Northland believes the fiscal year 2026 revenue guidance of $40 billion is “reasonable,” even as it estimates $30.9 billion for the year.

Super Micro Computer, Inc. (SMCI) stock was volatile on Thursday as traders weighed in on a positive analyst action against the backdrop of the broader market weakness.

The S&P 500 traded lower amid some disappointing tech earnings and lingering fears over the potential fallout of the Trump tariffs.

On Thursday, investment firm Northland lifted the price target for Super Micro’s stock to $70 from $57 and maintained an ‘Outperform’ rating, TheFly reported. The updated price target suggests scope for roughly 80% upside potential.

Analysts at the firm believe that short-term factors impacted the March quarter market share. They view the fiscal year 2026 guidance of $40 billion as “reasonable,” even as they estimate $30.9 billion for the year.

While issuing a business update for the second quarter in February, Super Micro CEO Charles Liang said, “With our leading direct-liquid cooling (DLC) technology and over 30% of new data centers expected to adopt it in the next 12 months, Supermicro is well positioned to grow AI infrastructure design wins based on NVIDIA Blackwell and more.”

Super Micro opened Thursday’s session down 3.7% at $37.47, dipping to a low of $35.66. Since then, it has clawed back some of its losses.

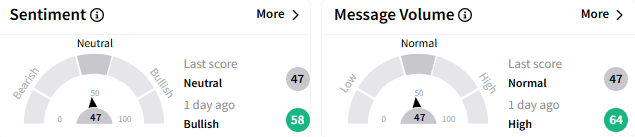

On Stocktwits, sentiment toward Super Micro stock dipped to ‘neutral’ (47/100) from the ‘bullish’ mood seen a day ago. Retail chatter grew quieter to ‘normal’ levels. Nevertheless, the stock was among the top 10 trending tickers on the platform.

A bullish user said they added more Super Micro stock on Thursday’s dip and will continue accumulating until it breaches $50. They look to hold the stock until it reaches triple digits.

Another user, who is bearish on the stock, fretted over the volatility and said they would soon be exiting their position.

Super Micro stock fell 0.91% to $38.55 by late-morning trading, giving back some of the nearly 27% gains for the year-to-date period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<