Shares of Sandisk Corp. continued their upward momentum on Monday, gaining over 16% after the company posted strong quarterly results last week.

- Barclays raised the price target on SanDisk to $750 from $385 and maintained an ‘Equal Weight’ rating on the shares, according to TheFly.

- Bernstein also raised its price target on SanDisk to $1,000 from $580 with an ‘Outperform’ rating on the shares following its quarterly results.

- Sandisk reported second-quarter (Q2) 2026 results on Jan. 29, recording a revenue of $3.03 billion, 31% higher sequentially, and adjusted earnings per share of $6.20, almost double the street consensus.

Shares of Sandisk Corp. (SNDK) continued their upward momentum on Monday, gaining over 16% after the flash memory company posted strong quarterly results and forecasts last week.

Barclays is the latest analyst to upgrade its price target on Sandisk after its earnings report. Tom O'Malley raised the price target on SanDisk to $750 from $385 and maintained an ‘Equal Weight’ rating on the shares, according to TheFly.

SNDK stock has surged nearly 143% in the past month and rallied a whopping 1,756% in the past year.

Street Consensus

Bernstein also raised its price target on SanDisk to $1,000 from $580 with an ‘Outperform’ rating on the shares following its quarterly results. That is about a 50% upside compared to its current price of about $668.50.

Bernstein analyst Mark C. Newman cited the "significant beat and guide to usher in the Year of the Fire-Horse" for the significant increase, one of the highest targets on the street at present, according to Investing.com.

Meanwhile, Bank of America raised SanDisk’s to $850 from $390 last week, with a ‘Buy’ rating on the shares for its quarterly results coming in "massively above" street expectations, the analyst said, as per TheFly.

Cantor Fitzgerald provided a price target of $800, up from $550, on SanDisk and maintained an ‘Overweight’ rating on the shares.

Goldman Sachs more than doubled its price target on the company, raising it to $700 from $320, with a ‘Buy’ rating. Apart from the results, the analyst also cited tight NAND supply, accelerating demand, and an improving product mix that could contribute to the company beating street estimates over the next 12 months, it said, as per TheFly.

RBC Capital, Citi, Morgan Stanley, and Jefferies are among other analysts that upgraded the stock’s price targets after its stellar performance.

Strong Earnings

Sandisk reported second-quarter (Q2) 2026 results on Jan. 29. The company reported revenue of $3.03 billion for the quarter, 31% higher sequentially, and above street estimates of $2.64 billion.

The company also reported adjusted earnings per share of $6.20 for the second quarter, almost double street consensus of $3.33 per share.

Sandisk also provided third-quarter forecasts, with revenue at a midpoint of $4.6 billion and adjusted profit at a midpoint of $14 per share.

What Do Stocktwits Users Think?

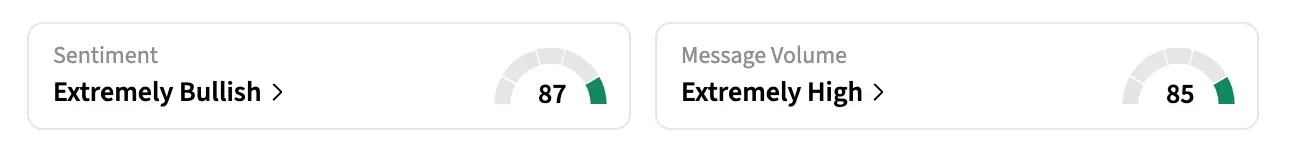

On Stocktwits, retail sentiment around SNDK shares remained in the ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volumes.

One user listed Sandisk’s “blow out” quarterly results that beat estimates, large guidance for the next quarter, and analysts raising price targets as massive upsides for the company.

A bullish user predicts that the company’s shares could more than double to $1,400 by the end of the year.

Another bullish user called Sandisk a ‘high growth tech stock’ and the company a ‘beast.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: This Fully-Automated Store Stock Is Up Over 82% Today — What's Happening With VHUB Shares?