The precious metal has been on a historic run this year, even outshining bullion

- Silver demand has surged due to its expanding use in solar panels and electric vehicles.

- Last week, veteran commodities expert and Head of Commodity Strategy at Saxo Bank, Ole Hansen, noted that silver could see profit-taking amid weakening risk sentiment across equities.

- John Meyer, partner and mining analyst at SP Angel, noted that if gold prices hit $5,000 next year, silver could hit $70.

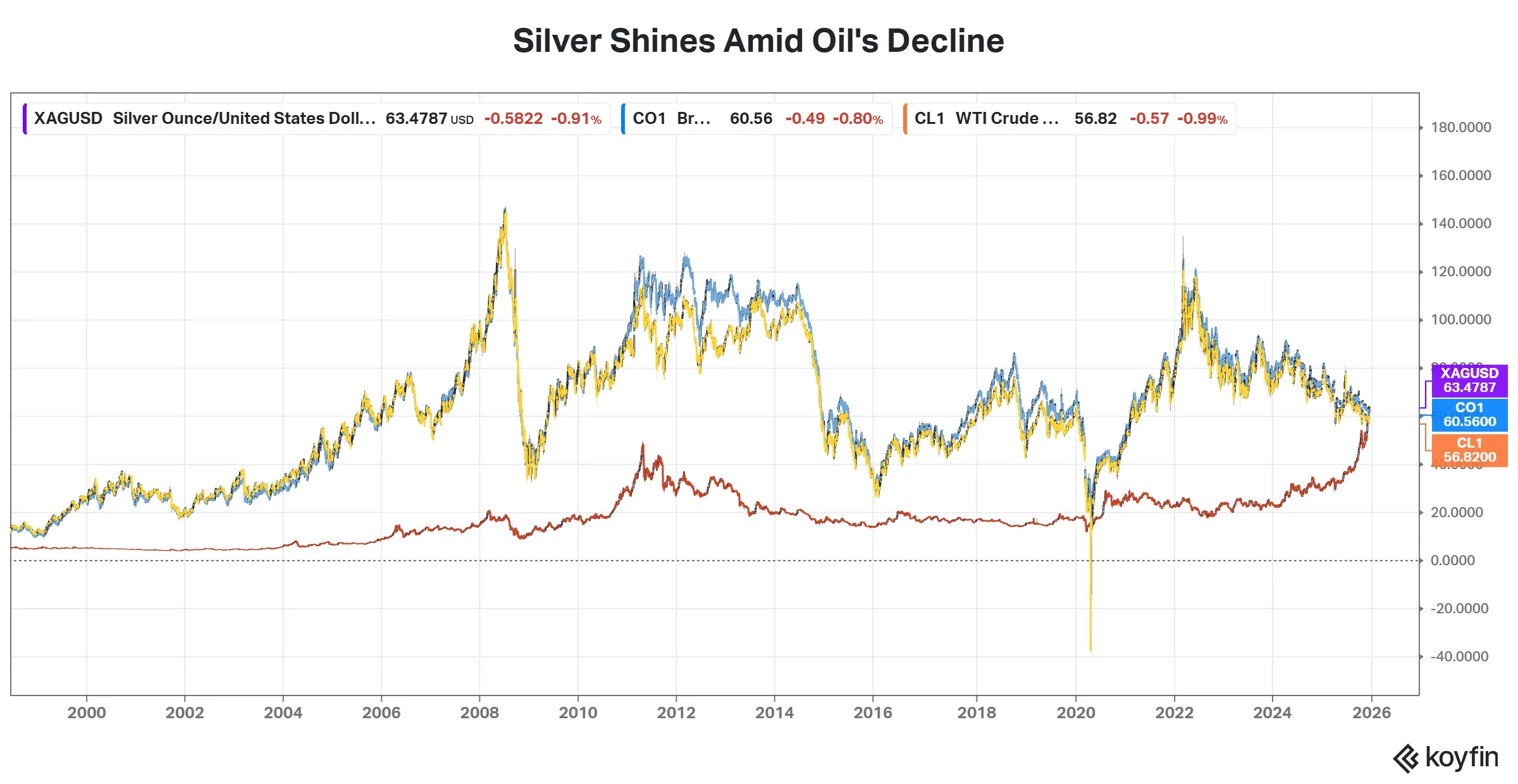

Silver prices have more than doubled this year, and the absolute price of the commodity has even topped the price of oil.

Despite a slight decline on Tuesday, spot silver prices remained about $63 per ounce, higher than the per-barrel prices of Brent crude and West Texas Intermediate. This was the first time this has happened since the early 1980s. In 2020, silver prices briefly rose above WTI but remained slightly below Brent.

“Any settlement could ease curbs on Russian oil flows in an already well-supplied market, partly offset by mixed Chinese data,” analyst Ole Hansen said about the recent pressure on oil prices.

What Is Driving Silver’s Gains?

The precious metal has been on a historic run this year, even outshining bullion. Silver demand has surged due to its expanding use in solar panels and electric vehicles, giving the metal a renewed role in the market and prompting concerns that supply could fall short, according to remarks made by John Meyer, partner and mining analyst at SP Angel, on CNBC.

“Silver is mainly a byproduct metal — you get silver when you mine copper, and you get silver when you mine gold. There aren’t many pure silver mines in the world. Because of that, it’s very difficult for supply to respond directly to higher silver prices,” Meyer said before adding that if gold prices rise above $5,000 per ounce, silver could even top $70.

However, last week, veteran commodities expert and Head of Commodity Strategy at Saxo Bank, Ole Hansen, noted that silver could see profit-taking amid weakening risk sentiment across equities.

What Are Stocktwits Users Saying?

Retail sentiment on Stocktwits about iShares Silver Trust was in the ‘bullish’ territory at the time of writing.

“Silver nibbled around $54 a few days in October, and the same $54 a few days in November. It’s mid-December, silver is $64. Step back and let that soak in,” one user noted.

Oil prices have fallen by more than 20% this year amid rising supply, primarily driven by OPEC. The United States Oil Fund is down 12% this year, compared with iShares Silver Trust's 117% gains.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<