While its India business delivered double-digit growth, margins shrank due to input cost pressures. Analysts warned of limited upside unless volumes recover.

Tata Consumer Products’ shares rose 1% on Thursday even as cost pressures offset its June quarter (Q1 FY26) profit and revenue growth.

Q1 Operational highlights

Consolidated net profit rose 15% to ₹334 crore in Q1FY26, while revenue came in 10% higher at ₹4,779 crore, driven by strong performance in India foods and beverages.

However, EBITDA declined 9% to ₹607 crore due to higher tea costs and price corrections in the non-branded segment. EBITDA margins contracted 250bps to 12.9%.

Its domestic business grew, with packaged beverages up 12%. Foods performed strongly, with Tata Sampann rising 27% and Tata Salt growing by 13%. The RTD segment saw a tepid 3% increase.

Internationally, constant currency growth stood at 5%, with solid traction in US coffee offset by a 7% decline in the UK.

The company acknowledged input cost pressures as the key drag on its operational performance.

Technical Analysis

Tata Consumer Products’ stock has slipped into a cautious zone after breaching mid-channel trend support, noted SEBI-registered analyst Rajneesh Sharma.

The price decisively broke below the ₹1,070 level, signaling a technical breakdown from the broadening wedge pattern, Sharma noted. Volume surged to 3.28 million on the breakdown day, suggesting firm seller conviction.

Resistance now lies in the ₹1,150 - ₹1,160 band, while near-term support is at ₹1,035 - ₹1,050, with a critical long-term cushion in the ₹980 - ₹1,000 zone, the analyst said. Until volumes revive on the upside, the technical setup suggests sideways to bearish consolidation.

SEBI-registered analysts Financial Independence were cautiously optimistic about Tata Consumer Products’ long-term prospects, stating that while the company’s topline remains strong, bottom-line performance is vulnerable to input price volatility. Margin recovery will be a key watch point for Q2 FY26.

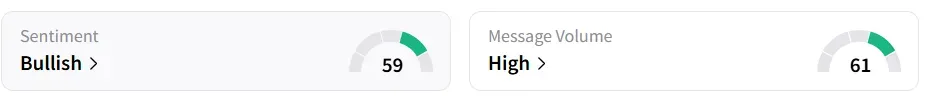

Retail sentiment on Stocktwits shifted from ‘neutral’ to ‘bullish,’ amid high message volumes.

The stock was up 0.8% at ₹1,072.40, having gained 17% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com<