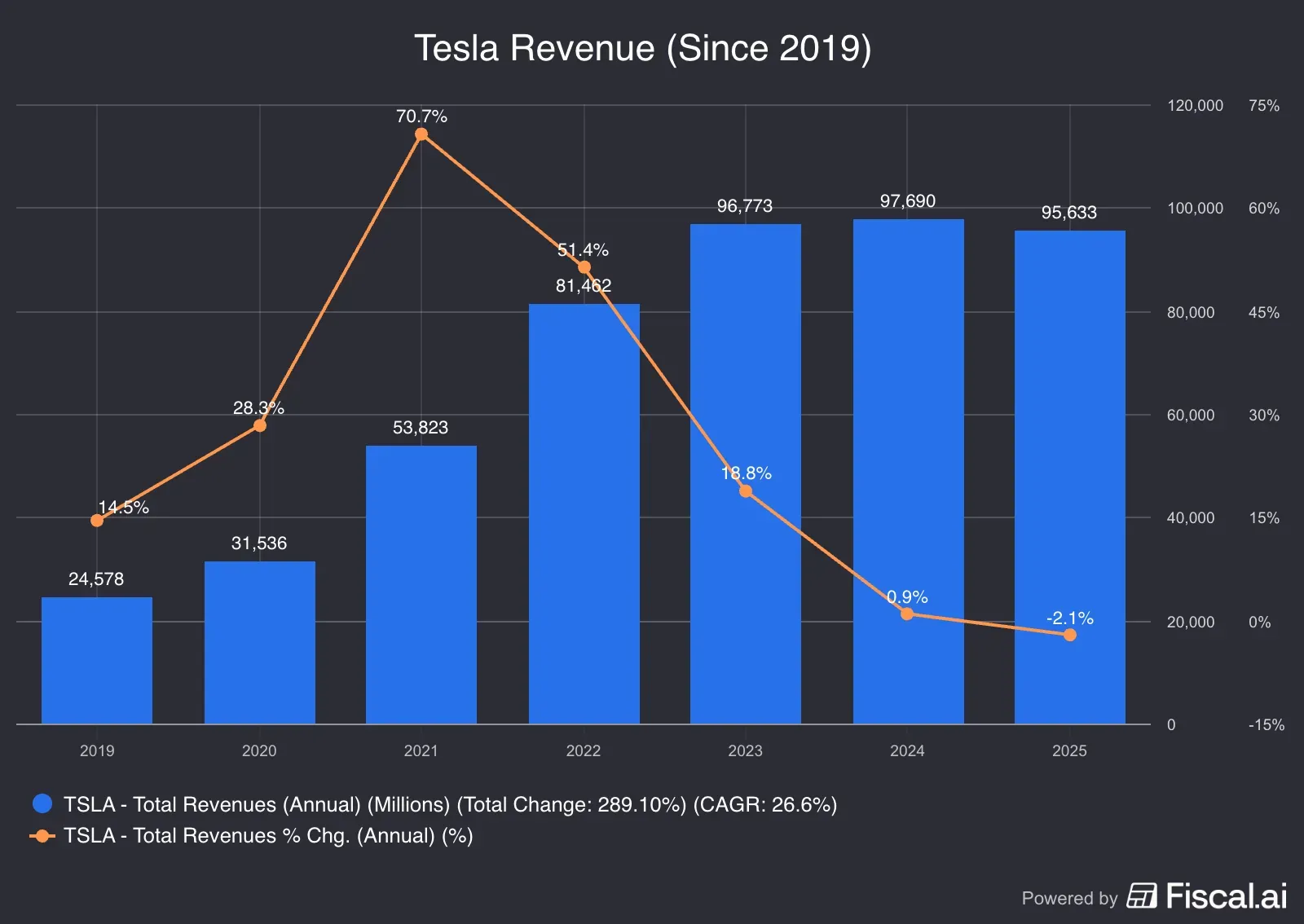

Tesla’s revenue, which received a big boost in 2021 following the Model Y launch, began to slow down subsequently. Annual revenue nearly flatlined at around $97K in 2023 and 2024, and the trailing 12-month revenue for 2025 shows a 2.1% year-over-year decline.

Source: Fiscal.ai<

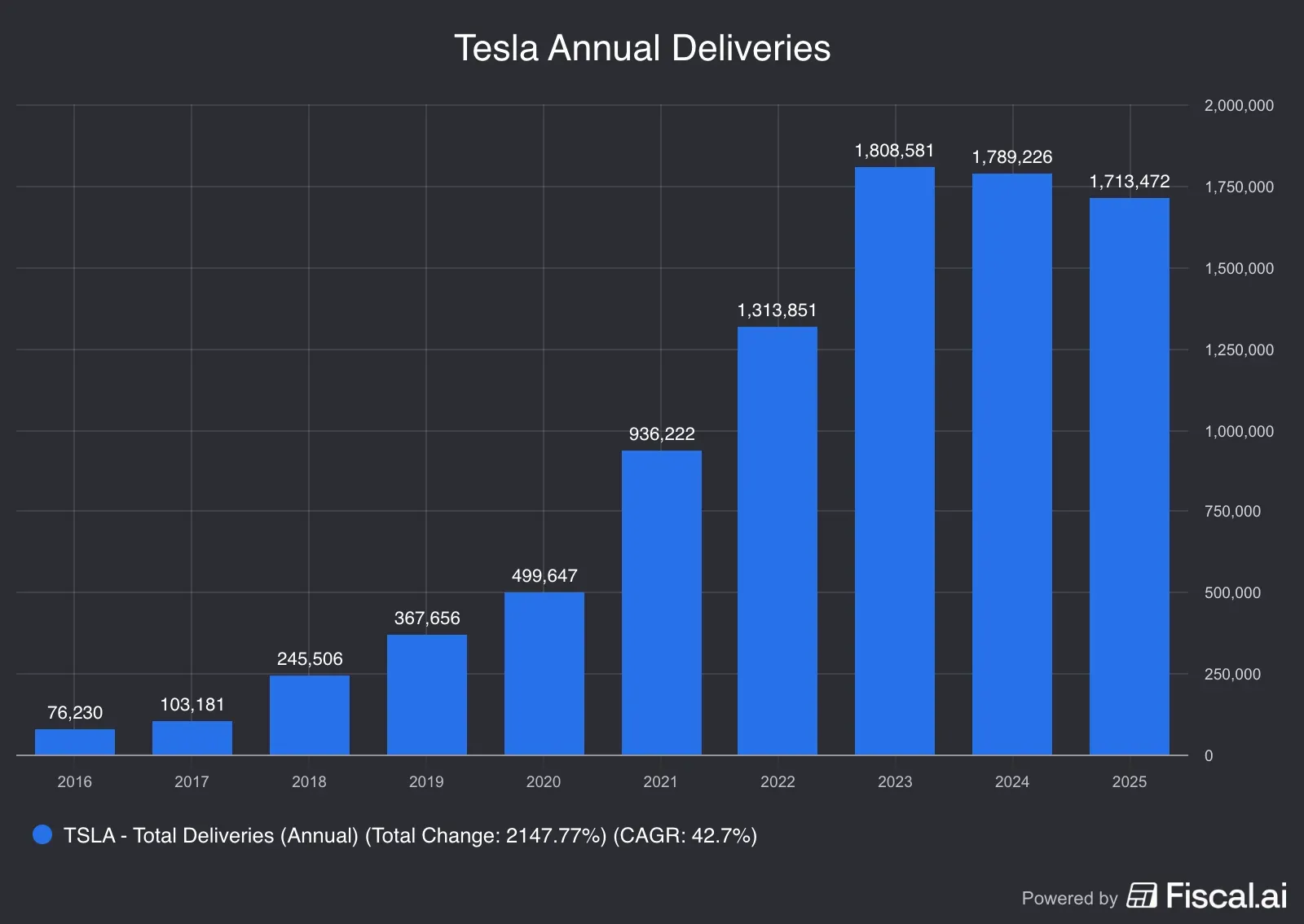

The revenue stagnation is a function of slack delivery numbers. Deliveries for the nine months this year totaled 1.22 million. The magic number for Tesla to resume YoY revenue growth is 568,917. It should be noted that the company has not yet exceeded 500,000 in quarterly deliveries.

Source: Fiscal.ai<

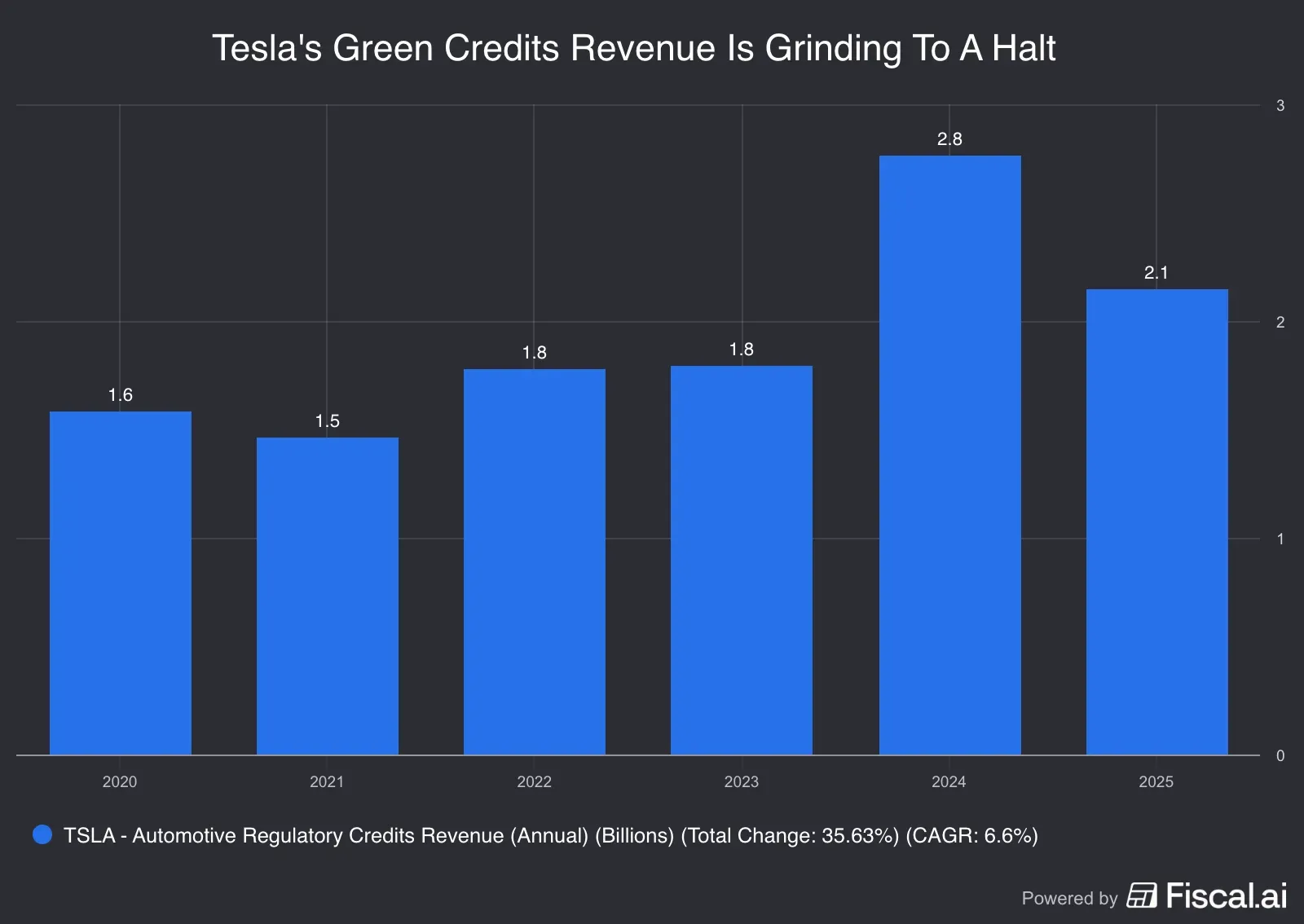

Automotive regulatory credits, which the government awards to companies for producing zero emissions and can be sold to other automakers seeking to comply with the norms, boost the company’s revenue and profits. These regulatory credits carry a 100% margin because there is no cost.

Source: Fiscal.ai<

After peaking at 16.8%, Tesla’s operating margin has gone downhill. Over the trailing 12 months, the metric has dipped to sub-5%.

Source: Fiscal.ai<

Notwithstanding the fundamental setbacks, Tesla stock is trading at a pricey forward price-earnings (P/E) multiple of 220.

Source: Fiscal.ai<

What Wall Street Feels

Tesla has polarized Wall Street analysts, though some longtime bulls have now become cautious. In a note released Sunday, Morgan Stanley analyst Andrew Percoco downgraded Tesla stock to ‘Equal Weight’ from ‘Overweight’ but upped the price target to $425 from $410, The Fly reported. Percoco concedes that Tesla would become a market leader across autonomous mobility, renewable energy, and robotics, but he is uncomfortable with the valuation.

Morgan Stanley now awaits a better entry point, given that the stock is trading at 30-times estimated 2030 EBITDA and there is potential downside to consensus estimates in the near term. The firm’s 2026 volume forecast for Tesla is now 13% below consensus, reflecting its more cautious outlook on the EV industry.

The research firm also believes Tesla's "non-auto catalyst path" is already priced into the shares.

According to the Future Funds’ Gary Black, the major catalyst for the stock now is the removal of safety monitors in all Robotaxis, which would signal an imminent scale-up. He noted that Musk has hinted that this could be accomplished in Austin by year-end.

Of the 47 analysts covering the stock, 20 have ‘Buy’ or ‘Strong Buy’ ratings and 10 analysts have either ‘Sell’ or ‘Strong Sell’ ratings, while 17 remain on the sidelines, according to Koyfin. The average price target ($392.93) suggests roughly 14% downside from current levels.

On Stocktwits, retail sentiment toward the stock was ‘neutral’ as of early Monday, and the message volume on the stream was ‘extremely low.’ In premarket trading, the stock traded down by more than 1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<